Search Interesting Articles Top Searched Forex Event Driven Trading Techniques, What TRADING STYLE is best for YOU? Different Trading Styles EXPLAINED!.

Find out what trading style best fits you and your personality! If you’re in forex trading, you have to pick a trading style that fits your time availability, your objectives, and your personality. Andrew Lockwood (from Forex Signals) goes over all the different trader styles (day trading, swing trading, scalping, robot trading) and explains how each one fits a different type of lifestyle or personality. By finding the best trading style and forex trading strategy, you will be well on your way to being a profitable forex trader.

💸 Become Financially Free By Learning How To Trade here: 👉 https://to.howtotrade.com/x9q

RECOMMENDED BROKERS:

🏅Switch Markets – https://to.howtotrade.com/ixx

🏅Oanda (US & Canada) – https://to.howtotrade.com/lx6

The best VPS for algo traders:

📀 The Best VPS for EA Traders – https://to.forexvps.net/yt-home

OUR SOCIALS:

📸 Instagram – https://www.instagram.com/howtotradecom/

📘 Facebook – https://www.facebook.com/howtotradecom

♪ TikTok – https://www.tiktok.com/@howtotradecom

↗️ Telegram – https://t.me/forexsignalscom

🐦 Twitter – https://twitter.com/howtotradecom

🟦 Linkedin – https://www.linkedin.com/company/howtotradecom

1,800+ REVIEWS ⭐⭐⭐⭐⭐

💚 Trustpilot – https://www.trustpilot.com/review/forexsignals.com

AFFILIATE PROGRAM

💰Earn money with our leading affiliate program: https://howtotrade.com/affiliate-program/

FREE TRADING EDUCATION:

📩 Free Weekly Forex Forecast – https://to.howtotrade.com/ica

📩 Free custom trading tools for all types of traders – https://to.howtotrade.com/4jv

📩 Join our free monthly NFP special live event – https://to.howtotrade.com/e8l

📩 Free library of trading Cheat Sheets – https://to.howtotrade.com/fix

👩🏫 Learn more about Chart Patterns – https://to.howtotrade.com/mbs

👩🏫 Learn How To Trade with 100% Free Courses – https://to.howtotrade.com/atn

👩🏫 Learn more about trading Forex Strategies – https://to.howtotrade.com/0cq

* The information provided in this video is intended for educational purposes only and is not to be construed as investment advice. Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. There is a possibility you could sustain losses of some, or all of your initial investment and therefore seek independent financial advice if you have any doubts.

** Our team of coaches will never contact you directly outside of the Trading Room. If any person(s) contacts you via Social Media platforms offering account management or asking for payment, this is not HowToTrade and should be ignored.

*** This video and the video description may contain affiliate links, meaning HowToTrade.com will get a commission if you decide to make a purchase or trade through our links, at no cost to you.

Forex Event Driven Trading Techniques, What TRADING STYLE is best for YOU? Different Trading Styles EXPLAINED!.

Measurable Event Trading Versus Over-Simplistic Assumptions

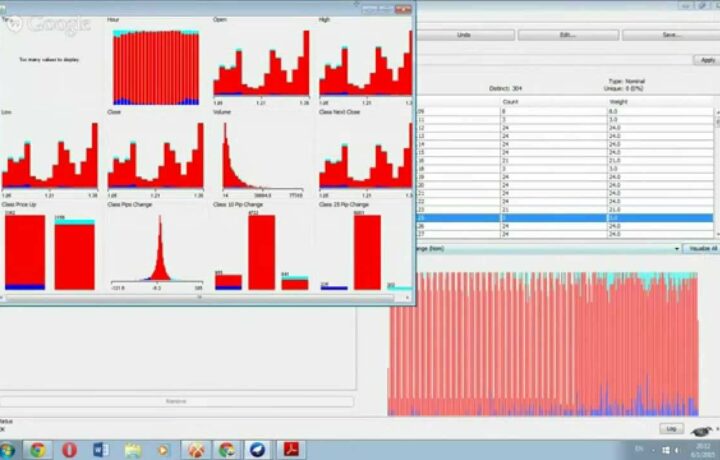

Spikes do not vary a lot hereof, they just take place over a smaller window of time. A spike occurs in the first place due to the fact that the market has just discovered brand-new details, details which is not yet “valued in”. Depending on the intensity of the details, the spike will be huge or small, and proceed or fail. To explain this concept a little far better, I’m going to cite what several event-driven measurable approaches do on a regular basis:

Developers of these event-based (spike) trading methods are able to evaluate data recovered from financial information releases rather quickly. They just take the discrepancy from the actual and also anticipated number, couple it with other financial information releases that occur at that point in time (if essential), take the typical modification in rate prior to as well as after specific variances happen, the duration in which these adjustments occur, and are able to maximize a strategy based upon this and any other technological variables they desire. They have a background of data (numbers) with which to work.

In all of the factors detailed above, numbers are readily available, and machines require numbers. Yet what happens when a spike is brought on by a comment from a high ranking government official? No numbers there, just words. Yes, words.

What concerning words? Words, when it concerns programming, can be numbers. Let me clarify:

Words are weights, when measured versus each other in relation to price movements. “downgrade” carries a different weight than “stimulus” or “safeguard” or “shield the money”, etc., depending on who it is coming from as well as the context of various other words utilized at the time.

Low and high ranking government officials can be weights. The high ranking government official evaluates more than a low ranking government official, etc. A score agency, as well as words made use of in their press releases, can be weight. Etc. and so on.

So when you take an industry-standard information feed, assign weights (numbers) to everything stated over against average rate motions, time, various other technological variables, and so on, you wind up with a sample of information that can be enhanced right into a potentially lucrative trading approach.

And while I know it all might seem absurd initially, if you think I’m simply pulling your leg on every one of this, think again. While I’m giving a very streamlined explanation of the principle, it is certainly made use of in primarily all markets by numerous individuals, and most definitely in this one.

How is the foreign exchange market regulated?

Regardless of the enormous size of the forex market, there is really little regulation because there is no regulating body to police it 24/7. Rather, there are a number of nationwide trading bodies around the globe who oversee domestic forex trading, in addition to various other markets, to make certain that all forex service providers stick to particular standards. As an example, in Australia the regulatory body is the Australian Stocks and Investments Commission (ASIC).

How much money is traded on the forex market daily?

Around $5 trillion well worth of forex deals take place daily, which is an average of $220 billion per hour. The marketplace is largely composed of establishments, corporations, governments and currency speculators speculation composes roughly 90% of trading volume and a large bulk of this is concentrated on the US dollar, euro and also yen.

What are gaps in foreign exchange trading?

Spaces are factors in a market when there is a sharp activity up or down with little or no trading in between, causing a ‘space’ in the normal cost pattern. Spaces do take place in the foreign exchange market, yet they are considerably much less common than in various other markets because it is traded 24-hour a day, five days a week.

Nonetheless, gapping can occur when financial information is released that comes as a shock to markets, or when trading resumes after the weekend break or a holiday. Although the foreign exchange market is closed to speculative trading over the weekend, the marketplace is still open up to reserve banks and also relevant organisations. So, it is feasible that the opening cost on a Sunday night will be various from the closing price on the previous Friday evening leading to a gap.

Final Thoughts:

Matching different kinds of trading to a person’s personality type is certainly no guarantee for forex trading success. However, discovering a trading design that’s well suited to your personality type can help brand-new investors locate their feet and make the right relocate the marketplace. Simply take the quiz as well as answer the 15 questions honestly to disclose which trading style is the appropriate fit for you.

Get Relevant Posts Relevant to Forex Event Driven Trading Techniques and Financial market news, evaluation, trading signals and also Foreign exchange financial expert evaluations.

Disclaimer:

Any type of point of views, information, study, evaluations, prices, various other details, or web links to third-party websites contained on this web site are supplied on an “as-is” basis, as general market discourse and do not comprise investment guidance. The market commentary has actually not been prepared according to lawful demands developed to promote the independence of financial investment research study, and also it is therefore exempt to any prohibition on dealing ahead of circulation. Although this discourse is not created by an independent resource, “TradingForexGuide.com” TFG takes all adequate actions to get rid of or stop any type of disputes of interests arising out of the production and circulation of this communication.