Find More Videos Related to Forex Algorithmic Trading Models, Tutorial: Deep Reinforcement Learning For Algorithmic Trading in Python.

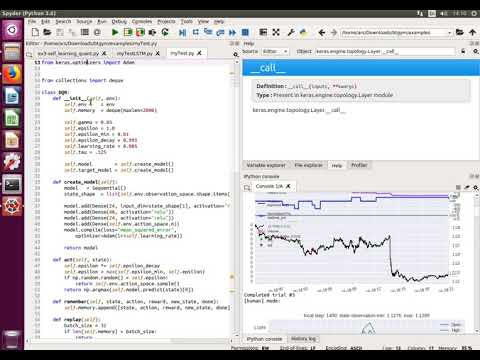

In this tutorial, we’ll see an example of deep reinforcement learning for algorithmic trading using BTGym (OpenAI Gym environment API for backtrader backtesting library) and a DQN algorithm from a medium post (link below) to interact with the environment and does the trading.

Access to the code: https://gist.github.com/arsalanaf/d10e0c9e2422dba94c91e478831acb12

Telegram Group: https://t.me/joinchat/DmGkrhIE_g6Mk-zJS6sWgA

Links:

OpenAI Gym: https://gym.openai.com/

BTGym: https://github.com/Kismuz/btgym

backtrader: https://www.backtrader.com/

TensorForce: https://github.com/reinforceio/tensorforce

Bitcoin TensorForce Trading Bot: https://github.com/lefnire/tforce_btc_trader

Self Learning Quant: https://hackernoon.com/the-self-learning-quant-d3329fcc9915

DQN: https://towardsdatascience.com/reinforcement-learning-w-keras-openai-dqns-1eed3a5338c

Forex Algorithmic Trading Models, Tutorial: Deep Reinforcement Learning For Algorithmic Trading in Python.

Is Zerodha streak cost-free?

The Zerodha Streak System is presently cost-free to make use of for Zerodha Trading Account holders, during the screening stage. 5) For how long is Zerodha Streak System Free? The system is cost-free up until 31st March 2018. You can make use of upto 25 backtests and 5 online algos a day.

Recommended Book for Trading Strategies

Building Algorithmic Trading Systems: A Trader’s Journey From Data Mining to Monte Carlo Simulation to Live Trading, + Website

Book by Kevin J. Davey

Develop your own trading system with practical guidance and expert advice In Building Algorithmic Trading Systems: A Trader’s Journey From Data Mining to Monte Carlo Simulation to Live Training, award-winning trader Kevin Davey shares his secrets for developing trading systems that generate triple-digit returns. read more…

Develop your own trading system with practical guidance and expert advice In Building Algorithmic Trading Systems: A Trader’s Journey From Data Mining to Monte Carlo Simulation to Live Training, award-winning trader Kevin Davey shares his secrets for developing trading systems that generate triple-digit returns. read more…

Originally published: June 11, 2014

Author: Kevin J. Davey

An Instance of algo Trading

Royal Dutch Shell (RDS) is provided on the Amsterdam Stock Market (AEX) and London Stock Market (LSE).1 We start by developing a formula to identify arbitrage possibilities. Right here are a few fascinating monitorings:

AEX trades in euros while LSE sell British pound sterling.

Because of the one-hour time distinction, AEX opens up an hour earlier than LSE complied with by both exchanges trading at the same time for the following few hrs and then trading just in LSE during the last hour as AEX shuts.

Can we check out the possibility of arbitrage trading on the Royal Dutch Shell stock listed on these two markets in two various money?

Needs

A computer system program that can read existing market value.

Price feeds from both LSE and AEX.

A forex (foreign exchange) rate feed for GBP-EUR.

- Order-placing capacity that can course the order to the right exchange.

Backtesting capacity on historic cost feeds. - The computer system program ought to perform the following:.

- Check out the incoming cost feed of RDS stock from both exchanges.

- Using the offered foreign exchange rates, transform the cost of one money to the other.

- If there is a big sufficient cost disparity (discounting the broker agent prices) bring about a lucrative possibility, then the program ought to place the buy order on the lower-priced exchange and sell the order on the higher-priced exchange.

- If the orders are implemented as preferred, the arbitrage profit will certainly follow.

Simple and very easy! Nevertheless, the technique of algo trading is not that straightforward to preserve and perform. Keep in mind, if one investor can place an algo-generated trade, so can other market participants. Subsequently, costs fluctuate in milli- and even microseconds. In the above instance, what occurs if a buy trade is implemented but the sell trade does not due to the fact that the sell costs change by the time the order hits the market? The trader will certainly be entrusted to an open position making the arbitrage method pointless.

There are extra threats and challenges such as system failing threats, network connection errors, time-lags between trade orders and implementation and, crucial of all, imperfect algorithms. The even more complex a formula, the extra rigorous backtesting is required before it is used.

Find More Videos Related to Forex Algorithmic Trading Models and Financial market news, analysis, trading signals and Foreign exchange mentor reviews.

Disclaimer about Risk

Please note that trading in leveraged items might involve a significant degree of risk and is not suitable for all capitalists. You ought to not run the risk of more than you are prepared to lose. Before choosing to trade, please ensure you comprehend the threats included and take into consideration your degree of experience. Look for independent guidance if necessary.