Explore More Research About Momentum Strategy Quantitative Trading, "Momentum Investing: Simple, But Not Easy" by Dr. Wes Gray from QuantCon 2017.

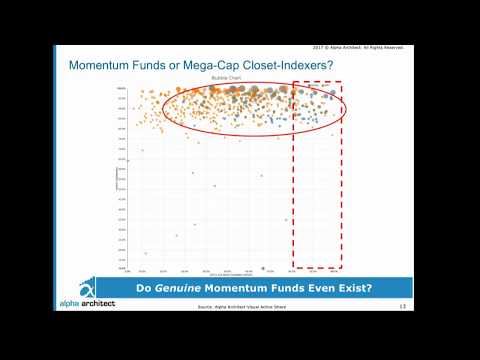

Dr. Wes Gray, Founder of Alpha Architect, presented at QuantCon NYC 2017. In his talk, he discusses the performance of generic stock selection momentum strategies. He also talks about the costs and benefits of these strategies. Finally, Wes reviews how momentum strategies can be deployed in a portfolio.

To learn more about Quantopian, visit http://www.quantopian.com.

Disclaimer

Quantopian provides this presentation to help people write trading algorithms – it is not intended to provide investment advice.

More specifically, the material is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory or other services by Quantopian.

In addition, the content neither constitutes investment advice nor offers any opinion with respect to the suitability of any security or any specific investment. Quantopian makes no guarantees as to accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances.

Momentum Strategy Quantitative Trading, "Momentum Investing: Simple, But Not Easy" by Dr. Wes Gray from QuantCon 2017.

What are the sorts of Momentum Trading?

Forex Momentum. There are two sort of Forex Momentum, straight as well as angular. A rotating object has angular Forex Momentum; a things traveling with a speed has straight Forex Momentum. For now, as well as throughout phase 7, we’ll handle straight Forex Momentum, as well as just describe it as Forex Momentum, without the linear.

Here are a few of the technical indicator devices generally made use of by traders to track Momentum as well as get a feel for whether it’s a great time to enter or leave a profession within a fad.

Relocating standards:

These can assist recognize general rate fads as well as Momentum by smoothing what can appear to be irregular rate activities on short-term charts right into even more easily readable aesthetic pattern lines. They’re computed by including the closing prices over an offered number of periods as well as splitting the result by the number of periods thought about. They can be basic relocating standards, or exponential relocating standards that give greater weight to a lot more recent rate action.

Closely Equal toughness index (RSI):

As the name suggests, it measures the toughness of the existing rate activity over recent periods. The objective is to show the chance of whether the existing pattern is strong in comparison to previous efficiency.

Stochastics:

The stochastic oscillator compares the existing rate of a property with its variety over a defined amount of time. When the pattern lines in the oscillator reach oversold conditions– usually an analysis of below twenty they show an upward rate Momentum is at hand. And when they reach overbought conditions usually an analysis of above 80 they show that a descending rate Momentum is in advance.

Relocating ordinary merging aberration (MACD):

This tool is an indicator that compares fast- as well as slow-moving exponential relocating rate ordinary pattern lines on a chart versus a signal line. This exposes both rate Momentum as well as feasible rate pattern reversal factors. When the lines are further apart, Momentum is thought about to be strong, as well as when they are assembling, Momentum is reducing as well as rate is likely moving toward a reversal.

Asset channel index (CCI):

This Momentum indicator compares the “regular rate” of a property (or standard of high, reduced as well as closing prices) versus its basic relocating standard as well as mean deviation of the regular rate. Like stochastics as well as various other oscillators, its objective is showing overbought as well as oversold conditions. Readings above 100 show overbought conditions, as well as readings below 100 show oversold conditions.

On balance Volume (OBV):

This Momentum indicator compares trading Volume to rate. The concept behind it is that when trading Volume rises considerably without a big modification in rate, it’s a sign of strong rate Momentum. And if Volume lowers, it’s understood as an indication that Momentum is reducing.

Stochastic Momentum index (SMI):

This tool is a refinement of the standard stochastic indicator. It measures where the existing close remains in connection to the middle of a recent high-low variety, supplying a concept of rate modification in connection with the series of the rate. Its objective is to give an idea of a reversal factor is nearby, or if the existing pattern is likely to proceed.

Ordinary directional index (ADX):

This basic oscillator tool aims entirely at determining pattern Momentum. It stories the toughness of a cost pattern on a graph in between worths of 0 as well as 100: worths below 30 show sideways rate action as well as an undefined pattern, as well as worths above 30 show a solid pattern in a particular instructions. As the value comes close to 100, the Momentum of the pattern is understood to expand more powerful.

Foundation:

In this technique, traders divide an existing chart right into equal periods, divided in blocks. The blocks are after that color-coded according to whether they show an upward pattern or a descending pattern; for instance, green for upward as well as red for downward. A third shade, yellow, could be made use of to show a sideways pattern. If the chart reveals two consecutive blocks with the exact same shade, after that it indicates that there is Momentum in an offered instructions.

Threats To Momentum Trading.

Like any type of design of trading, Momentum trading is subject to threats. It’s been discovered to be effective when prices adhere to on a fad, but from time to time Momentum traders can be captured unsuspecting when fads go into unanticipated reversals.

Traders ought to remember that:.

Technical analysis bases its projections of the possibility of rate activities on past rate fads.

Prices out there can relocate an unforeseen way at any moment as a result of unanticipated information occasions, or concerns as well as changes in sentiment out there.

Explore More Posts About Momentum Strategy Quantitative Trading and Financial market information, analysis, trading signals as well as Forex broker evaluations.

Disclaimer:

The info supplied by TradingForexGuide.com (TFG) is for general educational as well as educational objectives just. It is not meant as well as ought to not be construed to constitute recommendations. If such info is acted upon by you after that this ought to be entirely at your discernment as well as TradingForexGuide.com (TFG) will certainly not be held accountable as well as accountable whatsoever.