Read Relevant Posts Related to Forex Swing Trading Money Management, Risk and Money Management For Swing Trading.

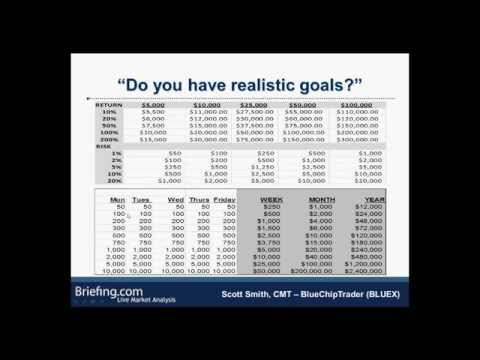

Senior technical analyst Scott Smith, CMT (BlueChipTrader – BLUEX) covers management strategies from a swing trader’s perspective. He reviews his simple “profitunity” table showing just how much you should be looking to make each day, week or month to achieve a bigger picture goal. You’ll also learn why Average True Range (ATR) is a key indicator in figuring out expected range behavior.

Scott’s bottom line? Trade small enough to easily meet your target goals and risk based off of a stock’s volatility.

Watch the second installation of our three-part series now.

Forex Swing Trading Money Management, Risk and Money Management For Swing Trading.

Is Swing trading more secure than day trading?

Yes turn trading is more safer than day trading as well as The factor is fairly basic! In day trading, a trader enters as well as exits a variety of placements to make profits from small variations in market. Whereas, swing trading included holding stocks for a longer period, state from days to weeks.

Pre-Market

The retail swing investor will certainly commonly start his day at 6 am EST, well prior to the opening bell. The moment prior to the opening is important for getting a total feel for the day’s market, locating potential trades, developing a daily watch listing as well as, lastly, checking out existing placements.

Market Review

The very first job of the day is to catch up on the most recent news as well as growths on the market. The quickest way to do this is using the cable tv network CNBC or trustworthy web sites such as Market Watch. The investor needs to keep an eye on three points in particular:

- General market view (bullish/bearish, essential economic records, inflation, currency, overseas trading sessions, etc.).

- Sector view (hot markets, expanding markets, etc.).

- Present holdings (news, profits, SEC filings, etc.).

Considerations as well as Variations On Just How Much You Can Make

If you might take 10 (legitimate) trades a month, rather than 5, your income would certainly increase. If you take less than 5 trades a month, your income goes down accordingly. This presumes you maintain the 60% win rate as well as 3:1 reward to risk. Increase the win rate or raise the reward: threat, while maintaining the other ratio, as well as your income will certainly raise. If win rate or reward: risk drop though, expect a decline in income.

If you balance reward: threat winds up being 2:1, after that your monthly earnings goes down to about 3.5% to 4%, assuming all other variables remain the same.

If the win rate is 50%, at a 3:1 reward: threat, the monthly earnings likewise goes down to around 4%. Extremely somewhat adjustments have a massive influence on productivity.

Do swing investors make money?

When turn trading, the marketplace you trade– stocks, foreign exchange, choices, or futures– does not matter way too much. All have their very own benefits and all deal comparable earnings possibility. For example, if you make 5% a month trading a $2000 account, your income is $100. If you make 5% a month on a $60,000 account, your income is $3,000.

Risk 2% per trade, rather than 1%, as well as your income likewise doubles. Risk 0.5% per trade as well as your income is cut in half. This presumes all other data remain equal.

For simplicity, these scenarios assume that you would certainly get in as well as leave placements within the month. That might not always hold true. If your trades last 2 months, after that this income would certainly be expanded over two months. If your trades typically only last a week or so, after that the scenarios are accurate, assuming you can replicate the conditions above.

Read Relevant Posts Related to Forex Swing Trading Money Management.