Find Latest Posts Explaining Forex Swing Trading Signals, How to Use Forex Swing Trading Signals on VantagePointTrading.com.

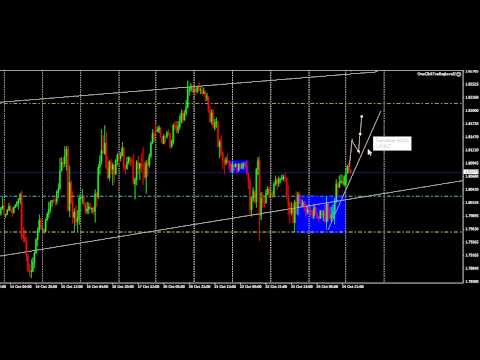

This video describes the type of forex swing trading signals published numerous times a week on http://vantagepointtrading.com/, as well as how to trade the signals and manage positions. Occasionally there may be other types of swing trades published, but this video should give a good idea how to trade the signals. Unfortunately a 15 minute video won’t reveal everything. You’re encouraged to utilize your own tested forex trading methods if you opt to use these forex swing trading signals, as well as practice in a demo account and establish consistent profitability before trying to trade these signals with real capital.

Sign up for our free weekend newsletter to stay on top of the most recent forex swing trading signals: http://vantagepointtrading.com/about-us/vantage-point-trading-newsletter

Forex Swing Trading Signals, How to Use Forex Swing Trading Signals on VantagePointTrading.com.

What Is Swing Trading?

Swing trading is a style of trading that tries to capture gains in a supply (or any type of economic tool) over a duration of a few days to several weeks. Swing traders largely utilize technical evaluation to search for trading chances. These traders may utilize essential evaluation along with evaluating price fads and patterns.

Understanding Swing Trading

Swing trading includes holding a position either long or short for greater than one trading session, however usually not longer than several weeks or a couple months. This is a general time frame, as some professions may last much longer than a couple of months, yet the investor may still consider them swing professions.

The objective of swing trading is to capture a piece of a prospective price action. While some traders seek out unstable supplies with lots of movement, others may favor extra calm supplies. In either situation, swing trading is the process of identifying where an asset’s price is likely to move next off, getting in a position, and then recording a piece of the make money from that action.

What is swing trading method?

Swing trading is a style of trading that tries to capture gains in a supply (or any type of economic tool) over a duration of a few days to several weeks. Swing traders largely utilize technical evaluation to search for trading chances.

Effective swing traders are just looking to capture a piece of the anticipated price action, and then go on to the following opportunity.

Swing trading is one of one of the most preferred kinds of active trading, where traders search for intermediate-term chances utilizing various kinds of technical evaluation. If you have an interest in swing trading, you need to be thoroughly knowledgeable about technical evaluation. Investopedia’s Technical Analysis Program provides an extensive summary of the subject with over five hrs of on-demand video, workouts, and interactive content cover both fundamental and advanced strategies.

Can you earn a living trading supplies?

It is feasible to earn a living trading supplies, however the genuine concern is if it’s potential. Research studies on day investor performance have revealed that many lose cash over the long term. Still, some people make an excellent living trading supplies and have done so effectively for many years.

Many swing traders evaluate professions on a risk/reward basis. By evaluating the graph of an asset they identify where they will enter, where they will put a quit loss, and then anticipate where they can venture out with an earnings. If they are taking the chance of $1 per share on a configuration that could sensibly produce a $3 gain, that is a positive risk/reward. On the other hand, taking the chance of $1 to make $1 or only make $0.75 isn’t as beneficial.

Swing traders largely utilize technical evaluation, due to the short-term nature of the professions. That said, essential evaluation can be used to enhance the evaluation. For instance, if a swing investor sees a favorable configuration in a supply, they may wish to validate that the principles of the asset appearance beneficial or are boosting additionally.

Swing traders will frequently search for chances on the day-to-day graphes, and may see 1-hour or 15-minute graphes to find exact entrance and quit loss points.

Find Latest Posts Explaining Forex Swing Trading Signals.