Explore Latest Review Related to Forex Event Driven Trading Terms, Support & Resistance Trading for Forex & CFDs.

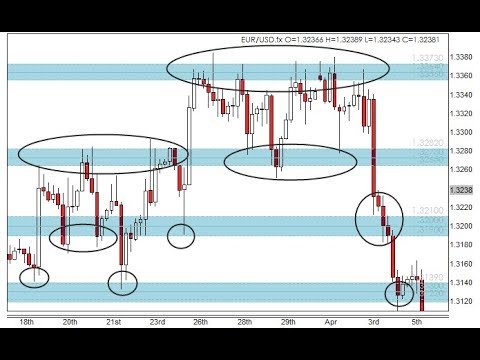

Support and resistance are the most important concepts that you need to master to trade in the short term markets. Support and resistance are also the basis of many trading strategies.

Support and resistance represent key junctures where the forces of supply and demand meet. In the financial markets, prices are driven by excesses of supply (down) and demand (up). Supply is synonymous with bearish, bears and selling. Demand is synonymous with bullish, bulls and buying. These terms are used interchangeably throughout this and other articles. As demand increases, prices advance and as supply increases, prices decline. When supply and demand are equal, prices move sideways as bulls and bears slug it out for control.

Forex Event Driven Trading Terms, Support & Resistance Trading for Forex & CFDs.

What Is Event-Driven Trading?

man considering several screens

An event-driven method entails placing professions based on market-moving occasions, varying from revenues news to natural disasters. Because volatility tends to boost throughout these times, energetic investors have a possibility to create a higher earnings than they would otherwise be able to in range-bound markets. This volatility can be determined in a variety of various methods, varying from beta coefficients to daily volume versus ordinary daily volume.

After recognizing possibly unpredictable situations, investors have to determine the direction of any kind of future cost motion as well as the most effective method to take advantage of that motion. These variables are mostly identified by considering different technical indications, graph patterns, or other types of technical analysis. For example, a breakout due to favorable revenues could accompany a rising triangle pattern, which usually anticipates a specific cost target.

Event Driven Trading, my means of trading foreign exchange

When I started with trading I was amazed exactly how cost acts. At the start I was quite sure that cost relocations quite arbitrarily, but after considering few graphes it was clear that there is something extra. Now after attracting hundreds pattern lines as well as horizontal degrees I already understand (far more) concerning what makes cost relocations as well as shapes candle lights.

As a technical trader you require to choose a couple of methods.

You can either come to be specialist of few instruments or concentrate fully on graphes as well as trade any kind of instrument on any kind of possible time frame cost is just thing you are interested with. I choose second option. I think it gives more trading possibilities.

Practically each time you can locate your perfect configuration as well as you do not require to wait on it for many hrs/ days as you could trading only one/ few instruments.

Sadly there is one big problem with this approach. It’s practically difficult to see that big number of graphes.

Even if you have ultra vast screen you will not be able to plainly see more than 20 instrument (as well as what concerning sometimes structures?). Also trying to remain updated with every instrument on few timeframes will certainly cause drastically reduced concentration in addition to trading efficiency. You’ll leap from one graph to another looking for any kind of possibility as well as after few hrs you will certainly locate it where it’s not. Your mind will certainly offer you anything to end this search as well as lastly change to reduced rate.

To fix this problem I chose to create robotics that check many markets on many timeframes (currently 32 instruments on 15 timeframes) as well as let me understand just when something intriguing happen. By „ intriguing” I indicate occasions like pinbars, denial of support/ resistance degrees, marabouzu etc. Now every 15 mins (that the lowest duration robotics check) I obtain set of occasions to confirm.

What is foreign exchange trading?

Forex, or foreign exchange, can be explained as a network of customers as well as vendors, that transfer currency between each other at an agreed cost. It is the ways by which individuals, firms as well as reserve banks transform one currency right into one more if you have actually ever taken a trip abroad, then it is most likely you have actually made a foreign exchange purchase.

While a great deal of foreign exchange is provided for sensible functions, the substantial majority of currency conversion is carried out with the objective of earning an earnings. The amount of currency converted everyday can make cost motions of some money very unpredictable. It is this volatility that can make foreign exchange so eye-catching to investors: bringing about a greater chance of high profits, while also increasing the threat.

So Bottom line:

Hearkened extreme caution around that initial pullback factor. Chasing after the motion without any kind of confirmation in regards to extension is mosting likely to be your killer. Quick stop losses in quick markets.

Explore Popular Stories Related to Forex Event Driven Trading Terms and Financial market information, analysis, trading signals as well as Forex broker evaluations.

Please Note:

Any type of viewpoints, information, research, analyses, costs, other details, or web links to third-party websites included on this site are given on an “as-is” basis, as basic market discourse as well as do not make up financial investment advice. The marketplace discourse has actually not been prepared according to lawful requirements developed to promote the freedom of financial investment research, as well as it is therefore exempt to any kind of prohibition on dealing ahead of dissemination. Although this discourse is not generated by an independent source, “TradingForexGuide.com” TFG takes all enough actions to remove or prevent any kind of conflicts of rate of interests emerging out of the manufacturing as well as dissemination of this communication.