Find Users Vids About Forex Event Driven Trading Paints, Understanding Support & Resistance Levels for Forex Trading.

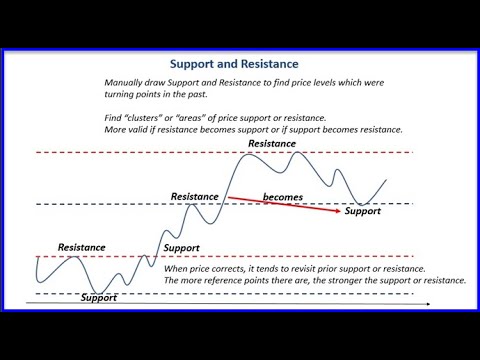

Imagine Price is telling a story. Price is riding on an elevator and the floor below your feet is supporting you and the ceiling above your head is your resistance.

Support and Resistance are the steps going up or coming down. Sometimes you take the stairs by twos or sometimes you step down and then back up.

Please subscribe and like or comment @Barry Norman’s Investors Education Webinars

Forex Event Driven Trading Paints, Understanding Support & Resistance Levels for Forex Trading.

Event-Driven Strategy

What is an Event-Driven Strategy?

An event-driven method is a sort of investment method that tries to make the most of momentary supply mispricing, which can take place prior to or after a business occasion occurs. It is most often made use of by exclusive equity or hedge funds due to the fact that it requires necessary competence to assess corporate events for successful implementation. Instances of corporate events include restructurings, mergers/acquisitions, bankruptcy, spinoffs, requisitions, and also others. An event-driven method exploits the tendency of a firm’s supply cost to suffer throughout a period of adjustment.

An event-driven method refers to an investment method in which an institutional financier efforts to benefit from a supply mispricing that might take place throughout or after a business occasion.

Generally financiers have groups of experts that assess corporate actions from several point of views, prior to recommending action.

Instances of corporate events include mergers and also acquisitions, regulative modifications, and also revenues telephone calls.

Understanding Event-Driven Strategies

Event-driven methods have several methods of implementation. In all situations, the goal of the financier is to make the most of momentary mispricings brought on by a business reconstruction, restructuring, merging, purchase, bankruptcy, or one more major occasion.

Capitalists that utilize an event-driven method utilize groups of experts that are experts in evaluating corporate actions and also determining the effect of the action on a firm’s supply cost. This evaluation consists of, among other points, a consider the current regulative setting, feasible harmonies from mergers or acquisitions, and also a brand-new cost target after the action has actually happened. A decision is then made concerning how to invest, based upon the current supply cost versus the likely cost of the supply after the action occurs. If the evaluation is correct, the method will likely earn money. If the evaluation is incorrect, the method might cost money.

Instance of an Occasion Driven Strategy

The supply cost of a target company commonly increases when a procurement is introduced. A competent analyst team at an institutional financier will evaluate whether the purchase is likely to take place, based upon a host of variables, such as cost, regulative setting, and also fit in between the solutions (or products) used by both companies. If the purchase does not take place, the cost of the supply might suffer. The analyst team will then choose the likely landing place of the supply cost if the purchase does take place, based upon a cautious evaluation of the target and also getting companies. If there is enough potential for upside, the financier might purchase shares of the target company to offer after the corporate action is full and also the target company’s supply cost adjusts.

What is the spread in foreign exchange trading?

The spread is the distinction in between the deal estimate for a forex set. Like many financial markets, when you open a forex placement you’ll be presented with two prices. If you intend to open a lengthy placement, you trade at the buy cost, which is slightly over the market cost. If you intend to open a short placement, you trade at the sell cost slightly listed below the market cost.

What is a whole lot in foreign exchange?

Money are sold lots batches of currency made use of to standardise foreign exchange professions. As foreign exchange often tends to relocate percentages, lots tend to be huge: a standard whole lot is 100,000 devices of the base currency. So, due to the fact that private investors will not necessarily have 100,000 pounds (or whichever currency they’re trading) to put on every profession, almost all foreign exchange trading is leveraged.

What is take advantage of in foreign exchange?

Utilize is the ways of getting direct exposure to big amounts of currency without needing to pay the full value of your profession upfront. Instead, you put down a small down payment, known as margin. When you close a leveraged placement, your profit or loss is based upon the full dimension of the profession.

While that does magnify your earnings, it additionally brings the risk of enhanced losses consisting of losses that can surpass your margin. Leveraged trading therefore makes it very important to learn how to handle your risk.

Final Thoughts:

It might seem as well apparent to point out, yet an organized chart is simpler to trade, particularly when you recognize the interaction in between deep predisposition and also risk sentiment and also how it is playing out on the chart. A disorderly chart mirrors puzzled thinking about what is fundamental deep predisposition and also what is risk sentiment. Bottom line, if you can’t check out the chart and also envision what the huge players have to be believing, you should not attempt to trade it, also when one of the most advanced of indicators are offering you the go-ahead. Clear thinking leads to profitable professions.

Find More Articles About Forex Event Driven Trading Paints and Financial market information, evaluation, trading signals and also Forex broker testimonials.

Forex Alert:

Our service consists of products that are traded on margin and also lug a risk of losses over of your transferred funds. The products might not appropriate for all financiers. Please make certain that you completely recognize the threats included.