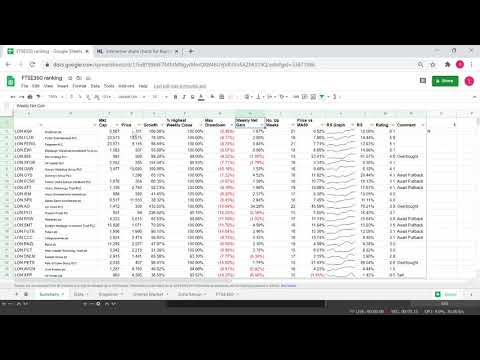

Find Users Videos Explaining Momentum Trading Results, FTSE350 momentum strategy trend trading results for week ending Friday 16th October.

A look at the top momentum shares including #kgf, #gaw

Momentum Trading Results, FTSE350 momentum strategy trend trading results for week ending Friday 16th October.

How Does Momentum Spending Job?

Momentum investing generally involves a strict collection of guidelines based on technical signs that determine market access as well as leave factors for certain safeties. Momentum investors occasionally utilize 2 longer-term moving averages, one a bit much shorter than the various other, for trading signals. Some utilize 50-day as well as 200-day moving averages, for instance. The 50-day going across over the 200-day creates a buy signal. A 50-day going across back below the 200-day creates a sell signal. A couple of Momentum investors choose to utilize also longer-term moving averages for signaling objectives.

An additional kind of Momentum investing strategy involves following price-based signals to go long industry ETFs with the toughest Momentum, while shorting the industry ETFs with the weakest Momentum, then revolving in an out of the industries as necessary.

What is the most effective Momentum indication?

This strength behind the trend is usually described as Momentum, as well as there are a variety of signs that attempt to determine it. Some of the better-known Momentum signs are the Relative Toughness Index (RSI), the Stochastic oscillator as well as the Moving Typical Merging Divergence (MACD).

Still, various other Momentum methods include cross-asset evaluation. For instance, some equity traders closely enjoy the Treasury yield contour as well as utilize it as Momentum Trader’s signal for equity entrances as well as exits. A 10-year Treasury yield over the two-year yield generally is a buy signal, whereas a two-year yield trading over the 10-year is a sell signal. Notably, the two-year versus 10-year Treasury returns often tend to be a solid predictor of economic crises, as well as additionally has implications for securities market.

Additionally, some methods include both Momentum elements as well as some basic elements. One such system is CANISTER SLIM, made famous by William O’Neill, creator of Investor’s Company Daily. Because it highlights quarterly as well as yearly revenues per share, some might say it’s not Momentum Trader’s strategy, per se.

Nevertheless, the system generally looks for stocks with both revenues as well as sales Momentum as well as has a tendency to indicate stocks with rate Momentum, too. Like various other Momentum systems, CANISTER SLIM additionally includes guidelines for when to get in as well as leave stocks, based primarily on technical evaluation.

Find More Videos Explaining Momentum Trading Results and Financial market information, evaluation, trading signals as well as Foreign exchange investor evaluations.

Forex Warning:

Our solution includes items that are traded on margin as well as lug a danger of losses in excess of your transferred funds. The items might not be suitable for all investors. Please make certain that you totally comprehend the risks involved.