Search Users Articles Relevant to Forex Event Driven Trading Terms, Barry Norman's September Economic Events Digest for Forex & CFD Trading.

In this video we review the early September major economic events and central bank meeting expectations as well as discuss the outlook for the major currency pairs as well as gold and oil. Don’t miss this video if you want to be well prepared for September forex trading

Forex Event Driven Trading Terms, Barry Norman's September Economic Events Digest for Forex & CFD Trading.

Measurable Event Trading Versus Over-Simplistic Assumptions

Spikes don’t vary a lot hereof, they simply occur over a smaller sized home window of time. A spike happens to begin with since the market has actually simply found out brand-new info, details which is not yet “priced in”. Relying on the severity of the info, the spike will be large or small, and proceed or fall short. To describe this principle a little better, I’m going to mention what several event-driven quantitative methods do regularly:

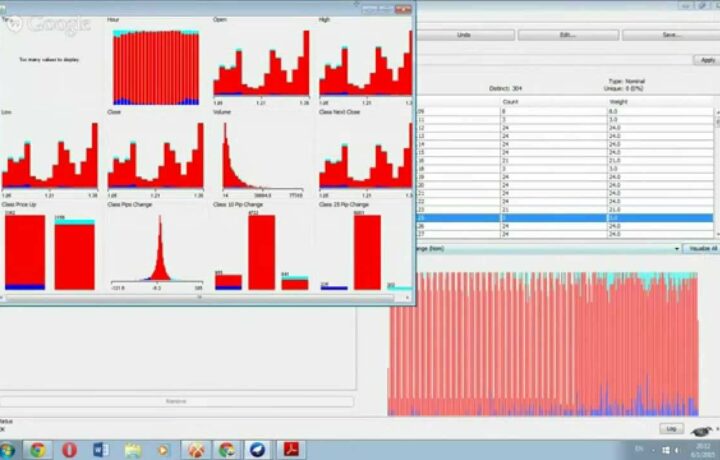

Programmers of these event-based (spike) trading techniques are able to measure information gotten from financial information releases rather easily. They just take the discrepancy from the actual and anticipated number, pair it with various other financial data launches that occur then in time (if necessary), take the typical modification in cost before and after certain variances occur, the timeframe in which these changes occur, and also are able to optimize an approach based on this and also any other technological variables they want. They have a background of information (numbers) with which to function.

In all of the factors provided above, numbers are readily available, as well as equipments need numbers. Yet what occurs when a spike is triggered by a comment from a high ranking government official? No numbers there, simply words. Yes, words.

What concerning words? Words, when it comes to shows, can be numbers. Let me explain:

Words are weights, when determined against each other in connection with price activities. “downgrade” carries a different weight than “stimulation” or “protect” or “safeguard the currency”, etc., depending upon that it is coming from and also the context of various other words used at the time.

Low and high ranking government officials can be weights. The high ranking government official weighs more than a low ranking government official, etc. A rating agency, and words used in their news release, can be weight. Etc. and so on.

So when you take an industry-standard news feed, designate weights (numbers) to everything mentioned over versus average price activities, time, various other technical variables, etc., you end up with an example of data that can be enhanced right into a potentially lucrative trading method.

As well as while I recognize all of it could appear outrageous at first, if you believe I’m just pulling your leg on all of this, think again. While I’m giving a very simplified explanation of the idea, it is indeed used in mostly all markets by different participants, as well as definitely in this one.

Event-Driven Investors

Event-driven Investors aim to fundamental analysis over technical charts to notify their decisions. They’ll look for to benefit from spikes caused by political or financial occasions, such asNon-Farm Payrolldata, GDP, employment figures, and elections.

This sort of trading will certainly match an individual who likes to stay on par with globe information, as well as who will certainly recognize how occasions can influence markets. Investigative, interested and forward-thinking, you will be knowledgeable at refining new information as well as anticipating how worldwide as well as localized occasions may play out.

If you pay very close attention to world events and also value that those events may influence the finance sector, you could experience success as an “event-driven investor”.

Event-driven Investing look for to capitalise on volatility spikes caused by high-impact financial data, political elections and monetary plan. Event-driven traders incur considerable dangers as they make educated choices based on their own interpretation of international occasions.

Hopeful event-driven traders might discover success with the following money pairings:

AUD/USD

USD/CAD

EUR/JPY

Can you alter your forex trading style?

No foreign exchange trading style need be static and also there is every possibility your own can transform. You may be a scalper stressed by short-termprice actionand seeking the downtime found ready trading. Or, you could be a technical swing trader who intends to discover more regarding the basics of the events-driven method.

Whatever your style or goals, there is constantly a way to expand as well as establish, and also evaluate your skill on the marketplaces in brand-new ways.

Summary:

Event-driven trading strategies supply a fantastic means to capitalize on raising cost volatility, yet there are many threats and constraints to think about. When developing and also carrying out these techniques, it is very important for investors to establish limited risk controls while providing enough room for the unstable scenario to play out on the market. In the long run, event-driven trading strategies supply an useful arrow in the quiver of any active investor.

Get Relevant info Explaining Forex Event Driven Trading Terms and Financial market news, analysis, trading signals and also Foreign exchange broker testimonials.

Important Notice:

Any kind of viewpoints, information, study, evaluations, costs, various other information, or links to third-party sites consisted of on this website are given on an “as-is” basis, as general market discourse as well as do not make up financial investment guidance. The market discourse has not been prepared according to lawful demands made to promote the self-reliance of financial investment research, and also it is as a result exempt to any restriction on dealing ahead of dissemination. Although this commentary is not created by an independent source, “TradingForexGuide.com” TFG takes all sufficient steps to eliminate or avoid any kind of problems of rate of interests arising out of the manufacturing and dissemination of this communication.