Read Relevant Articles Relevant to Forex Position Trading Money, Basic FOREX Money Management.

http://www.LotsofPips.com

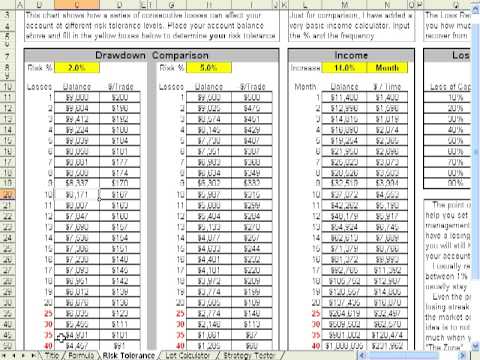

Formulas and practices for managing your money in the forex market. How to calculate position sizing using risk tolerance and draw-down.

Forex Position Trading Money, Basic FOREX Money Management.

The Forex Trading Position Technique

Over the in 2019 as well as a half, there have actually been some terrific fads, the majority of noticeably brief JPY initially, and after that the current lengthy USD fad. In these problems, a great deal of traders begin to wonder why they are not making the kinds of professions where victors are delegated compete weeks and even months, accumulating hundreds of pips in earnings in the process. This kind of long-lasting trading is referred to as “setting” trading. Investors that are made use of to shorter-term professions tend to discover this design of trading a terrific obstacle. That is an embarassment, because it normally the most convenient and also most rewarding kind of trading that is available to retail Forex investors. Here I’ll describe a method with fairly easy policies that simply utilizes a couple of indicators that you can utilize to attempt to capture and hold the best, lengthiest Forex patterns.

Select the Acquiring Currencies to Trade

Choose the Currencies to Trade. You need to find which currencies have been obtaining over recent months, and which have actually been falling. A great period to make use of for measurement is about 3 months, and if this is in the very same instructions as the longer-term trend such as 6 months, that is very good. One straightforward way to do this is established a 12 period RSI and also scan the once a week charts of the 28 greatest currency pairs each weekend break. By noting which currencies are above or listed below 50 in all or mostly all of their pairs and crosses, you can obtain a concept of which pairs you should be trading throughout the coming week. The idea, essentially, is “get what’s currently been increasing, offer what’s already been decreasing”. It is counter-intuitive, however it works.

How Many Money Pairs to Trade?

You must now have between one and also four currency pairs to trade. You don’t need to try to trade way too many pairs.

Set up Graphes for perpetuity Frames

Establish charts on D1, H4, H1, M30, M15, M5 and M1 period. Install the 10 period RSI, the 5 period EMA and also the 10 period SMA. You are looking to enter trades in the instructions of the trend when these signs line up in the same direction as that trend on ALL TIMEFRAMES during energetic market hrs. That means the RSI being above the 50 degree for longs or below that level for shorts. Pertaining to the moving averages, for a lot of pairs, this would be from 8am to 5pm London time. If both money are North American, you can prolong this to 5pm New york city time. If both currencies are Eastern, you might additionally look for professions throughout the Tokyo session.

Decide Account Percent to Threat on each Profession

Decide what percentage of your account you are mosting likely to take the chance of on each profession. Usually it is best to take the chance of less than 1%. Calculate the money quantity you will certainly risk and also separate it by the Average Real Series of the last 20 days of the pair you will trade. This is how much you must take the chance of per pip. Keep it regular.

20 Day Ordinary True Range Away

Get in the trade according to 3), and also position a tough stop loss on 20 day Ordinary True Array Far from your entry cost. Now you must patiently see and also wait.

Positive-Looking Candle Holder Pattern in the Desired Instructions

If the profession steps against you promptly by around 40 pips as well as shows no signs of coming back, departure manually. If this does not occur, wait a few hrs, and also inspect again at the end of the trading day. If the trade is revealing a loss currently, and is not making a positive-looking candle holder pattern in the desired direction, then leave the profession manually.

Backtrack Back to Your Entrance Point

If the trade is in your favour at the end of the day, after that view as well as wait on it to retrace back to your entrance factor. If it does not get better once again within a few hrs of reaching your entry factor, leave the trade manually.

Profession Level of Earnings Dual to Tough Stop Loss

This should continue up until either your trade gets to a degree of earnings double your hard stop loss. At this moment, relocate the quit to break even.

Move the Stop-Up under Assistance or Resistance

As the profession moves a growing number of in your favour, move the stop up under assistance or resistance as appropriate to the direction of your profession. Eventually you will be quit out, however in a great fad the trade need to make thousands or a minimum of hundreds of pips.

You can customize this approach a little according to your choices. However, whatever you do, you will certainly lose most of the trades, and also you will certainly go through long periods where there are no professions which is monotonous or where every profession is a loss or recover cost. There will certainly be frustrating moments as well as tough periods. Nevertheless, you are bound to earn money in the long run if you follow this sort of trading method, because it complies with the timeless principles of robust, successful trading:

Cut your shedding trades short.

Allow your winning professions run.

Never ever take the chance of too much on a single profession.

Dimension your positions according to the volatility of what you are trading.

Trade with the trend.

Do not fret about capturing the first sector of a pattern, or its last. It is the part in the center that is both secure as well as rewarding enough.

Get Users Stories Related to Forex Position Trading Money and Financial market news, analysis, trading signals as well as Foreign exchange mentor reviews.

Important Notice:

The information supplied by TradingForexGuide.com (TFG) is for general educational and academic objectives just. It is not meant as well as must not be interpreted to constitute suggestions. If such information is acted on by you after that this must be solely at your discretion and TradingForexGuide.com (TFG) will not be held accountable and also liable at all.