Find More Videos Relevant to Momentum Trading Time Frame, Combining Timeframes for Momentum Scalping Using Oscillators 💡.

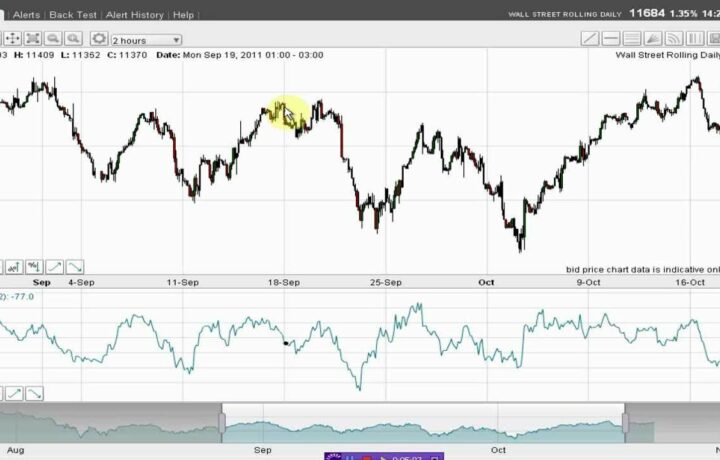

Combining timeframes for momentum scalping using oscillators. http://www.financial-spread-betting.com/course/technical-analysis.html PLEASE LIKE AND SHARE THIS VIDEO SO WE CAN DO MORE! If I’m looking at trading using an oscillator (say the RSI), the market might be overbought on a higher timeframe and we are looking for an oversold condition on a lower timeframe to push in the direction of the trend. You have a trend, you are looking for a counter-trend move on a lower timeframe (preferably oversold)… This often gives a lot of false signals while everyone catches up…

1) Wait until there is some sort of price signal back in the direction – say another filter like a bullish engulfing..etc

2) Wait until it gets going and buy on a pullback

Related Video

How to Combine two Oscillators Indicators for Trading? Multi Time Frame Analysis With Oscillators 👊

NEW: Full Scalping Course at

https://www.youtube.com/watch?v=IDXG0p3f59c&list=PLnSelbHUB6GRgarut4otIfX7IAB1RLFGy

Momentum Trading Time Frame, Combining Timeframes for Momentum Scalping Using Oscillators 💡.

Just how do we determine Momentum Trader?

Scientists calculate Momentum Trader by increasing the mass of the item by the rate of the item. It is an indication of exactly how hard it would certainly be to quit the object. If you were running, you may have a mass of 50 kilograms as well as a rate of 10 meters per 2nd west (really fast).

Nevertheless, the principle was covered and also left inactive following the development and also popularisation of value investing concept from the 1930s onward. Capitalists would certainly concentrate much more on the innate, or “fundamental,” worth of a property, and less on the trajectory of the motion of its price.

Following a renaissance of technical analysis later in the century, the concept of Momentum investing enjoyed a rebirth with the magazine of a research by Jegadeesh and also Titman in 1993. It revealed that traders and also markets had a tendency to offer favorable feedback to recent info regarding asset prices, thus enhancing price patterns as they are in effect.

Closely Equal Momentum And Absolute Momentum.

Momentum trading can be classified in two groups: Relative Momentum and also absolute Momentum.

Matching Momentum strategy is where the performance of different safeties within a specific possession class are contrasted versus one another, and financiers will certainly favour buying solid doing protections and also offering weak carrying out protections.

Absolute Momentum strategy is where the behaviour of the rate of a security is compared against its previous performance in a historical time collection.

In currency trading, either Matching or outright Momentum can be made use of. However, Momentum trading methods are a lot more frequently connected with absolute Momentum.

Just how Is The Momentum Approach Employed?

Momentum can be determined over longer periods of weeks or months, or within day-trading amount of time of minutes or hrs.

The first step traders usually take is to establish the direction of the trend in which they intend to trade. Utilizing among several Momentum signs available, they may then seek to establish an entry indicate purchase (or sell) the asset they are trading. They will certainly additionally intend to establish a successful and also affordable leave factor for their trade based upon forecasted and also formerly observed degrees of support and resistance within the market.

In addition, they are suggested to set stop-loss orders above or below their trade entry point– relying on the instructions of the profession. This is in order to safeguard versus the possibility of an unforeseen price-trend reversal and undesired losses.

Find Popular Stories Explaining Momentum Trading Time Frame and Financial market information, analysis, trading signals and Foreign exchange financial expert evaluations.

Risk Alert:

“TradingForexGuide.com” TFG will not be held accountable for any kind of loss or damages arising from reliance on the details consisted of within this internet site including market news, analysis, trading signals as well as Forex broker testimonials. The data contained in this site is not always real-time neither precise, and analyses are the point of views of the author and also do not represent the referrals of “TradingForexGuide.com” TFG or its workers. Money trading on margin includes high threat, and also is not appropriate for all investors. As a leveraged product losses are able to go beyond initial deposits as well as capital goes to danger. Before determining to trade Forex or any other economic instrument you ought to thoroughly consider your investment goals, degree of experience, and also danger hunger. We strive to supply you important information about all of the brokers that we evaluate. In order to supply you with this totally free service we obtain marketing fees from brokers, including several of those provided within our rankings and also on this page. While we do our utmost to ensure that all our information is updated, we urge you to confirm our details with the broker directly.