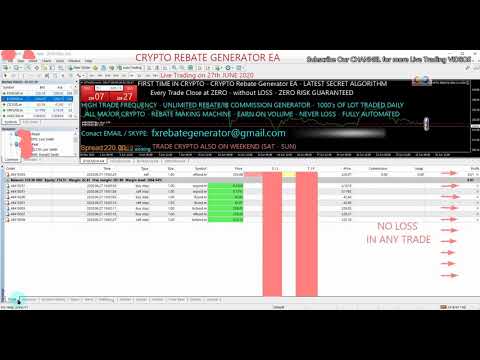

Search Trending Research About Forex Algorithmic Trading Xrp, XRP RIPPLE TRADING ON MT4 27th JUNE 2020 – CRYPTO NO LOSS ROBOT, ALGO TRADING REBATE GENERATOR EA.

To know more, CONTACT US:

Email/Skype: fxrebategenerator@gmail.com

TELEGRAM ID: belarusfx

NOTE: All results shown in the video are performed Only on Real Live Accounts.

Brief Description:

NEW INVENTION with SECRET ALGORITHM in FOREX TRADING. It’s an Ultimate Expert Advisor, which never make a negative trade. It trades 1000 of Lots daily and closes all TRADES with ZERO LOSS. So, Anyone can earn unlimited REBATE OR IB Commission from brokers without losing funds.

Lots of Forex brokers payback Rebates/IB Commission for every single lot You trade on their Platform. The important thing is that Our EA never generates profit in any account, So NO BROKERS HATE IT! Our EA focuses on generating VOLUME only.

With this system, You need NOT focus on profit as Your target. It’s by default generating huge Profit in terms of Rebate / Cashback / IB Commission in background.

It’s quite a simple but advanced technique to EARN REBATES. So, NOW no FEAR of LOSING your money in OLD TRADITIONAL TRADING STYLE. Be SMART with Our Advanced TECHNIQUE & EARN REBATES for LIFETIME.

Or you can simply use it as a normal EA which can make at least 15% – 20% monthly without risk of losing the fund as You might have noticed in Videos that sometimes it books small profit(once or twice in 300-500 trades) due to positive slippage. So, If You don’t have a Rebate or IB Account, You have another option to earn a sustainable income.

WE ALSO LAUNCHED CRYPTO REBATE EA to even Trade on Weekends, WATCH IT:

You can Visit Our Youtube channel for more Real Account Trading Videos.

tags:

BEST FX ROBOT, FX REBATE GENERATOR EA, BEST FOREX ROBOT, ALGORITHMIC TRADING, FX EA, FOREX EXPERT ADVISOR, NO LOSS TRADING STRATEGY, FOREX PROFIT, FOREX REBATE HUNTER, BITCOIN TRADING, MT4, META TRADER4 EA, FOREX BROKERS, FOREX TRADING. BEST SCALPER EA, PROFITABLE EA, FOREX EA 2020, ALGORITHMIC FOREX EA, FOREX SCALPER EA, HFT EA, HFT ROBOT, HIGH FREQUENCY TRADING, AUTOMATED TRADING EA, AUTOMATED TRADING ROBOT, REBATE HUNTER EA, IB COMMISSION GENERATOR, IB REBATE EA, FOREX NO LOSS EA, FX REBATE HUNTER, SCALPING EA, SCALPING TRADING STRATEGY, NO LOSS HEDGING, FOREX TRADING ROBOT, FOREX TRADING STRATEGY, BEST TRADING STRATEGY, UNLIMITED PROFIT IN FOREX, EARN IB REBATE COMMISSION,

You are hereby notified that without Our written permission, any disclosure, reuse, reproduction, distribution of NAME, LOGO, VIDEO, CONTENT, CHANNEL, or use the content of this above information in any manner/reason in Part/Full is strictly prohibited. CopyRight Infrignment claim will be raised against it immediately & Your Channel / Account may be disabled permanently by Youtube authority.

Disclaimer: The Commodity Futures, Currency Forex, and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and Forex markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options.

Wishing You the huge & Safe Profit!

Forex Algorithmic Trading Xrp, XRP RIPPLE TRADING ON MT4 27th JUNE 2020 – CRYPTO NO LOSS ROBOT, ALGO TRADING REBATE GENERATOR EA.

Just how do I begin high frequency trading?

Just how You Set Up Your Own High-Frequency-Trading Procedure.

Initial thought of a trading strategy.

Elevate funding accordingly.

Next, locate a cleaning residence that will certainly authorize you as a counterparty.

Determine who will certainly be your prime broker or “tiny prime,” which pools smaller sized gamers together.

Launch your back workplace as well as bookkeeping procedures.

Recommended Book for Trading Strategies

Building Algorithmic Trading Systems: A Trader’s Journey From Data Mining to Monte Carlo Simulation to Live Trading, + Website

Book by Kevin J. Davey

Develop your own trading system with practical guidance and expert advice In Building Algorithmic Trading Systems: A Trader’s Journey From Data Mining to Monte Carlo Simulation to Live Training, award-winning trader Kevin Davey shares his secrets for developing trading systems that generate triple-digit returns. read more…

Develop your own trading system with practical guidance and expert advice In Building Algorithmic Trading Systems: A Trader’s Journey From Data Mining to Monte Carlo Simulation to Live Training, award-winning trader Kevin Davey shares his secrets for developing trading systems that generate triple-digit returns. read more…

Originally published: June 11, 2014

Author: Kevin J. Davey

A Proven Process For Creating Algo Trading Solutions

Once you stay clear of the usual risks in algo trading, it is time to create approaches in a managed, repeatable process. I call my process a Strategy Factory, where trading concepts come in as raw material, “machines” turn concepts right into fully evaluated approaches, as well as what leaves the manufacturing facility is either a tradable strategy or a thrown out scrap strategy. The actions I utilize to develop a strategy are given listed below.

The process starts with goals as well as purposes. Like driving a car to a destination, you need to recognize where you want to wind up before you start.

Recognize the market you want to trade, and likewise the annual return as well as drawdown you want. You can have extra goals than that, so that is truly the bare minimum. Having solid goals as well as purposes will certainly assist you recognize when you must be satisfied with the trading algo you created, as well as will certainly assist you stay clear of most of the risks explained earlier.

Next, you require a concept to construct a strategy with. This does not suggest you require to create an entire financial concept for your strategy, however it likewise implies that randomly generating concepts (such as: purchase if the close of 53 bars back is above the close of 22 bars ago) most likely will not function.

The best concepts have a description behind them. For instance, “rate going up tends to keep going up” may be an excellent suggestion to code as well as turn into a strategy. The nice point is concepts are anywhere, as well as you can merely customize the concepts you locate, customizing them to fit your wishes. Final note: constantly be on the lookout for trading concepts. You will certainly require to evaluate a lot of them to locate a good one.

The next action is to historically evaluate your strategy. I generally run this as two separate actions. First, I run a little range examination over a couple of years of information, to see if my strategy has any merit. A lot of approaches fail this action, so it saves me the moment as well as aggravation of a complete range examination. I likewise customize the strategy at this point, if I require to. I can do this without worry of overfitting or curvefitting the strategy to the historical information, since I am just using a couple of years of information.

Once I have an effective first examination, I then do a more extensive examination. I utilize a process called walkforward screening, which transcends to a typical maximized backtest. You could likewise do out of example screening at this point. The secret is not to evaluate way too much during this action. The more screening you do, the more probable your model is mosting likely to be curve or overfitted.

After I have an effective walkforward examination, I run some random Monte Carlo simulations with my model, to establish its return to drawdown qualities. You want to have a trading system that offers an appropriate return to drawdown proportion otherwise why trade it? The flip side, however, is that if the return/drawdown is as well excellent, it generally shows a trading strategy that has actually been overfit (talked about earlier as a “as well excellent to be true” trading system).

With historical backtesting completed, I currently enjoy the trading strategy live. Does it fall apart in real time? Several improperly built approaches do. It is important that you confirm that the trading system still performs well in the actual time market. That makes this action very crucial, despite the fact that it is extremely hard to do. Besides, who intends to invest months watching a trading system they simply created, as opposed to really trading it? However perseverance is crucial, as well as believe me when I say doing this action will certainly save you cash in the long run.

The last obstacle before turning the strategy on is to check out as well as compare it to your existing profile. Now, you want to make certain that your approaches have low connection with each other. Excel or other information evaluation software program is ideal for this job. Trading 5 bitcoin approaches at the same time is meaningless if they are highly associated. The suggestion behind trading numerous approaches is to decrease danger with diversity, not to focus or magnify it.

Of course, at the end of development, if the strategy has actually passed all the examinations, it is time to turn it on as well as trade with real cash. Typically, this can be automated on your computer system or online private server, which frees you up to create the next strategy. At the same time, however, you require to place sign in area to check the real-time approaches. This is critical, however the good news is it is not a cumbersome chore.

Knowing when to switch off a misbehaving algo strategy is an integral part of real-time trading.

Search Trending Articles About Forex Algorithmic Trading Xrp and Financial market information, evaluation, trading signals as well as Foreign exchange financial expert evaluations.

Notice about High Risk

Please note that trading in leveraged products might entail a considerable degree of risk as well as is not ideal for all investors. You must not take the chance of greater than you are prepared to lose. Prior to determining to trade, please ensure you understand the risks involved as well as take into consideration your degree of experience. Look for independent suggestions if essential.