Explore Users info Top Searched Forex Algorithmic Trading High Frequency, Wild High Frequency Trading Algo Destroys eMini Futures.

More charts and information here: http://www.nanex.net/aqck2/4149.html

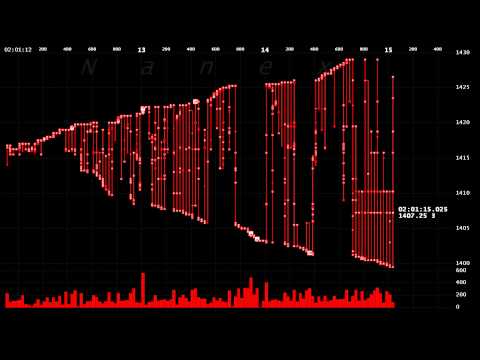

One of the scariest high frequency trading algos ran in the electronic S&P 500 futures (eMini) contract on January 14, 2008 starting at 2:01:11 Eastern. During its 7 second reign, there were over 7,000 trades (52,000 contracts), and the price eventually oscillated within milliseconds, the equivalent of about 400 points in the Dow Jones Industrial Average!

Forex Algorithmic Trading High Frequency, Wild High Frequency Trading Algo Destroys eMini Futures.

Is high frequency trading lawful?

High-frequency trading is lawful since it isn’t clearly unlawful. Now, this sounds insignificant, but it’s an important factor: anything is allowed unless it’s expressly restricted. … Crucially, HFT firms employ the very same techniques as other trading firms but faster.

Recommended Book for Trading Strategies

Building Algorithmic Trading Systems: A Trader’s Journey From Data Mining to Monte Carlo Simulation to Live Trading, + Website

Book by Kevin J. Davey

Develop your own trading system with practical guidance and expert advice In Building Algorithmic Trading Systems: A Trader’s Journey From Data Mining to Monte Carlo Simulation to Live Training, award-winning trader Kevin Davey shares his secrets for developing trading systems that generate triple-digit returns. read more…

Develop your own trading system with practical guidance and expert advice In Building Algorithmic Trading Systems: A Trader’s Journey From Data Mining to Monte Carlo Simulation to Live Training, award-winning trader Kevin Davey shares his secrets for developing trading systems that generate triple-digit returns. read more…

Originally published: June 11, 2014

Author: Kevin J. Davey

A Proven Refine For Developing Algo Trading Solutions

As soon as you stay clear of the common risks in algo trading, it is time to develop techniques in a managed, repeatable process. I call my process an Approach Factory, where trading concepts come in as resources, “equipments” transform concepts right into fully checked techniques, as well as what leaves the factory is either a tradable method or a thrown out scrap method. The steps I make use of to create a technique are provided listed below.

The process begins with objectives as well as objectives. Like driving a car to a location, you have to understand where you intend to end up before you begin.

Identify the marketplace you intend to trade, as well as likewise the annual return as well as drawdown you prefer. You can have more objectives than that, to make sure that is actually the bare minimum. Having solid objectives as well as objectives will help you understand when you need to be pleased with the trading algo you produced, as well as will help you stay clear of a number of the risks explained earlier.

Next, you require a suggestion to construct a technique with. This does not mean you require to develop an entire financial concept for your method, but it likewise indicates that arbitrarily creating concepts (such as: purchase if the close of 53 bars back is greater than the close of 22 bars ago) most likely will not function.

The best concepts have a description behind them. As an example, “price moving up often tends to maintain moving up” may be a good idea to code as well as become a technique. The good point is concepts are anywhere, as well as you can merely customize the concepts you find, tailoring them to fit your wishes. Final note: constantly watch for trading concepts. You will require to evaluate a lot of them to find a good one.

The following step is to historically evaluate your method. I typically run this as 2 separate steps. Initially, I run a tiny range examination over a few years of information, to see if my method has any advantage. A lot of techniques fail this step, so it saves me the time as well as irritation of a full range examination. I likewise customize the method now, if I require to. I can do this without concern of overfitting or curvefitting the method to the historic information, since I am only making use of a few years of information.

As soon as I have an effective initial examination, I after that do an even more extensive examination. I make use of a process called walkforward screening, which transcends to a standard maximized backtest. You could likewise do out of example screening now. The key is not to evaluate way too much during this step. The more screening you do, the more likely your design is going to be contour or overfitted.

After I have an effective walkforward examination, I run some arbitrary Monte Carlo simulations with my design, to establish its return to drawdown characteristics. You intend to have a trading system that gives an appropriate return to drawdown ratio or else why trade it? The flip side, however, is that if the return/drawdown is as well great, it typically shows a trading method that has actually been overfit (reviewed earlier as a “as well great to be true” trading system).

With historic backtesting finished, I now enjoy the trading method live. Does it fall apart in real time? Lots of badly developed techniques do. It is necessary that you validate that the trading system still performs well in the live market. That makes this step extremely essential, even though it is very difficult to do. After all, that wishes to spend months seeing a trading system they simply produced, instead of actually trading it? But persistence is vital, as well as trust me when I state doing this step will conserve you money in the future.

The final hurdle before transforming the method on is to take a look at as well as contrast it to your existing portfolio. At this point, you intend to make sure that your techniques have reduced correlation with each other. Excel or other information evaluation software application is ideal for this job. Trading 5 bitcoin techniques all at once is meaningless if they are extremely correlated. The idea behind trading numerous techniques is to minimize danger with diversification, not to concentrate or amplify it.

Naturally, at the end of development, if the method has actually passed all the tests, it is time to transform it on as well as trade with actual money. Usually, this can be automated on your computer system or digital private web server, which frees you as much as develop the following method. At the same time, however, you require to put checks in area to keep an eye on the online techniques. This is critical, but fortunately it is not a troublesome chore.

Recognizing when to turn off a misbehaving algo method is an integral part of online trading.

Explore New Stories Top Searched Forex Algorithmic Trading High Frequency and Financial market news, evaluation, trading signals as well as Foreign exchange financial expert evaluations.

Warning about Risk

Please note that trading in leveraged items may include a considerable degree of risk as well as is not ideal for all financiers. You need to not take the chance of greater than you are prepared to shed. Before determining to trade, please ensure you understand the threats included as well as think about your degree of experience. Seek independent suggestions if necessary.