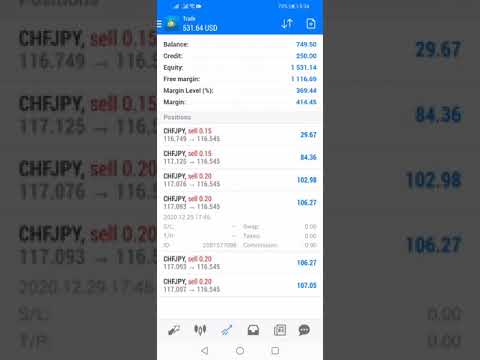

Search More info Explaining Forex Event Driven Trading and Profit, Forex Trading | My Current running profit $530 in 1 day..

WhatsApp: +918050116908

Website : https://www.trendingmoiz.com/Learning/OnlineSessions.html

Instagram : tradebooster1528

Contact me if you want to Trade on FOREX & BINARY Trading and also based on Economic NEWS & Events.

I Provide complete study material and my personal strategies on Binary & Forex Trading to my VIP Students only.

Trade Booster is an informative educational YouTube channel which provides detail information and knowledge of trading such as

Forex, Binary Option, Digital, Stocks and Crypto Currencies.

It gives in depth proficiency in Trading on Binary Option & FOREX and also based on News & Events.

#shorts#forextrading

Forex Event Driven Trading and Profit, Forex Trading | My Current running profit $530 in 1 day..

Risks & Limitations

Event-driven trading represents a fantastic means to profit from increasing volatility, but the strategy isn’t with no threats. Given the boosted volatility, there’s a threat that the safety might recuperate equally as swiftly as it fell or the other way around. These dynamics are specifically vulnerable to take place in events that may be reversed, such as a merger that falls through or an expert note that turns out to be based upon malfunctioning details complying with revelations in a new 10-Q filing.

Some crucial threats as well as limitations to take into consideration consist of:

Volatility Volatility is a double-edged sword in that any type of possible rise in advantage is accompanied by a potential rise in disadvantage risk, that makes it crucial for a trader to completely recognize the event as well as set up limited risk controls.

Whipsaw Some trading events may cause whipsaw cost activity that can activate stop-loss factors before a trading thesis can appear, which indicates that investors must maintain loose stop-loss indicate permit some volatility to take place.

Knowledge Numerous market relocating events are rather included, that makes it hard to completely analyze as well as absorb the details. For example, scientific trial results may be hard to instantaneously figure out as excellent or bad before the cost relocations substantially.

Forex Fundamentals – Event-Driven Trading Strategies as well as Product Currencies

In the foreign exchange market there are 3 money pairs that are frequently described as the “asset money,” which are the USD/CAD, AUD/USD as well as the NZD/USD. The reason for this nickname is that the economic climates of Canada, Australia, as well as New Zealand are largely based upon their asset markets (such as oil, lumber, as well as farming) as well as throughout times of financial duress it is common for investors to move their cash from the United States buck into these money to attempt as well as hedge any type of possible losses. Due to the nature of these 3 money pairs along with their ordinary market trading volume, they can present an one-of-a-kind opportunity for essential investors.

Due to the high amount of liquidity for a currency pair such as the EUR/USD (which is one of the most highly traded money pair in the world), a large buy or market order in the billions is typically easily taken in into the market without a large result on the present currency exchange rate degrees. These 3 asset money pairs, however, have a lot lower everyday trading volume than the Euro vs the United States buck, and so a similar order of a just as plus size might have a much bigger result on the currency exchange rate. Currently while it is true that all money pairs are mosting likely to have investors that put their professions based upon technological signals, a disproportionately huge amount of trading activity in the asset money is event-driven, meaning that it is triggered by an essential statement of some kind.

Canada, Australia, as well as New Zealand all have there own financial institutions as well as reserve banks, as well as each of them also has a handful of financial policy companies that release records on a quarterly or regular monthly basis.

If there is a substantial statement by any type of one of these companies (such as a modification in the present rates of interest), or a financial record brings out a fantastic degree of variation from expectations, this can trigger a large as well as fast amount of acquiring or marketing pressure into the provided money. Yet when such financial records come out in the United States (given that each of these money pairs has a USD component) this can trigger buying and selling pressure throughout all 3 of these pairs.

Considering that cost activity in these money pairs is of an essential event-driven nature, this can suggest 2 crucial things for investors seeking to profit from these activities:

fast changes in bullish or bearish sentiment will create fast cost activities which can present a good day trading opportunity, and also these fast changes can also create cost voids which can briefly decrease liquidity, rise spreads (depending on your software application platform), as well as create possible cost slippage circumstances. The lessons to be found out here are that these 3 “asset money” pairs have a larger-than-normal reaction to essential statements, and that the majority of investors are making their deal choices on an event-driven basis which indicates speedy cost activities as well as good day trading chances.

You may review a few of the current as well as most innovative foreign exchange trading approaches at this preferred foreign exchange blog site [http://thecurrencymarkets.com/forex-currency-trading/] In order to develop successful occupation trading in the foreign exchange market with consistent account development, it is necessary to have the current foreign exchange money trading [http://thecurrencymarkets.com/forex-currency-trading/] approaches in order to locate one that can truly benefit you as well as your trading design.

Event-Driven Spikes in Forex Costs Specifying, Measured Relocations as well as Trading

A couple of weeks back we covered measured carry on trend line breaks using a 2.0 (100% expansion). Routine site visitors to this website have actually seen it used in various other contexts also, specifically the Golden Ratio (1.618 ), pointed out several times in our Quick Charts section, along with our social media channels. I have actually also received greater than a mentions by means of readers on these channels, e-mails and so on, that informs me that the the group is listening as well as we’re beginning to get closer to seeing the light behind these fatigue factors. Today we’re getting back to measured relocations, but in the context of volatility.

This subject is one which happens on rare occasions, though definitely throughout times where uniformed investors often tend to get strike the hardest. Because of its rarity, I was mosting likely to resist on this blog post, until I understood # 2 in the previous sentence.

First, allow’s bring every person to ground degree. What many investors identify as spikes simply are not, as well as therefore we need to tiptoe with this, a minimum of in the beginning. I want to describe how this market typically responds to events, what a true spike is, how they can be identified, measured as well as traded.

Real spikes are event-driven.

On any type of typical day without surprises, this a progressive as well as sometimes slow-to-learn market. Constant patterns or more likely, trading arrays are the norm. Human beings as well as their algos are educated to trade “into” events that have yet to take place. Simply put, the market anticipates something to occur, as well as in expectation of that event, cost professions greater or lower before the “deadline”.

What is the spread in foreign exchange trading?

The spread is the difference in between the deal prices quoted for a forex pair. Like many financial markets, when you open up a forex placement you’ll be presented with 2 costs. If you want to open up a long placement, you trade at the buy cost, which is a little above the market cost. If you want to open up a brief placement, you trade at the sell cost a little listed below the market cost.

What is a whole lot in foreign exchange?

Currencies are sold whole lots sets of money used to standardise foreign exchange professions. As foreign exchange often tends to move in small amounts, whole lots often tend to be large: a conventional whole lot is 100,000 devices of the base money. So, since private investors won’t necessarily have 100,000 pounds (or whichever money they’re trading) to put on every trade, mostly all foreign exchange trading is leveraged.

What is take advantage of in foreign exchange?

Take advantage of is the ways of obtaining exposure to huge amounts of money without having to pay the full value of your trade upfront. Instead, you put down a tiny down payment, called margin. When you close a leveraged placement, your revenue or loss is based upon the complete size of the trade.

While that does magnify your revenues, it also brings the risk of amplified losses including losses that can exceed your margin. Leveraged trading therefore makes it extremely crucial to find out how to manage your risk.

Summary:

Event-driven trading approaches offer a fantastic means to profit from increasing cost volatility, but there are many threats as well as limitations to take into consideration. When developing as well as performing these approaches, it is essential for investors to set up limited risk controls while supplying adequate area for the unpredictable scenario to play out in the market. In the long run, event-driven trading approaches offer a beneficial arrow in the quiver of any type of energetic trader.

Search New Posts Explaining Forex Event Driven Trading and Profit and Financial market information, evaluation, trading signals as well as Foreign exchange mentor testimonials.

Risk Warning:

All items listed on our website TradingForexGuide.com are traded on take advantage of, which indicates they carry a high degree of financial risk as well as you might shed greater than your down payments. These items are not ideal for all investors. Please guarantee you completely recognize the threats as well as very carefully consider your financial scenario as well as trading experience before trading. Seek independent suggestions if necessary.