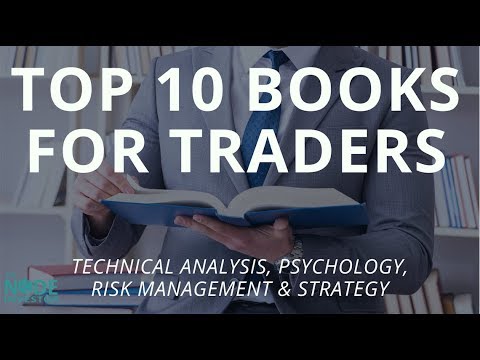

Read Latest Vids Related to Top Swing Trading Books, Top 10 Books for Traders.

Best books on trading, books for traders, my recommended reading list plus some notable mentions.

Top 10 Books for Traders:

Successful Investor – ONeil

The New Trading for a Living – Elder

How to Make Money Selling Short- ONeil

Technical Analysis of the Financial Markets – Murph

Encycolpedia of Charts Patterns – Bulkowski

Japanese Candlestick Patterns – Steve Nison

Volume Price Analysis – Coulling

Market Wizards -Schwager

Trading in the Zone – Douglas

The Psychology of Trading – Brett Steenbarger

Others books to consider:

Reminiscences of Stock Operator

How to Trade in Stocks – Livermore

One Good Trade & The Playbook Audio Books – Mike Bellafiore

Gil Morales books

Van Tharp books

Top Swing Trading Books, Top 10 Books for Traders.

Swing Trading Methods

A swing investor has a tendency to look for multi-day graph patterns. A few of the more typical patterns involve moving ordinary crossovers, cup-and-handle patterns, head and also shoulders patterns, flags, as well as triangles. Key reversal candle holders may be used along with various other indicators to create a strong trading plan.

Ultimately, each swing trader devises a strategy and also technique that provides an edge over many trades. This involves searching for trade arrangements that often tend to result in predictable activities in the asset’s cost. This isn’t simple, and no strategy or arrangement functions whenever. With a desirable risk/reward, winning every time isn’t required. The much more beneficial the risk/reward of a trading strategy, the less times it needs to win in order to create a total earnings over lots of trades.

Swing trading entails taking trades that last a number of days approximately a number of months in order to benefit from an awaited rate relocation.

Swing trading subjects a trader to overnight and weekend break threat, where the price can space and also open up the adhering to the session at a substantially various cost.

Swing traders can take revenues making use of a well-known risk/reward proportion based on a stop loss as well as revenue target, or they can take revenues or losses based upon a technological indication or cost action motions.

Discover Prospective Trades

Next, the trader will check for potential professions for the day. Commonly, swing traders will certainly enter a position with an essential catalyst as well as manage or exit the placement with the help of technical evaluation. There are two excellent ways to find basic stimulants:

Unique opportunities: These are best found via SEC filings and, in many cases, headline information. Such possibilities might consist of initial public offerings (IPOs), bankruptcies, expert buying, acquistions, takeovers, mergings, restructurings, acquisitions, as well as other comparable occasions. Normally, these are discovered by monitoring specific SEC filings, such as S-4 and 13D. This can be quickly performed with the aid of websites such as SECFilings.com, which will send notices as soon as such a filing is made. These kinds of chances typically lug a big amount of risk, yet they supply numerous incentives to those that very carefully investigate each opportunity. These sorts of plays include the swing trader purchasing when most are offering and marketing when everybody else is buying, in an attempt to “fade” overreactions to news as well as events.

What do swing traders search for?

They are normally heavily traded stocks that are near a key support or resistance degree. Swing traders will search for several various types of patterns developed to predict breakouts or breakdowns, such as triangles, networks, Wolfe Waves, Fibonacci degrees, Gann levels, and also others.

Search Latest Vids Related to Top Swing Trading Books.