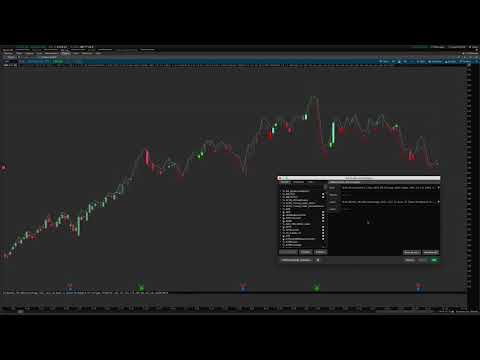

Explore Trending Posts Relevant to Forex Position Trading Labels, Thinkorswim Position Sizer Walk-through – Thinkorswim Tutorial.

Get the Position Sizer! https://easycators.com/positionsizer

Install tutorial: https://easycators.com/install-thinkorswim-indicators/

Forex Position Trading Labels, Thinkorswim Position Sizer Walk-through – Thinkorswim Tutorial.

What is a Position Trader?

A position investor is a sort of investor that holds a placement in a possession for a long period of time. The holding period might differ from several weeks to years. Apart from “get and hold”, it is the lengthiest holding period amongst all trading designs.

Position trading is basically the reverse of day trading. A position investor is generally much less concerned about the short-term vehicle drivers of the costs of a possession and market modifications that can momentarily reverse the price fad.

Position traders put even more focus on the lasting efficiency of a possession. From such a viewpoint, the traders are more detailed to lasting investors instead of to other traders.

Position investor refers to an individual that holds a financial investment for an extensive period of time with the expectation that it will certainly appreciate in worth.

Position traders are fad fans.

An effective position investor needs to determine the access/ leave degrees and have a plan in position to control danger, usually via stop-loss degrees.

The objective of position traders is identifying patterns in the costs of safety and securities, which can continue for fairly long periods of time, and making make money from such patterns. Typically, position trading might offer rewarding returns that will certainly not be eliminated by high purchase costs.

What Is a Position?

A position is the amount of a security, product or money which is had by an individual, dealer, institution, or other fiscal entity. They can be found in 2 types: brief settings, which are borrowed and after that sold, and long settings, which are had and after that sold. Depending upon market patterns, movements and fluctuations, a placement can be lucrative or unprofitable. Reiterating the worth of a placement to show its real current worth on the competitive market is described in the market as “mark-to-market.”.

Placements Explained?

The term position is made use of in several circumstances, consisting of the copying:.

1. Dealers will certainly typically maintain a cache of lengthy settings in particular safety and securities in order to assist in fast trading.

2. The investor closes his position, resulting in an internet revenue of 10%.

3. An importer of olive oil has an all-natural brief position in euros, as euros are frequently streaming in and out of its hands.

Placements can be speculative, or the natural effect of a particular business. For instance, a money speculator can get British pounds sterling on the assumption that they will certainly appreciate in worth, which is taken into consideration a speculative position. Nevertheless, a company which patronizes the UK will certainly be paid in pounds sterling, giving it an all-natural lengthy position on pounds sterling. The money speculator will certainly hold the speculative position till he or she makes a decision to liquidate it, safeguarding a revenue or limiting a loss. Nevertheless, business which patronizes the UK can not simply abandon its natural position on pounds sterling in the same way. In order to insulate itself from money fluctuations, business might filter its revenue with a balancing out position, called a “bush.”.

Place vs. Futures Placements.

A position which is made to be supplied promptly is called a “place.” Areas can be supplied essentially the next day, the next business day, or sometimes after 2 business days if the safety and security in question calls for it. On the purchase day, the price is set yet it generally will not settle at a set price, given market fluctuations. Transactions which are longer than areas are described as “future” or “onward settings,” and while the price is still set on the purchase day, the negotiation day when the purchase is completed and the safety and security supplied day can occur in the future.

Explore Trending Posts Relevant to Forex Position Trading Labels and Financial market news, analysis, trading signals and Foreign exchange investor reviews.

Risk Alert:

“TradingForexGuide.com” TFG will certainly not be held accountable for any type of loss or damages arising from dependence on the details had within this website consisting of market news, analysis, trading signals and Foreign exchange broker reviews. The information had in this website is not always real-time nor precise, and analyses are the viewpoints of the writer and do not stand for the recommendations of “TradingForexGuide.com” TFG or its employees. Money trading on margin entails high danger, and is not ideal for all investors. As a leveraged product losses are able to surpass first down payments and resources is at danger. Prior to choosing to trade Foreign exchange or any other economic tool you need to thoroughly consider your financial investment purposes, degree of experience, and danger cravings. We strive to provide you important details about every one of the brokers that we examine. In order to offer you with this complimentary service we receive advertising fees from brokers, consisting of some of those noted within our positions and on this page. While we do our utmost to make sure that all our information is up-to-date, we urge you to verify our details with the broker straight.