Get Trending Stories About Forex Event Driven Trading Divergence, Trading Divergence – An Advance Warning System for Forex and Crypto Traders.

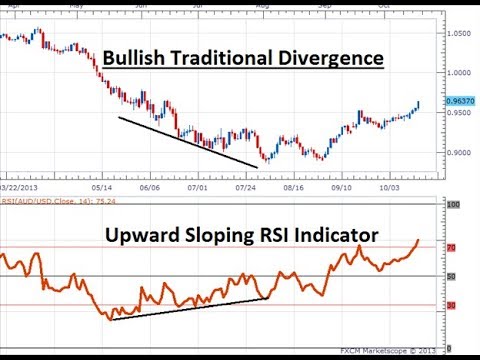

Divergence is not an indicator or an oscillator, it is not a chart pattern but its a way to predict when market instability or trend change is about to happen. By realizing inconsistencies and changes in your prefered indicators and price action you can be alerted to a change in market sentiment. Divergence occurs in all markets, including stocks, bonds, options, futures, forex, gold and oil, bitcoin or altcoins.

Divergence occurs in all time frames.

Forex Event Driven Trading Divergence, Trading Divergence – An Advance Warning System for Forex and Crypto Traders.

Quantitative Event Trading Versus Over-Simplistic Assumptions

Spikes don’t vary much in this regard, they just take place over a smaller window of time. A spike happens in the first place because the marketplace has just discovered new information, information which is not yet “priced in”. Relying on the seriousness of the information, the spike will be big or tiny, and continue or fall short. To explain this principle a little far better, I’m going to cite what a number of event-driven measurable methods do often:

Programmers of these event-based (spike) trading methods have the ability to measure information gotten from financial information releases rather conveniently. They just take the inconsistency from the actual and expected number, pair it with other financial information releases that take place at that point in time (if necessary), take the ordinary modification in price prior to and after particular variances occur, the timeframe in which these modifications take place, and have the ability to enhance a method based upon this and any other technical aspects they wish. They have a history of information (numbers) with which to function.

In all of the aspects detailed above, numbers are available, and makers require numbers. However what occurs when a spike is triggered by a remark from a high ranking government official? No numbers there, just words. Yes, words.

What about words? Words, when it pertains to programs, can be numbers. Let me explain:

Words are weights, when measured versus each other in relation to price movements. “downgrade” brings a various weight than “stimulation” or “defend” or “secure the money”, etc., depending upon who it is originating from and the context of other words made use of at the time.

Low and high ranking government officials can be weights. The high ranking government official evaluates greater than a reduced ranking government official, and so on. A ranking company, and the words made use of in their news release, can be weight. AND SO ON and so on.

So when you take an industry-standard news feed, designate weights (numbers) to whatever pointed out over versus ordinary price movements, time, other technical aspects, etc., you end up with an example of information that can be enhanced into a potentially successful trading strategy.

And while I recognize it all could sound outrageous in the beginning, if you think I’m just drawing your leg on every one of this, think again. While I’m offering a really streamlined explanation of the principle, it is certainly made use of in mainly all markets by different participants, and most definitely in this one.

How does foreign exchange trading work?

There are a selection of different ways that you can trade foreign exchange, however they all function the same way: by simultaneously getting one money while marketing another. Generally, a lot of foreign exchange deals have been made via a foreign exchange broker, however with the rise of online trading you can benefit from foreign exchange price movements making use of by-products like CFD trading.

CFDs are leveraged products, which enable you to open a position for a simply a fraction of the amount of the trade. Unlike non-leveraged products, you don’t take possession of the property, however take a position on whether you think the marketplace will increase or fall in value.

Although leveraged products can amplify your revenues, they can also amplify losses if the marketplace relocates versus you.

Final Words:

Matching different sorts of trading to an individual’s personality type is definitely no warranty for foreign exchange trading success. Nevertheless, locating a trading style that’s well fit to your personality type can help new traders locate their feet and make the right relocate the marketplace. Just take the quiz and answer the 15 inquiries truthfully to reveal which trading style is the right suitable for you.

Get More Stories About Forex Event Driven Trading Divergence and Financial market news, evaluation, trading signals and Forex investor testimonials.

Important Notice:

Any point of views, news, study, evaluations, costs, other information, or web links to third-party websites included on this website are provided on an “as-is” basis, as basic market commentary and do not comprise financial investment suggestions. The market commentary has not been prepared based on lawful demands made to promote the self-reliance of financial investment study, and it is as a result exempt to any prohibition on dealing ahead of circulation. Although this commentary is not generated by an independent resource, “TradingForexGuide.com” TFG takes all sufficient steps to get rid of or stop any disputes of interests arising out of the production and circulation of this interaction.