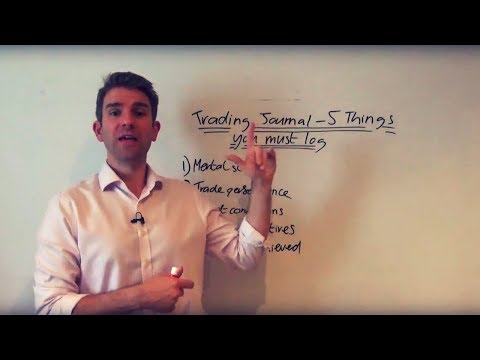

Find Relevant Stories Relevant to Forex Position Trading Journals, 5 Things You Must Have In Your Trading Journal 📚📘.

Why you need a Trading Journal and 5 Things you must have in your trading journal. http://www.financial-spread-betting.com/course/trading-diary-journal.html PLEASE LIKE AND SHARE THIS VIDEO SO WE CAN DO MORE! A trading journal or trading diary is dull but it will give you the biggest improvements in your trading and personal development as a trader. Most traders are focused on the next big trade but they are missing out if they don’t document their trading.

1) Mental State – this is how you’re feeling on the day you’re trading. This will allow you to identify the mental states that you should be avoiding or periods where you should be trading.

2) Trade Performance – document every single trade during the period. Your entry, your position size, why you got into it, what setup, how the trade went, the amount of profit or loss you made or suffered and what the trade did before and after you got in.

3) Market conditions – trends? was it a news economic announcement? was the market choppy? ..etc

4) Positives + Negatives – be brutally honest about your trading performance. Positives could be ‘I analysed the market’, ‘I waited for the trade’, ‘I didn’t go too big’. Negatives could be ‘I closed the trade before my target’, ‘I traded in too much size.’..etc

5) % Goals Achieved. Making an X per trade is not an achievable goal. Are you sticking to your goals in your trading plan?

Related Videos

Maximum Favorable Excursion: Measurement of Potential in Trading Strategy 🍆🙌

Why do Pro Traders Define Risk in Terms of R? 🤔

How to Measure & Improve Your Trading Performance 🔔

5 Things You Must Have In Your Trading Journal 📚📘

Trading Diary: Different Ways to Journal your Trades 📖

Tracking Additional Trade Metrics

The Trading Journal Do’s and Don’ts: Don’t Sabotage Your Trading Success! 😟🙂

https://www.youtube.com/watch?v=gUEjmLRwEWg

Forex Position Trading Journals, 5 Things You Must Have In Your Trading Journal 📚📘.

What is Naked Shorting?

Naked shorting is the unlawful practice of brief marketing shares that have actually not been affirmatively figured out to exist. Usually, traders should borrow a stock, or determine that it can be borrowed, prior to they sell it brief. So naked shorting describes brief stress on a stock that might be larger than the tradable shares in the market. Despite being made unlawful after the 2008-09 economic dilemma, naked shorting continues to take place due to loopholes in guidelines and discrepancies between paper and digital trading systems.

Recognizing Naked Shorting.

Naked shorting happens when investors sell shorts associated with shares that they do not possess and have actually not validated their ability to possess. If the trade associated with the brief needs to take place in order to accomplish the commitments of the setting, after that the trade might stop working to complete within the needed cleaning time since the seller does not in fact have access to the shares. The strategy has a really high threat degree but has the prospective to generate high benefits.

While no specific system of dimension exists, numerous systems indicate the degree of trades that stop working to deliver from the seller to the customer within the necessary three-day stock negotiation period as evidence of naked shorting. Naked shorts are believed to represent a significant portion of these stopped working trades.

Approaches of Setting Traders

Setting trading generally entails the application of both essential and technological analyses.

Fundamental analysis is specifically vital to place traders who expect to hold the properties for a longer period. Fundamental analysis in position trading is regularly associated with stock-picking. It allows traders to locate winning stocks that might provide high returns.

Technical analysis is used to identify fads in asset prices that will certainly allow a trader to earn profits. Additionally, it aims to identify fads that will certainly last long enough and provides warning signals of prospective pattern turnarounds

Technical analysis usually provides setting traders with two alternatives: trade the properties with solid trending potential that have actually not yet begun trending, or trade the properties that have actually currently begun trending.

The first option might provide higher returns, but it is riskier and more research-intensive. On the other hand, the second choice is less research-intensive, but the investor might miss the momentum to earn significant profits.

Threats with Setting Trading

Comparable to various other trading methods, setting trading is associated with some dangers. One of the most typical dangers of setting trading are:

Trend turnaround:

An unanticipated pattern turnaround in asset prices can result in significant losses for the investor.

Reduced liquidity:

The capital of setting traders is usually secured for relatively long time periods.

Additional Resources

CFI is the main company of the international Financial Modeling & Valuation Analyst (FMVA) ™ accreditation program, made to assist anybody end up being a first-rate economic expert. To maintain progressing your job, the added sources below will certainly serve:

- Lengthy and Short Placements

- Momentum Spending

- Swing Trading

- Trading Order Timing

The Effect of Naked Shorting.

Naked shorting can affect the liquidity of a particular safety and security within the industry. When a particular share is not easily offered, naked brief marketing allows a person to participate despite the fact that they are incapable to in fact get a share. If added investors end up being curious about the shares associated with the shorting, this can create a rise in liquidity associated with the shares as demand within the industry boosts.

Regulations Regarding Naked Shorting.

The Securities and Exchange Compensation (SEC) outlawed the practice of naked brief marketing in the USA in 2008 after the economic dilemma. The ban relates to naked shorting only and not to various other short-selling activities.

Before this ban, the SEC modified Regulation SHO to limit possibilities for naked shorting by eliminating loopholes that existed for some brokers and suppliers in 2007. Regulation SHO requires checklists to be released that track stocks with uncommonly high fads in stopping working to deliver (FTD) shares.

Naked Shorting as a Market Function.

Some experts indicate the reality that naked shorting accidentally might assist markets stay in equilibrium by enabling the negative belief to be reflected in specific stocks’ prices. If a stock has a limited float and a big amount of shares in friendly hands, after that market signals can theoretically be postponed unavoidably. Naked shorting forces a price decrease even if shares aren’t readily available, which can it transform result in some discharging of the real shares to reduce losses, enabling the market to locate the ideal equilibrium.

Naked shorting was the focus of regulative changes in 2008, in part as a response to the overdoing of shorts on Lehman Brothers and Bear Stearns.

Naked shorting is commonly believed in emerging fields where the float is known to be tiny but the volatility and brief rate of interest is nonetheless fairly high.

Although debatable, some believe naked shorting plays an essential market duty in price exploration.

Find Relevant Stories Relevant to Forex Position Trading Journals and Financial market news, analysis, trading signals and Forex financial expert testimonials.

Warning about Risk

Please note that trading in leveraged products might involve a substantial degree of risk and is not appropriate for all investors. You need to not run the risk of more than you are prepared to shed. Before choosing to trade, please ensure you understand the dangers involved and take into account your degree of experience. Look for independent guidance if essential.