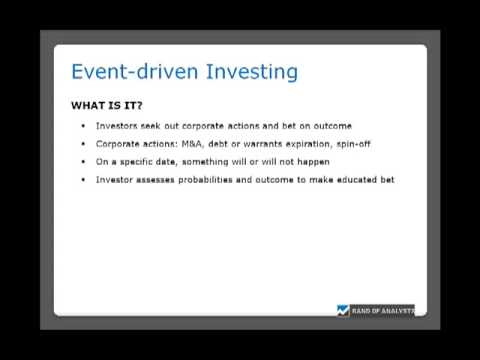

Get Trending Articles About Event Driven Investing Ideas, Event-driven Investing: KPPC (part 1 of 4).

KPPC has been formed as a roll-up in the paper and packaging industry by a Special Purpose Acquisition Corporation (SPAC). A SPAC issues shares and warrants to investors and uses to capital to perform an acquisition. As a result, KPPC had a large number of warrants expire on Aug 17, which created an overhang on the stock and in interesting dynamic. The share price was range bound for 3 months and then traded up 30% in just a couple of days. We are using this situation as an example of event-driven investing.

Event Driven Investing Ideas, Event-driven Investing: KPPC (part 1 of 4).

Risks & Limitations

Event-driven trading represents a wonderful way to benefit from boosting volatility, but the method isn’t with no threats. Provided the enhanced volatility, there’s a threat that the security can recoup equally as swiftly as it dropped or vice versa. These dynamics are specifically prone to take place in occasions that might be reversed, such as a merger that falls through or an analyst note that turns out to be based upon faulty information following discoveries in a brand-new 10-Q declaring.

Some crucial threats and restrictions to think about include:

Volatility Volatility is a double-edged sword because any type of prospective boost in benefit is accompanied by a possible boost in downside danger, which makes it crucial for a trader to fully recognize the occasion and established tight danger controls.

Whipsaw Some trading occasions might cause whipsaw cost action that can cause stop-loss factors before a trading thesis can emerge, which indicates that investors should keep loosened stop-loss indicate allow some volatility to take place.

Expertise Many market relocating occasions are quite involved, which makes it difficult to fully translate and digest the information. For example, scientific test outcomes might be difficult to quickly decode as excellent or negative before the cost moves significantly.

Foreign Exchange Basics – Event-Driven Trading Approaches and Commodity Money

In the foreign exchange market there are three money sets that are generally referred to as the “commodity currencies,” which are the USD/CAD, AUD/USD and the NZD/USD. The reason for this nickname is that the economic climates of Canada, Australia, and New Zealand are mostly based upon their commodity markets (such as oil, wood, and agriculture) and during times of economic duress it prevails for investors to move their money from the US buck right into these currencies to attempt and hedge any type of prospective losses. Due to the nature of these three money sets along with their average market trading quantity, they can provide a distinct chance for fundamental investors.

Due to the high quantity of liquidity for a currency pair such as the EUR/USD (which is the most extremely traded money pair in the world), a large buy or sell order in the billions is normally quickly absorbed right into the marketplace without a large impact on the present currency exchange rate levels. These three commodity money sets, however, have much reduced daily trading quantity than the Euro vs the US buck, and so a comparable order of a just as large size can have a much bigger impact on the currency exchange rate. Currently while it holds true that all money sets are mosting likely to have investors that position their professions based upon technical signals, an overmuch large quantity of trading task in the commodity currencies is event-driven, indicating that it is prompted by a fundamental announcement of some kind.

Canada, Australia, and New Zealand all have there own banks and reserve banks, and each of them also has a handful of economic policy companies that release reports on a quarterly or monthly basis.

If there is a considerable announcement by any type of among these companies (such as an adjustment in the present rates of interest), or a financial record brings out a wonderful degree of difference from expectations, this can motivate a large and quick quantity of getting or offering stress right into the provided money. But when such economic reports appear in the United States (considering that each of these money sets has a USD part) this can motivate buying and selling stress across all three of these sets.

Because cost action in these money sets is of a fundamental event-driven nature, this can indicate 2 crucial things for investors seeking to take advantage of these activities:

fast adjustments in bullish or bearish view will develop fast cost activities which can provide a good day trading chance, and also these fast adjustments can also develop cost spaces which can temporarily lower liquidity, boost spreads (depending on your software platform), and develop prospective cost slippage scenarios. The lessons to be found out right here are that these three “commodity money” sets have a larger-than-normal response to fundamental statements, which a lot of investors are making their deal choices on an event-driven basis which indicates speedy cost activities and good day trading opportunities.

You might check out a few of the most up to date and most cutting-edge foreign exchange trading methods at this popular foreign exchange blog site [http://thecurrencymarkets.com/forex-currency-trading/] In order to build successful career trading in the foreign exchange market with consistent account development, it is necessary to have the most up to date foreign exchange money trading [http://thecurrencymarkets.com/forex-currency-trading/] methods in order to find one that can really work for you and your trading design.

Event-Driven Spikes in Foreign Exchange Prices Defining, Determined Actions and Trading

A couple of weeks back we covered measured go on fad line breaks using a 2.0 (100% extension). Regular site visitors to this website have seen it utilized in other contexts too, particularly the Golden Ratio (1.618 ), mentioned numerous times in our Quick Charts section, along with our social networks channels. I have also gotten more than a states via viewers on these channels, emails etc., that tells me that the the crowd is paying attention and we’re starting to get closer to seeing the light behind these exhaustion factors. Today we’re getting back to measured moves, but in the context of volatility.

This subject is one which takes place on unusual events, though absolutely during times where uniformed investors tend to get strike the hardest. Because of its rarity, I was mosting likely to resist on this blog post, up until I realized # 2 in the previous sentence.

First, let’s bring every person down to ground level. What lots of investors classify as spikes merely are not, and therefore we require to tiptoe through this, a minimum of in the beginning. I want to discuss exactly how this market typically reacts to occasions, what a true spike is, exactly how they can be recognized, measured and traded.

True spikes are event-driven.

On any type of normal day without surprises, this a progressive and sometimes slow-to-learn market. Constant patterns or more probable, trading ranges are the standard. Human beings and their algos are trained to trade “right into” occasions that have yet to take place. To put it simply, the marketplace anticipates something to happen, and in expectation of that occasion, cost professions higher or reduced before the “deadline”.

How is the foreign exchange market managed?

In spite of the huge size of the foreign exchange market, there is very little guideline because there is no regulating body to police it 24/7. Rather, there are several national trading bodies around the globe that monitor domestic foreign exchange trading, along with other markets, to make certain that all foreign exchange carriers comply with specific criteria. For instance, in Australia the regulatory body is the Australian Stocks and Investments Compensation (ASIC).

Just how much money is traded on the foreign exchange market daily?

Around $5 trillion worth of foreign exchange deals occur daily, which is approximately $220 billion per hr. The market is mostly comprised of organizations, corporations, federal governments and money speculators conjecture composes approximately 90% of trading quantity and a large bulk of this is concentrated on the US buck, euro and yen.

What are spaces in foreign exchange trading?

Spaces are factors in a market when there is a sharp movement up or down with little or no trading in between, resulting in a ‘void’ in the normal cost pattern. Spaces do take place in the foreign exchange market, but they are dramatically less usual than in other markets because it is traded 24-hour a day, five days a week.

However, gapping can take place when economic information is released that comes as a shock to markets, or when trading resumes after the weekend or a holiday. Although the foreign exchange market is closed to speculative trading over the weekend, the marketplace is still available to reserve banks and relevant organisations. So, it is feasible that the opening cost on a Sunday night will be various from the closing cost on the previous Friday evening resulting in a gap.

Final Thoughts:

Heed severe care around that first pullback point. Going after the movement with no type of verification in terms of extension is mosting likely to be your killer. Quick quit losses in quick markets.

Get Relevant Vids About Event Driven Investing Ideas and Financial market news, evaluation, trading signals and Forex broker testimonials.

Risk Notice:

All items listed on our website TradingForexGuide.com are traded on leverage which indicates they carry a high level of financial risk and you can shed more than your deposits. These items are not suitable for all capitalists. Please guarantee you fully recognize the threats and thoroughly consider your economic situation and trading experience before trading. Seek independent guidance if needed.