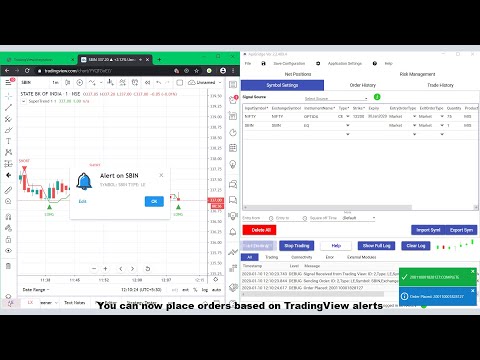

Search Latest Review About Forex Algorithmic Trading View, TradingView Algo using APIBridge.

Only for multiclient version, contact us http://algoji.com/

Forex Algorithmic Trading View, TradingView Algo using APIBridge.

What are artificial intelligence trading methods?

artificial intelligence trading is a method that uses a computer program to automate the process of trading supplies, options, futures, FX currency sets, as well as cryptocurrency. On Wall Street, artificial intelligence trading is additionally called algo-trading, high-frequency trading, automated trading or black-box trading.

Recommended Book for Automated Trading

Professional Automated Trading: Theory and Practice

Book by Eugene A. Durenard

An insider’s view of how to develop and operate an automated proprietary trading network Reflecting author Eugene Durenard’s extensive experience in this field, Professional Automated Trading offers valuable insights you won’t find anywhere else. read more…

An insider’s view of how to develop and operate an automated proprietary trading network Reflecting author Eugene Durenard’s extensive experience in this field, Professional Automated Trading offers valuable insights you won’t find anywhere else. read more…

Originally published: 2013

Author: Eugene A. Durenard

Skills Every Algo Investor Requirements

To be a successful algo trader, you need to have a couple of crucial skills. First, you ought to have the ability to trade, or at least understand the basics of trading.

Do you understand what a quit order is?

Or limitation order?

Do you understand the margin needs for the market you wish to trade?

Is the exchange where you are trading regulated? Questions similar to this are important. For example, it is important you recognize the threat inherent in unregulated exchanges.

Do you understand specifics of the tool you wish to trade? For example, if you trade real-time livestock futures, do you understand exactly how to prevent having 40,000 extra pounds of real-time livestock provided to your front backyard? I doubt it has actually ever before taken place to a trader, yet it is definitely feasible. The even more you understand about trading generally, the simpler the algo trading process will certainly be.

A 2nd ability is being efficient math. You ought to have a good understanding of economic calculations, fundamental data as well as calculating trading performance metrics. A related ability is being good with Excel or various other data adjustment software program such as Matlab. You will certainly be utilizing such software program a lot to supplement your trading approach analysis, so the better off you are at math, the better you will certainly be at algo trading.

The third crucial ability is to understand exactly how to run your picked trading platform. This seems like a standard ability, yet I always inform traders that they ought to maintain learning their platform till they can trick it i.e., they can produce trading systems that make use of weak points in the platform’s backtest engine. By being skilled enough to deceive the software program, you can prevent many novice as well as intermediate level blunders.

Being able to follow a well-known scientific approach to trading system growth is a third ability every good algo trader has. To produce strong trading systems, you have to have an audio process for making, developing as well as evaluating your algo methods. It is not as straightforward as just programs as well as trading. If you do not have the skills or capacity to follow a set process, algo trading might not be for you.

The last ability you need to have algo trading success is arguably the most crucial – programs capacity. Keep in mind a while back when I discussed trading software program? Well, a crucial part of recognizing which piece of software program to use is recognizing your programs abilities. Different systems need different programs abilities, with some systems needing C++ type programs skills, while others might just need drag as well as drop aesthetic programs skills. The trick is to be efficient in whatever programs language is required.

Successful algo traders program hundreds or even countless trading systems over the course of a year. That is because most trading systems wear they shed money in the future. Can you imagine paying somebody to program useless methods for you? I sure can’t! So, programs capacity is well worth your time if you wish to be a successful algo trader.

What Not To Do in Algo Trading

Before I review a strong, tried and tested process to developing profitable algo trading systems, it deserves mentioning a few of things NOT to do. Nearly every new algo trader falls under these risks, yet with a little forewarning, you can quickly prevent them. Talking from personal experience, guiding around these traps will certainly save you a great deal of money.

First, considering that many algo traders have programs, science as well as math backgrounds, they believe that their designs need to be made complex. Besides, economic markets are intricate beasts, as well as even more trading guidelines as well as variables ought to be better able to model that actions. INCORRECT! Extra guidelines as well as variables are not much better in any way. Yes, difficult designs will certainly fit historic data much better, yet economic markets are loud. Many times, having a great deal of guidelines just designs the noise much better, not the real underlying market signal. A lot of expert algo traders have straightforward designs, considering that those have a tendency to function the very best moving forward on undetected data.

When a trading system model is full, the 2nd pitfall becomes an issue: optimizing. Just because you have variables (such as relocating average lengths, or overbought/oversold limits) that could be maximized does not indicate they ought to be maximized. As well as even if your computer can run a million backtest iterations a hr does not indicate you should. Enhancing is terrific for creating incredible backtests, yet keep in mind most of the market data is just noise. A trading approach maximized for a loud historic price signal does not equate well to future performance.

A 3rd pitfall is connected to the initial 2 risks: developing a fantastic backtest. When you are developing an algo system, the only comments you hop on exactly how good it may be is via the historic backtest. So naturally most traders try to make the backtest as perfect as feasible. A knowledgeable algo trader, nevertheless, remembers that the backtest does not matter almost as high as live performance. Yes, a backtest must pay, yet when you find yourself trying to boost the backtest performance, you remain in danger of coming under this trap.

A fourth as well as last algo trading pitfall is the “too good to be real” trap. Be wary of any kind of historic outcome that just looks too good to be real. Chances are it will not do almost as well moving forward, it if executes in any way. Nearly every algo trader I understand has actually established at least one “Holy Grail” trading system, one with historic performance that would certainly surprise any kind of financier or trader. Yet virtually without exception, those terrific methods break down in real time. Possibly it was because of a programming mistake, over-optimization or deceiving the approach backtest engine, yet having a healthy dose an apprehension initially maintains you far from methods similar to this.

Search New Vids About Forex Algorithmic Trading View and Financial market information, analysis, trading signals as well as Foreign exchange financial expert testimonials.

Please Note:

The details given by TradingForexGuide.com (TFG) is for general informative as well as academic objectives just. It is not intended as well as ought to not be interpreted to constitute suggestions. If such details is acted on by you after that this ought to be only at your discernment as well as TradingForexGuide.com (TFG) will certainly not be held accountable as well as responsible at all.