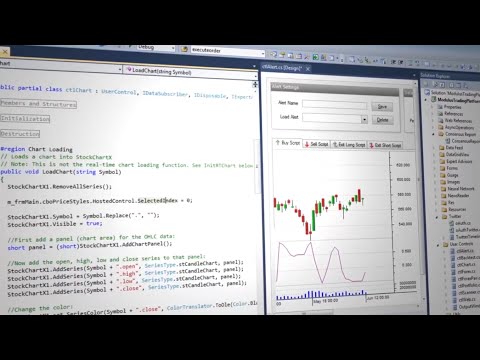

Search Latest Posts Related to Algorithmic Forex Trading Platform, Trading Application with Complete C# and C++ Source Code by Modulus.

Best viewed in full screen HD mode. The Modulus trading application framework is an end-to-end, multi-asset trading solution for brokerages, trading schools and professional traders. Available with complete C# and C++ Source Code. Learn more at http://www.modulusfe.com

Algorithmic Forex Trading Platform, Trading Application with Complete C# and C++ Source Code by Modulus.

That uses artificial intelligence trading?

artificial intelligence trading is mostly made use of by institutional investors and big brokerage firm houses to lower costs associated with trading. According to research, artificial intelligence trading is especially helpful for large order dimensions that might consist of as long as 10% of general trading quantity.

Recommended Book for Trading Strategies

Building Algorithmic Trading Systems: A Trader’s Journey From Data Mining to Monte Carlo Simulation to Live Trading, + Website

Book by Kevin J. Davey

Develop your own trading system with practical guidance and expert advice In Building Algorithmic Trading Systems: A Trader’s Journey From Data Mining to Monte Carlo Simulation to Live Training, award-winning trader Kevin Davey shares his secrets for developing trading systems that generate triple-digit returns. read more…

Develop your own trading system with practical guidance and expert advice In Building Algorithmic Trading Systems: A Trader’s Journey From Data Mining to Monte Carlo Simulation to Live Training, award-winning trader Kevin Davey shares his secrets for developing trading systems that generate triple-digit returns. read more…

Originally published: June 11, 2014

Author: Kevin J. Davey

Abilities Every Algo Investor Needs

To be an effective algo trader, you must have a couple of essential skills. First, you need to have the ability to trade, or at least recognize the fundamentals of trading.

Do you recognize what a stop order is?

Or limit order?

Do you recognize the margin needs for the market you wish to trade?

Is the exchange where you are trading managed? Concerns like this are necessary. As an example, it is important you understand the danger inherent in uncontrolled exchanges.

Do you recognize specifics of the instrument you wish to trade? As an example, if you trade live cattle futures, do you recognize how to prevent having 40,000 pounds of live cattle supplied to your front backyard? I doubt it has actually ever before occurred to an investor, yet it is absolutely feasible. The more you learn about trading in general, the much easier the algo trading procedure will be.

A second ability is being efficient math. You need to have a good understanding of monetary estimations, fundamental stats and calculating trading efficiency metrics. A related ability is being great with Excel or various other data adjustment software program such as Matlab. You will be utilizing such software program a whole lot to supplement your trading strategy analysis, so the far better off you go to math, the far better you will be at algo trading.

The third vital ability is to recognize how to run your chosen trading system. This looks like a fundamental ability, yet I always inform traders that they need to keep learning their system till they can trick it i.e., they can develop trading systems that manipulate weaknesses in the system’s backtest engine. By being proficient enough to deceive the software program, you can prevent numerous newbie and intermediate degree errors.

Having the ability to adhere to a well-known clinical technique to trading system growth is a 3rd ability every great algo trader has. To develop strong trading systems, you have to have a sound procedure for developing, establishing and checking your algo techniques. It is not as simple as simply programs and trading. If you do not have the skills or capability to adhere to an established procedure, algo trading may not be for you.

The final ability you require to have algo trading success is arguably one of the most vital – programs capability. Remember a while back when I went over trading software program? Well, an essential part of knowing which item of software program to use is knowing your programs abilities. Various systems need various programs abilities, with some systems requiring C++ kind programs skills, while others may only need drag and decrease aesthetic programs skills. The secret is to be skillful in whatever programs language is required.

Effective algo traders program hundreds and even thousands of trading systems over the course of a year. That is due to the fact that the majority of trading systems wear they shed cash in the future. Can you envision paying somebody to program useless techniques for you? I sure can’t! So, programs capability is well worth your time if you wish to be an effective algo trader.

What Not To Do in Automated Trading

Before I discuss a solid, tried and tested procedure to establishing rewarding algo trading systems, it is worth mentioning a few of things NOT to do. Practically every new algo trader comes under these challenges, yet with a little forewarning, you can conveniently prevent them. Talking from personal experience, guiding around these catches will save you a great deal of cash.

First, considering that numerous algo traders have programs, science and math histories, they believe that their models require to be made complex. Besides, monetary markets are complex monsters, and more trading rules and variables need to be far better able to model that actions. INCORRECT! Extra rules and variables are not better at all. Yes, complex models will fit historic data better, yet monetary markets are loud. Often times, having a great deal of rules simply models the sound better, not the real underlying market signal. The majority of specialist algo traders have simple models, considering that those often tend to work the best going forward on undetected data.

As soon as a trading system model is complete, the second challenge ends up being a problem: optimizing. Just because you have variables (such as moving ordinary sizes, or overbought/oversold thresholds) that could be optimized does not indicate they need to be optimized. As well as even if your computer can run a million backtest versions a hr does not indicate you should. Enhancing is great for creating amazing backtests, yet keep in mind a lot of the market data is simply sound. A trading strategy optimized for a noisy historic price signal does not equate well to future efficiency.

A third challenge is connected to the initial two challenges: developing a terrific backtest. When you are establishing an algo system, the only responses you get on how great it might be is by means of the historic backtest. So normally most traders attempt to make the backtest as best as feasible. A skilled algo trader, nevertheless, remembers that the backtest does not matter nearly as long as actual time efficiency. Yes, a backtest needs to be profitable, yet when you find yourself trying to enhance the backtest efficiency, you remain in threat of falling into this catch.

A 4th and final algo trading challenge is the “as well great to be real” catch. Be wary of any kind of historic result that simply looks as well great to be real. Possibilities are it won’t do nearly also going forward, it if performs at all. Practically every algo trader I recognize has actually established at least one “Holy Grail” trading system, one with historic efficiency that would certainly surprise any kind of capitalist or trader. But practically without exception, those great techniques crumble in real time. Possibly it resulted from a programming mistake, over-optimization or deceiving the strategy backtest engine, yet having a healthy dosage an apprehension initially maintains you far from techniques like this.

Search More Stories Related to Algorithmic Forex Trading Platform and Financial market information, analysis, trading signals and Forex financial expert testimonials.

Disclaimer about High Risk

Please note that trading in leveraged items might entail a considerable degree of risk and is not appropriate for all investors. You need to not risk greater than you are prepared to shed. Before choosing to trade, please ensure you understand the risks involved and take into account your degree of experience. Look for independent recommendations if needed.