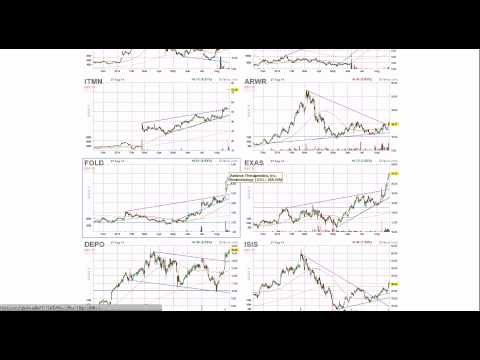

Find More info About How To Screen Stocks For Swing Trading, How to Screen For Strongest Stocks in Strongest Sectors – Swing Trading (Technical).

Find swing trade ideas on http://vantagepointtrading.com/. How to easily find the strongest stocks in the strongest sectors to buy, or how to find the weakest stocks in the weakest sectors to sell/short. I no longer use freestockcharts, instead I would recommend TradingView.com if you are looking for free charts.

Many traders look to buy very strong stocks because they have proven they can move aggressively to the upside, as well sell/short very weak stocks because they offer big moves to the downside.

We can’t just buy and sell the strongest or weakest stock though. I show you how to find these “potential trade” stocks and then quickly zero in on which ones are providing trades, based on your strategy, right now.

Fine tune the list even more by adding in additional criteria on the screener to suit your individual preferences.

This stock screening process is intended for swing traders (or day traders), and the strategies should be based on a technical approach. Look to capture a strong move over a short period of time, such as a few days to a few weeks. This is not an investment strategy.

How To Screen Stocks For Swing Trading, How to Screen For Strongest Stocks in Strongest Sectors – Swing Trading (Technical).

What Is Swing Trading?

Swing trading is a style of trading that attempts to capture gains in a supply (or any economic instrument) over a duration of a couple of days to several weeks. Swing traders largely make use of technical analysis to search for trading possibilities. These traders might make use of basic analysis in addition to assessing cost trends and also patterns.

Understanding Swing Trading

Swing trading involves holding a placement either long or short for greater than one trading session, however normally not longer than several weeks or a pair months. This is a general period, as some professions might last much longer than a couple of months, yet the trader might still consider them turn professions.

The goal of swing trading is to capture a piece of a possible cost action. While some traders look for volatile stocks with lots of motion, others might prefer more sedate stocks. In either situation, turn trading is the process of recognizing where an asset’s cost is most likely to relocate next, entering a placement, and after that capturing a piece of the profit from that action.

What is swing trading approach?

Swing trading is a style of trading that attempts to capture gains in a supply (or any economic instrument) over a duration of a couple of days to several weeks. Swing traders largely make use of technical analysis to search for trading possibilities.

Successful swing traders are only seeking to capture a piece of the anticipated cost action, and after that carry on to the next possibility.

Swing trading is among one of the most prominent forms of energetic trading, where traders search for intermediate-term possibilities using various forms of technical analysis. If you have an interest in swing trading, you ought to be intimately knowledgeable about technical analysis. Investopedia’s Technical Evaluation Course offers a comprehensive review of the subject with over 5 hrs of on-demand video clip, workouts, and also interactive web content cover both fundamental and also sophisticated techniques.

Can you earn a living trading stocks?

It is feasible to earn a living trading stocks, however the actual concern is if it’s probable. Studies on day trader performance have actually shown that most shed cash over the long term. Still, some people make a great living trading stocks and also have actually done so successfully for several years.

Lots of swing traders evaluate professions on a risk/reward basis. By assessing the graph of an asset they determine where they will get in, where they will place a quit loss, and after that expect where they can get out with a revenue. If they are risking $1 per share on a configuration that could sensibly generate a $3 gain, that is a favorable risk/reward. On the other hand, risking $1 to make $1 or only make $0.75 isn’t as positive.

Swing traders largely make use of technical analysis, because of the short-term nature of the professions. That stated, basic analysis can be used to boost the analysis. For example, if a swing trader sees a favorable configuration in a supply, they might intend to verify that the basics of the possession appearance positive or are boosting also.

Swing traders will commonly search for possibilities on the daily charts, and also might watch 1-hour or 15-minute charts to find precise entry and also stop loss factors.

Find More info About How To Screen Stocks For Swing Trading.