Find More Videos About Forex Factory Position Trading, How To Make Forex Factory An App On Your Cell Phone.

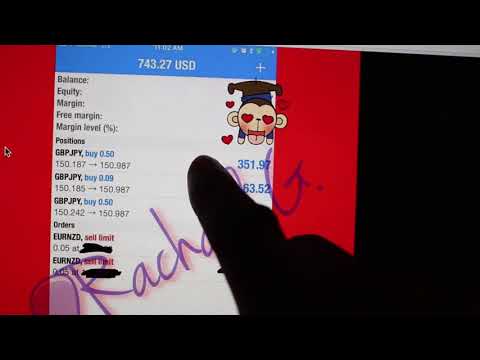

Forex Trading has never been easier! Learn how you can simply COPY AND PASTE trades from PROFESSIONAL TRADERS from an App on your Cell Phone!

Click here for more info: http://www.IncreaseMeNow.info

Forex Factory Position Trading, How To Make Forex Factory An App On Your Cell Phone.

What Is Long-Position?

A long position additionally known as merely long is the acquiring of a stock, commodity, or money with the assumption that it will rise in value. Holding a long placement is a bullish sight.

Lengthy position as well as long are typically used In the context of getting an alternatives agreement. The investor can hold either a long call or a long put choice, depending on the outlook for the underlying possession of the choice agreement.

A financier who intends to take advantage of an upward cost activity in a property will “go long” on a call alternative. The call offers the holder the alternative to purchase the hidden property at a particular price.

Conversely, a capitalist that anticipates an asset’s price to fall are bearish will certainly be long on a put alternative and also preserve the right to market the asset at a specific cost.

A lengthy position is the reverse of a brief setting (brief).

A long lengthy placement refers to the acquisition of an asset with the assumption it will certainly increase in value a bullish attitude.

A lengthy placement in options agreements indicates the owner possesses the hidden property.

A lengthy setting is the opposite of a brief position.

In choices, being long can refer either to straight-out ownership of an asset or being the holder of an alternative on the asset.

Being long on a stock or bond investment is a measurement of time.

Long Holding Investment.

Going long on a stock or bond is the a lot more traditional investing practice in the capital markets. With a long-position financial investment, the financier purchases a property and possesses it with the assumption that the price is going to rise. This investor normally has no plan to offer the safety and security in the near future. In reference to holding equities, long describes a measurement of time.

Going long on a stock or bond is the extra standard investing technique in the resources markets, specifically for retail financiers. An expectation that assets will certainly value in worth in the future the buy as well as hold technique spares the financier the demand for continuous market-watching or market-timing, and allows time to weather the inescapable ups as well as downs. Plus, history is on one’s side, as the securities market undoubtedly appreciates, over time.

Naturally, that doesn’t imply there can’t be sharp, portfolio-decimating decreases in the process, which can be fatal if one occurs right before, claim, a capitalist was preparing to retire or required to liquidate holdings for some reason. A long term bearish market can likewise be problematic, as it often favors short-sellers and also those banking on declines.

Lastly, going long in the outright-ownership sense indicates an excellent amount of funding is locked up, which could result in missing out on other opportunities.

Long Placement Choices Contracts.

Worldwide of alternatives contracts, the term long has nothing to do with the dimension of time yet instead talks with the owning of a hidden property. The lengthy setting holder is one who presently holds the hidden asset in their portfolio.

When a trader purchases or holds a phone call alternatives contract from an options author they are long, because of the power they keep in having the ability to acquire the property. A capitalist that is long a phone call choice is one who gets a telephone call with the expectation that the hidden security will certainly raise in value. The lengthy setting call owner believes the possession’s value is climbing as well as may determine to exercise their choice to buy it by the expiration day.

However not every investor that holds a lengthy setting thinks the asset’s worth will certainly boost. The investor that owns the hidden property in their portfolio as well as believes the value will fall can buy a put alternative contract.

They still have a lengthy placement due to the fact that they have the capability to offer the underlying asset they hold in their portfolio. The holder of a long setting placed believes the rate of a possession will fall. They hold the choice with the hope that they will certainly have the ability to market the underlying property at a helpful cost by the expiration.

So, as you see, the lengthy setting on an alternatives contract can express either a bullish or bearish belief relying on whether the long contract is a put or a call.

In contrast, the brief setting on an options contract does not possess the stock or various other underlying property however obtains it with the expectation of marketing it and after that buying it at a reduced price.

Long Futures Contracts.

Investors as well as companies can also enter into a long onward or futures agreement to hedge versus negative price motions.

A firm can utilize a lengthy hedge to secure a purchase cost for an asset that is needed in the future.

Futures differ from options in that the owner is bound to acquire or sell the underlying property. They do not reach select yet must finish these actions.

Expect a fashion jewelry supplier believes the price of gold is poised to transform upwards in the short-term. The company can become part of a lengthy futures agreement with its gold distributor to acquire gold in three months from the distributor at thirteen hundred. In 3 months, whether the rate is above or below $1,300, the business that has a long position on gold futures is obliged to buy the gold from the provider at the agreed agreement cost of $1,300. The distributor, consequently, is obliged to deliver the physical asset when the agreement runs out.

Speculators additionally go long on futures when they believe the prices will go up. They don’t always want the physical commodity, as they are just interested in maximizing the cost motion. Before expiry, a speculator holding a long futures contract can market the contract on the market.

Read New info Related to Forex Factory Position Trading and Financial market information, analysis, trading signals and Forex mentor testimonials.

Risk Warning:

All products listed on our website TradingForexGuide.com are traded on take advantage of, which means they carry a high degree of financial risk and also you might shed greater than your down payments. These products are not appropriate for all financiers. Please guarantee you completely recognize the dangers as well as thoroughly consider your economic circumstance and also trading experience prior to trading. Look for independent recommendations if necessary.