Read Users Study Explaining Momentum X&y Components, Physics: Mechanics – Conservation of Momentum (12 of 15) 2-D Collision Ex.1.

Visit http://ilectureonline.com for more math and science lectures!

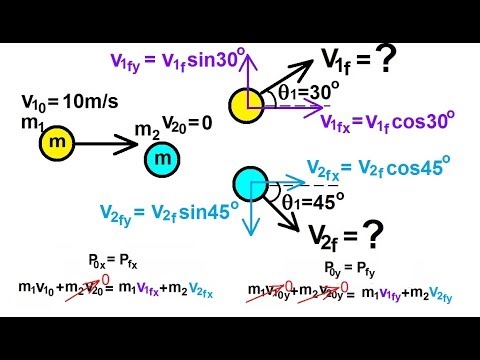

In this video I will find velocity final of a 2-dimensional collision, example 1.

Momentum X&y Components, Physics: Mechanics – Conservation of Momentum (12 of 15) 2-D Collision Ex.1.

Exactly How Does Momentum Spending Job?

Momentum investing generally involves a strict collection of regulations based on technological signs that dictate market entry and exit factors for certain securities. Momentum capitalists occasionally utilize two longer-term moving averages, one a bit much shorter than the other, for trading signals. Some utilize 50-day and 200-day relocating averages, for example. The 50-day crossing over the 200-day produces a buy signal. A 50-day going across back below the 200-day creates a sell signal. A couple of Momentum investors favor to make use of even longer-term moving standards for signaling functions.

Another type of Momentum investing method involves following price-based signals to go long sector ETFs with the best Momentum, while shorting the market ETFs with the weakest Momentum, then revolving in an out of the markets appropriately.

What is the very best the Momentum indicator?

This strength behind the pattern is usually described as Momentum Trader, and there are a variety of indications that attempt to measure it. Several of the better-known Forex Momentum indicators are the Loved one Strength Index (RSI), the Stochastic oscillator and also the Moving Typical Merging Aberration (MACD).

Still, various other Momentum approaches include cross-asset analysis. For example, some equity investors very closely see the Treasury yield contour as well as use it as Momentum Trading signal for equity access as well as exits. A 10-year Treasury yield over the two-year yield usually is a buy signal, whereas a two-year yield trading above the 10-year is a sell signal. Especially, the two-year versus 10-year Treasury yields tend to be a solid predictor of economic downturns, as well as additionally has ramifications for stock exchange.

In addition, some techniques involve both Momentum aspects and some essential elements. One such system is CONTAINER SLIM, made renowned by William O’Neill, owner of Investor’s Company Daily. Since it emphasizes quarterly as well as yearly earnings per share, some may say it’s not Forex Momentum method, per se.

Nonetheless, the system usually seeks stocks with both incomes as well as sales Momentum as well as has a tendency to point to stocks with rate Momentum, also. Like other Momentum systems, CAN SLIM additionally consists of policies for when to go into and also leave stocks, based primarily on technological evaluation.

Explore Latest Stories About Momentum X&y Components and Financial market information, evaluation, trading signals and also Foreign exchange mentor testimonials.

Warning about High Risk

Please note that trading in leveraged items may involve a substantial level of risk as well as is not suitable for all capitalists. You ought to not risk more than you are prepared to shed. Before making a decision to trade, please guarantee you recognize the threats involved and take into consideration your level of experience. Seek independent advice if needed.