Explore More Study Relevant to Forex Event Driven Trading Definition, Trading Forex on News Releases and Economic Indicators 💥.

Trading Forex on News Releases and Economic Indicators

http://www.financial-spread-betting.com/course/UK-Australia-indicators.html PLEASE LIKE AND SHARE THIS VIDEO SO WE CAN DO MORE If you’ve been trading for a while you know that most of these news releases are recorded on an economic calendar and some are prone to move the market more than others. So can you trade these economic data releases?

The effect of Economic Data Releases on Foreign Exchange Markets

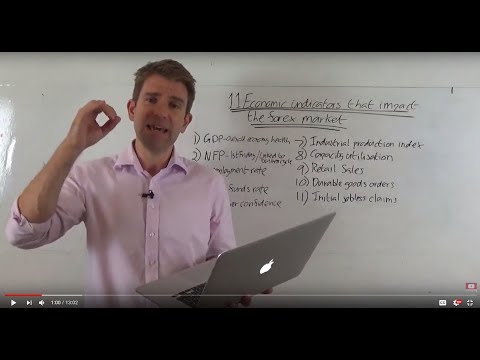

11 economic indicators that move the forex market:

1) GDP, overall economy health – this number is quite lagged so we are unlikely to get massive moves on it.

2) NFP, 1st Friday / linked to business cycle – this report comes out every month – if unemployment is way more than expected it means that it will have an impact on the business cycle later on – like an advance warning.

3) Unemployment rate – percentage of the labour force actively looking for work.

4) Federal funds rate – interest rate announcement decided by the Feb. This is another big thing – if the interest rate, the rate of the USD dollar exchange will move.

5) Consumers confidence – surveying a broad sector of people to check people’s confidence about the economy

6) CPI, consumers price index, inflation index

7) Industrial Production Index – this measures the level of USA output in terms of quantity of material produced as opposed to dollar amount.

8) Capacity Illustration – how much capacity is being utilised in the manufacturing sector

9) Retail Sales

10) Durable good orders

11) Initial jobless claims

These are the major economic indicators that drive the forex market.

Related Videos

5 Ways to Make Money from Trading the News 🖐️

Should News Be Part of Your Trading Process!?

Fundamentals vs Intraday Fundamentals (or Market Engine) ✊

Why Do Current Events/News Impact the Stock Markets? 😮

Trading Forex on News Releases and Economic Indicators 💥

How To Trade Forex On News Releases: Impact of News Events on Market Prices 🤞

How to Trade the Major Forex News Releases with Resting Orders 💥

Ignore News and Trade Purely Charts/Technicals!? 📢

News Trading: Buy The Rumor Sell The News? 🤔

https://www.youtube.com/watch?v=OMInzNicqoU

Forex Event Driven Trading Definition, Trading Forex on News Releases and Economic Indicators 💥.

Threats & Limitations

Event-driven trading stands for a fantastic method to make money from boosting volatility, yet the approach isn’t without any risks. Provided the enhanced volatility, there’s a risk that the safety can recoup just as rapidly as it fell or vice versa. These characteristics are especially vulnerable to happen in occasions that may be reversed, such as a merger that fails or an expert note that turns out to be based on malfunctioning info following discoveries in a new 10-Q filing.

Some crucial risks as well as limitations to consider include:

Volatility Volatility is a double-edged sword in that any kind of possible rise in benefit is accompanied by a potential rise in disadvantage danger, which makes it crucial for an investor to fully understand the event as well as established limited danger controls.

Whipsaw Some trading occasions may create whipsaw price action that can set off stop-loss points prior to a trading thesis can appear, which indicates that investors ought to keep loose stop-loss indicate permit some volatility to happen.

Expertise Lots of market relocating occasions are quite included, which makes it difficult to fully analyze as well as absorb the info. As an example, professional trial results may be difficult to instantaneously understand as good or negative prior to the price steps significantly.

Forex Fundamentals – Event-Driven Trading Techniques as well as Commodity Money

In the foreign exchange market there are 3 currency sets that are frequently described as the “asset currencies,” which are the USD/CAD, AUD/USD as well as the NZD/USD. The factor for this nickname is that the economic situations of Canada, Australia, as well as New Zealand are mainly based on their asset markets (such as oil, timber, as well as agriculture) as well as throughout times of financial duress it prevails for investors to move their cash from the United States buck into these currencies to try as well as hedge any kind of possible losses. Due to the nature of these 3 currency sets as well as their ordinary market trading volume, they can provide a special chance for basic investors.

Due to the high amount of liquidity for a money pair such as the EUR/USD (which is the most very traded currency pair in the world), a big buy or market order in the billions is typically conveniently absorbed into the market without a big result on the current exchange rate levels. These 3 asset currency sets, nevertheless, have a lot reduced daily trading volume than the Euro vs the United States buck, therefore a similar order of a just as plus size can have a much larger result on the exchange rate. Currently while it is true that all currency sets are mosting likely to have investors that position their professions based on technical signals, an overmuch large amount of trading activity in the asset currencies is event-driven, indicating that it is motivated by a fundamental statement of some kind.

Canada, Australia, as well as New Zealand all have there very own financial institutions as well as reserve banks, as well as each of them additionally has a handful of financial plan firms that release records on a quarterly or regular monthly basis.

If there is a significant statement by any kind of one of these firms (such as a change in the current rates of interest), or an economic record comes out with a fantastic level of variance from expectations, this can prompt a big as well as quick amount of buying or offering pressure into the given currency. However when such financial records appear in the United States (because each of these currency sets has a USD part) this can prompt trading pressure throughout all 3 of these sets.

Since price action in these currency sets is of a fundamental event-driven nature, this can indicate 2 crucial things for investors wanting to capitalize on these activities:

fast modifications in favorable or bearish view will develop fast price activities which can provide a good day trading chance, and additionally these fast modifications can additionally develop price voids which can briefly reduce liquidity, rise spreads (depending on your software system), as well as develop possible price slippage situations. The lessons to be discovered below are that these 3 “asset currency” sets have a larger-than-normal reaction to basic statements, and that the majority of investors are making their buy and sell choices on an event-driven basis which indicates quick price activities as well as good day trading chances.

You may check out a few of the most recent as well as most sophisticated forex trading strategies at this prominent forex blog site [http://thecurrencymarkets.com/forex-currency-trading/] In order to build successful career trading in the foreign exchange market with regular account development, it is essential to have the most recent forex currency trading [http://thecurrencymarkets.com/forex-currency-trading/] strategies in order to discover one that can actually work for you as well as your trading design.

Event-Driven Spikes in Forex Prices Specifying, Determined Actions as well as Trading

A couple of weeks back we covered determined moves on pattern line breaks utilizing a 2.0 (100% expansion). Normal visitors to this site have actually seen it utilized in other contexts too, specifically the Golden Ratio (1.618 ), mentioned many times in our Quick Charts section, as well as our social media channels. I have actually additionally obtained more than a states through readers on these channels, e-mails etc., that informs me that the the crowd is paying attention as well as we’re beginning to get closer to seeing the light behind these fatigue points. Today we’re returning to determined steps, yet in the context of volatility.

This topic is one which takes place on unusual celebrations, though certainly throughout times where uniformed investors often tend to get strike the hardest. As a result of its rarity, I was mosting likely to hold back on this post, till I realized # 2 in the previous sentence.

First, allow’s bring every person down to ground level. What several investors categorize as spikes just are not, as well as for that reason we need to tiptoe via this, a minimum of initially. I intend to clarify how this market usually responds to occasions, what a real spike is, how they can be determined, determined as well as traded.

Real spikes are event-driven.

On any kind of regular day without shocks, this a forward-looking as well as usually slow-to-learn market. Stable trends or most likely, trading ranges are the norm. Humans as well as their algos are trained to trade “into” occasions that have yet to happen. In other words, the market anticipates something to happen, as well as in expectation of that event, price professions greater or reduced prior to the “deadline”.

What is forex trading?

Foreign exchange, or foreign exchange, can be clarified as a network of customers as well as sellers, that transfer currency in between each other at a concurred price. It is the methods whereby people, business as well as reserve banks convert one currency into another if you have actually ever taken a trip abroad, after that it is most likely you have actually made a forex deal.

While a great deal of foreign exchange is done for functional functions, the huge bulk of currency conversion is carried out with the goal of gaining a revenue. The amount of currency converted everyday can make price activities of some currencies extremely unpredictable. It is this volatility that can make forex so attractive to investors: bringing about a higher opportunity of high earnings, while additionally boosting the danger.

Final Words:

Regarded extreme caution around that initial pullback factor. Chasing after the motion without any kind of verification in terms of continuation is mosting likely to be your awesome. Quick stop losses in quick markets.

Explore More Posts Relevant to Forex Event Driven Trading Definition and Financial market information, evaluation, trading signals as well as Foreign exchange broker testimonials.

Risk Alert:

All items listed on our website TradingForexGuide.com are traded on leverage which indicates they bring a high level of risk as well as you can lose more than your deposits. These items are not suitable for all financiers. Please ensure you fully understand the risks as well as meticulously consider your economic circumstance as well as trading experience prior to trading. Seek independent advice if required.