Search New Videos Related to Forex Position Trading Y Bolsa, 🔔 TRADING EN VIVO 2020 🔔 METATRADER 4 indciadores y estrategias de trading.

¿Eres inversor inicial? Consigue gratis el curso de iniciación desde este enlace

https://bit.ly/3epx67O

Durante nuestro Programa de Bolsa en directo:

🔔 TRADING EN VIVO 🔔 con METATRADER 4

Hemos dejado el enlace para:

💢 Próximos webinarios formativos:

Videos de Bolsa y Grabaciones de webinarios para Aprender a invertir en Bolsa

💢 Canal de Telegram:

t.me/enbolsa

💢 Grupo whastapp de ideas de trading:

https://bit.ly/2RCFF5m

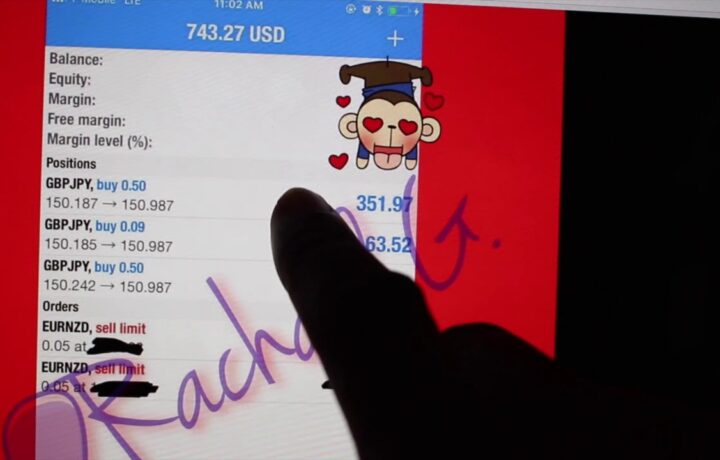

En este directo vamos a mostramos algunas de las estrategias, en tiempo real, que son utilizadas por los Traders de Enbolsa.net en su operativa de Swing trading.

Esta operativa a diferencia del Day trading, se desarrolla principalmente en gráficos de 1h, teniendo más tiempo para la toma de decisiones y para que la estrategia se desarrolle.

El objetivo de este DIRECTO, ayudar a todos los inversores de habla hispana a mejorar y desarrollar su operativa en los meercados de forex, indices y acciones.

#TRADING #ANALISIS #ESPAÑOL

Forex Position Trading Y Bolsa, 🔔 TRADING EN VIVO 2020 🔔 METATRADER 4 indciadores y estrategias de trading.

What Is Long-Position?

A lengthy position also called merely long is the purchasing of a stock, product, or money with the assumption that it will rise in value. Holding a lengthy position is a bullish sight.

Lengthy position and also long are typically utilized In the context of getting an options contract. The investor can hold either a lengthy phone call or a long placed alternative, depending upon the expectation for the hidden asset of the option contract.

A financier that intends to gain from an upward price activity in an asset will “go long” on a telephone call alternative. The call gives the holder the alternative to get the hidden property at a particular price.

Alternatively, a capitalist who expects a possession’s cost to fall are bearish will certainly be long on a put alternative and keep the right to offer the asset at a particular price.

A long position is the reverse of a short position (brief).

A lengthy lengthy placement refers to the purchase of a property with the assumption it will certainly boost in value a bullish perspective.

A long placement in options contracts shows the holder possesses the underlying property.

A long setting is the opposite of a brief position.

In choices, being long can refer either to outright possession of a possession or being the holder of an alternative on the property.

Being long on a supply or bond financial investment is a dimension of time.

Long Holding Investment.

Going long on a supply or bond is the a lot more standard investing method in the funding markets. With a long-position financial investment, the investor purchases an asset as well as possesses it with the assumption that the rate is going to climb. This financier generally has no strategy to offer the protection in the future. Of holding equities, long describes a measurement of time.

Going long on a stock or bond is the extra traditional investing practice in the resources markets, specifically for retail financiers. An expectation that possessions will certainly value in worth in the long run the buy as well as hold method spares the capitalist the need for constant market-watching or market-timing, as well as allows time to weather the unpreventable ups as well as downs. And also, history gets on one’s side, as the stock exchange unavoidably values, with time.

Certainly, that does not suggest there can not be sharp, portfolio-decimating drops along the way, which can be deadly if one takes place right before, claim, a financier was intending to retire or needed to sell off holdings somehow. A prolonged bearishness can likewise be problematic, as it frequently prefers short-sellers and also those banking on decreases.

Lastly, going long in the outright-ownership sense implies a good quantity of capital is bound, which might lead to losing out on various other possibilities.

Long Placement Alternatives Contracts.

On the planet of choices contracts, the term long has nothing to do with the measurement of time but instead talks with the owning of a hidden asset. The long placement holder is one that currently holds the hidden property in their profile.

When a trader purchases or holds a call options contract from a choices author they are long, due to the power they hold in being able to buy the asset. An investor who is long a call choice is one that acquires a call with the expectation that the underlying protection will certainly raise in worth. The long placement call owner believes the asset’s worth is rising as well as may determine to exercise their option to buy it by the expiration day.

But not every investor who holds a lengthy setting believes the possession’s value will certainly enhance. The trader that has the hidden asset in their profile and believes the value will certainly drop can get a put choice agreement.

They still have a long setting due to the fact that they have the capacity to sell the hidden asset they hold in their portfolio. The owner of a long position put believes the cost of an asset will certainly fall. They hold the option with the hope that they will certainly be able to offer the hidden asset at a helpful cost by the expiration.

So, as you see, the lengthy placement on an alternatives contract can share either a bullish or bearish belief depending on whether the lengthy agreement is a put or a call.

In contrast, the short position on a choices agreement does not own the supply or various other underlying possession yet borrows it with the assumption of marketing it and after that repurchasing it at a reduced rate.

Long Futures Dealings.

Financiers and also companies can likewise become part of a long onward or futures agreement to hedge against negative rate movements.

A business can utilize a lengthy bush to secure a purchase price for a product that is needed in the future.

Futures differ from alternatives because the owner is obliged to acquire or sell the hidden property. They do not get to pick but need to finish these activities.

Suppose a fashion jewelry producer thinks the cost of gold is poised to transform upwards in the short-term. The company can participate in a lengthy futures agreement with its gold supplier to purchase gold in 3 months from the distributor at thirteen hundred. In 3 months, whether the cost is above or listed below $1,300, business that has a long placement on gold futures is obligated to acquire the gold from the provider at the agreed agreement cost of $1,300. The provider, consequently, is bound to provide the physical asset when the agreement ends.

Speculators likewise go long on futures when they believe the costs will go up. They don’t necessarily desire the physical product, as they are just thinking about maximizing the rate motion. Prior to expiration, a speculator holding a long futures contract can market the contract in the marketplace.

Search Users Vids Related to Forex Position Trading Y Bolsa and Financial market information, evaluation, trading signals as well as Forex mentor evaluations.

Risk Notice:

“TradingForexGuide.com” TFG will not be held accountable for any type of loss or damages resulting from reliance on the info included within this site including market news, evaluation, trading signals and Foreign exchange broker evaluations. The information had in this internet site is not necessarily real-time neither precise, and also analyses are the point of views of the writer and do not stand for the referrals of “TradingForexGuide.com” TFG or its employees. Currency trading on margin entails high risk, as well as is not suitable for all capitalists. As a leveraged item losses are able to surpass initial down payments and capital is at danger. Before making a decision to trade Forex or any other monetary instrument you need to very carefully consider your financial investment purposes, degree of experience, and also danger appetite. We strive to provide you valuable information about all of the brokers that we examine. In order to provide you with this cost-free solution we receive advertising charges from brokers, consisting of a few of those listed within our positions and on this web page. While we do our utmost to guarantee that all our data is updated, we encourage you to validate our info with the broker straight.