Read More info Top Searched Base Camp Trading Momentum, Why We Watch Momentum.

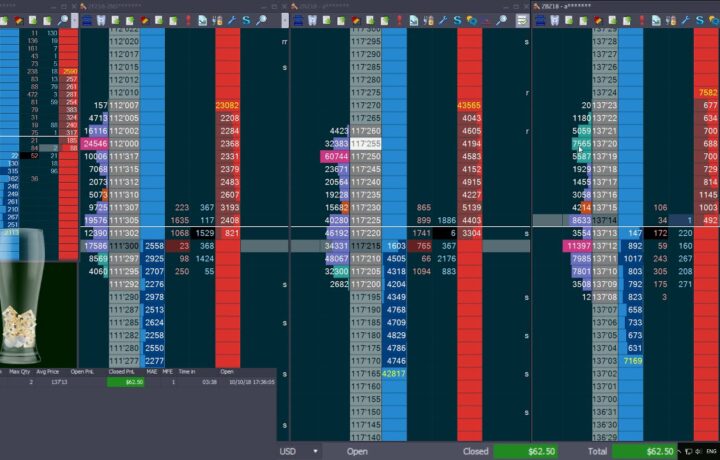

Today we discuss the momentum over the past couple weeks in the S&P emini (ES) Futures market. We always want to watch momentum when deciding on placing trades as this can be one of the best indicators of how a market will move as well as how much followthrough we will get on breakouts.

Ready to take the next step in your trading career? Start your one month, $7 trial today and join us in the trading room tomorrow!

https://grfly.co/oi9

For technical analysis on Stocks, Forex, Futures, Equities, Options and Other Market Commentary, Follow Us on StockTwits and Twitter:

Twitter:

Tweets by TradesWithTom

Tweets by TradeswithDave

StockTwits:

http://stocktwits.com/TradesWithTom

https://stocktwits.com/bctdave

Base Camp Trading Momentum, Why We Watch Momentum.

Just How Does Momentum Spending Work?

Momentum investing usually includes a rigorous set of regulations based upon technical signs that determine market entrance and exit points for specific securities. Momentum capitalists sometimes make use of two longer-term relocating standards, one a bit much shorter than the various other, for trading signals. Some make use of 50-day and 200-day relocating standards, for example. The 50-day crossing above the 200-day produces a buy signal. A 50-day crossing back listed below the 200-day produces a sell signal. A few Momentum capitalists favor to make use of even longer-term relocating standards for signaling functions.

An additional type of Momentum investing approach includes complying with price-based signals to go long sector ETFs with the greatest Momentum, while shorting the sector ETFs with the weakest Momentum, after that turning in an out of the sectors appropriately.

What is the best the Momentum indicator?

This toughness behind the trend is frequently described as the Momentum, and there are a variety of signs that attempt to measure it. Several of the better-known the Momentum signs are the Loved one Toughness Index (RSI), the Stochastic oscillator and the Moving Average Convergence Aberration (MACD).

Still, various other Momentum approaches include cross-asset evaluation. For instance, some equity traders carefully watch the Treasury yield curve and utilize it as A Momentum signal for equity entrances and departures. A 10-year Treasury yield above the two-year yield normally is a buy signal, whereas a two-year yield trading above the 10-year is a sell signal. Especially, the two-year versus 10-year Treasury returns often tend to be a solid predictor of economic downturns, and also has ramifications for stock markets.

In addition, some approaches include both Momentum variables and some essential variables. One such system is CONTAINER SLIM, made popular by William O’Neill, owner of Investor’s Service Daily. Because it stresses quarterly and annual earnings per share, some might say it’s not A Momentum approach, per se.

Nevertheless, the system normally looks for supplies with both earnings and sales Momentum and tends to point to supplies with rate Momentum, also. Like various other Momentum systems, CONTAINER SLIM also includes regulations for when to get in and exit supplies, based mostly on technical evaluation.

Read Popular Posts Top Searched Base Camp Trading Momentum and Financial market information, evaluation, trading signals and Forex financial expert testimonials.

Disclaimer:

The details offered by TradingForexGuide.com (TFG) is for basic informative and instructional functions just. It is not planned and ought to not be understood to constitute guidance. If such details is acted upon by you after that this ought to be exclusively at your discernment and TradingForexGuide.com (TFG) will certainly not be held accountable and responsible by any means.