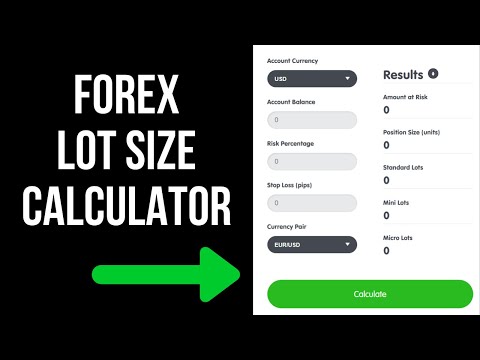

Read Popular Articles Explaining Forex Trade Position Size Calculator, FREE Forex Lot Size Calculator: How to use the Right Lot Size for your Trades!.

#forex #forexlifestyle #forextrader

Want to join the A1 Trading Team? See trades taken by our top trading analysts, join our live trading chatroom, and access our strategy library!

Use code ‘YTVIP’ to get $5 off! http://a1trading.com/vip/

// MY FAVORITE BROKERS

Outside of the USA:

https://www.axitrader.com/uk/live-account?token=EQImSTFE8fFDRyJkxRTyI2Nd7ZgqdRLk&affid=571

Note, please do your own due diligence before making a decision to do business with any financial brokerage. I will make a small affiliate commission should you choose to sign up for either of these brokers. Thank you for supporting our channel!

// SOCIAL

FREE Forex Telegram Channel: https://t.me/TraderNicksFXAnalysis

Instagram: https://www.instagram.com/tradernickfx/

Twitter: https://twitter.com/tradernickfx

Facebook: https://www.facebook.com/tradernick135/

// DISCLAIMERS

This video expresses my personal opinion only. Trading financial markets involves risk, and is not suitable for all investors. I am not responsible for any losses incurred due to your trading or anything else. I do not recommend any specific trade or action, and any trades you decide to take are your own.

Please be aware of impersonators online: Nick (or any other A1 Trading Company employee) does not message people directly asking for payment. Please be aware of impersonators and do not send money to any account that is not listed on our website.

Forex Trade Position Size Calculator, FREE Forex Lot Size Calculator: How to use the Right Lot Size for your Trades!.

What is a Position Trader?

A position investor is a type of investor that holds a placement in a property for a long period of time. The holding duration may vary from numerous weeks to years. Apart from “buy and also hold”, it is the longest holding duration amongst all trading designs.

Setting trading is basically the opposite of day trading. A position investor is generally less concerned regarding the short-term vehicle drivers of the prices of a property and also market adjustments that can briefly turn around the cost pattern.

Setting traders place even more focus on the long-lasting efficiency of a property. From such a perspective, the traders are better to long-lasting investors instead of to various other traders.

Setting investor refers to a person that holds a financial investment for an extended amount of time with the expectation that it will certainly value in value.

Setting traders are pattern fans.

A successful setting investor needs to identify the access/ departure degrees and also have a strategy in place to control threat, typically using stop-loss degrees.

The goal of setting traders is recognizing fads in the prices of protections, which can proceed for fairly extended periods of time, and also earning benefit from such fads. Generally, setting trading may provide lucrative returns that will certainly not be gotten rid of by high deal expenses.

What Is a Position?

A position is the amount of a safety, commodity or money which is owned by a specific, dealership, establishment, or various other financial entity. They are available in two types: brief placements, which are obtained and afterwards sold, and also long placements, which are owned and afterwards sold. Depending on market fads, activities and also changes, a placement can be successful or unlucrative. Reiterating the value of a placement to show its real existing value on the open market is referred to in the industry as “mark-to-market.”.

Positions Explained?

The term setting is used in numerous situations, including the copying:.

1. Dealers will certainly typically maintain a cache of long placements specifically protections in order to promote fast trading.

2. The investor shuts his setting, causing a web revenue of 10%.

3. An importer of olive oil has a natural brief setting in euros, as euros are frequently streaming in and out of its hands.

Positions can be speculative, or the all-natural consequence of a specific service. For instance, a money speculator can buy British pounds sterling on the assumption that they will certainly value in value, and that is taken into consideration a speculative setting. However, a business which trades with the UK will certainly be paid in pounds sterling, providing it a natural long setting on pounds sterling. The money speculator will certainly hold the speculative setting until she or he determines to liquidate it, safeguarding a profit or restricting a loss. However, the business which trades with the UK can not merely desert its all-natural setting on pounds sterling similarly. In order to shield itself from money changes, the business may filter its earnings through a countering setting, called a “hedge.”.

Spot vs. Futures Positions.

A position which is designed to be provided quickly is referred to as a “area.” Areas can be provided essentially the following day, the following service day, or often after two service days if the security concerned requires it. On the deal day, the cost is set however it generally will not clear up at a set price, given market changes. Deals which are longer than spots are referred to as “future” or “onward placements,” and also while the cost is still set on the deal day, the settlement day when the deal is finished and also the security provided day can take place in the future.

Read Popular Articles Explaining Forex Trade Position Size Calculator and Financial market news, evaluation, trading signals and also Forex financial expert reviews.

Forex Caution:

Our solution consists of items that are traded on margin and also carry a risk of losses in excess of your transferred funds. The items may not appropriate for all investors. Please ensure that you totally recognize the threats entailed.