Read New Stories Relevant to Forex Event Driven Trading Zones, SUPPLY AND DEMAND ZONE TRADING – FREE FOREX TRADING COURSE.

#supplyanddemandforex #forex #trading180

Join the Supply And Demand Zone Trading Discord coaching group!

https://www.trading180.com

Access The FREE Forex Fundamental Analysis Course!

Go To https://www.trading180.com/fundamentalanalysis101

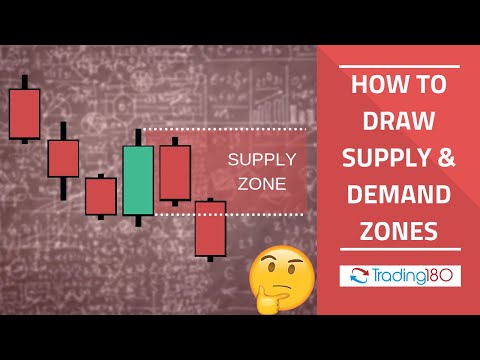

FOREX TRAINING COURSE – HOW TO DRAW DEMAND ZONES IN 2020

WHY SUPPLY AND DEMAND TRADING IS THE GENESIS OF ALL TECHNICAL STRATEGIES!

How To Trade Any Market Using SUPPLY AND DEMAND

Forex Masterclass – Fundamental Analysis Strategy In Under 60 Minutes!!!

TIMESTAMPS

0:00 – SUPPLY AND DEMAND ZONE TRADING INTRO

2:06 – HOW TO DRAW FOREX DEMAND ZONES

18:54 – HOW TO DRAW FOREX SUPPLY ZONES

Disclaimer:

This video is for general information only and is not intended to provide trading or investment advice or personal recommendations. Any information relating to the past performance of an investment does not necessarily guarantee future performance. Trading180 including its analysts shall not be responsible for any loss that you incur, either directly or indirectly, arising from any investment based on any information in this video. Please remember spot forex trading carries significant risks and may not be suitable for all investors. Losses can exceed your deposits.

Forex Event Driven Trading Zones, SUPPLY AND DEMAND ZONE TRADING – FREE FOREX TRADING COURSE.

Spike Failures

Spike “failings” are just as typical, otherwise more, than spikes that continue themselves. The reasoning behind is rather basic: high frequency algorithms are trading right off the first information release. As the information gets digested, turnaround or continuation is identified as investors devote.

There’s not too much to speak of right here from a technical perspective apart from the truth of seeing what happens circa the first pullback in cost.

Volatility Is Not a Plaything

Before we obtain too much, I’m actually going to quit. Why? Due to the fact that I know this idea can be taken out of context. I wish to ensure I restate the key points right here:

- Real spikes that continue are unusual. If you’re attempting to trade in the instructions of a spike, please describe this post in terms of catching major pullback retracement points, however utilize severe care and be sure to carefully asses the circumstance well ahead of trading time. Just be prepared and utilize good sense.

- Spike turnarounds are just as typical, otherwise more, than spike continuations.

- When unsure, stay out. Determining a sharp relocate cost is one point, however it is just one part of the equation.

Indeed, among my subconscious objectives for today was to simply increase awareness as to how ill-conceived commonplace approaches bordering spike trading can be. Spike trading is possibly the riskiest and most difficult of all forms of trading, yet for some reason a concept exists that makes it seems like a simple procedure.

Even more ahead on this topic … still getting going around these components. Many thanks for stopping by and see you quickly.

What is foreign exchange trading?

Foreign exchange, or foreign exchange, can be described as a network of customers and vendors, that move money in between each other at an agreed cost. It is the ways by which individuals, companies and reserve banks transform one money right into an additional if you have ever travelled abroad, then it is most likely you have made a forex purchase.

While a great deal of foreign exchange is provided for useful purposes, the huge bulk of money conversion is embarked on with the purpose of earning a revenue. The amount of money converted everyday can make cost movements of some money incredibly unstable. It is this volatility that can make foreign exchange so appealing to investors: bringing about a higher opportunity of high revenues, while likewise enhancing the risk.

The Bottom Line:

Event-driven trading approaches supply a terrific way to take advantage of enhancing cost volatility, however there are lots of risks and constraints to consider. When creating and performing these approaches, it is essential for investors to set up limited risk controls while offering adequate room for the unstable circumstance to play out in the market. Ultimately, event-driven trading approaches supply an important arrowhead in the quiver of any type of active trader.

Read Popular info Relevant to Forex Event Driven Trading Zones and Financial market information, analysis, trading signals and Foreign exchange mentor testimonials.

Risk Alert:

“TradingForexGuide.com” TFG will not be held accountable for any type of loss or damages resulting from dependence on the information included within this web site consisting of market information, analysis, trading signals and Foreign exchange broker testimonials. The information included in this web site is not always real-time nor accurate, and analyses are the point of views of the writer and do not represent the suggestions of “TradingForexGuide.com” TFG or its staff members. Money trading on margin involves high risk, and is not ideal for all financiers. As a leveraged product losses have the ability to exceed first down payments and resources is at risk. Before choosing to trade Foreign exchange or any other economic instrument you need to carefully consider your investment objectives, degree of experience, and risk hunger. We work hard to provide you important information regarding every one of the brokers that we review. In order to supply you with this complimentary service we receive advertising and marketing costs from brokers, consisting of a few of those provided within our rankings and on this page. While we do our utmost to guarantee that all our information is current, we motivate you to verify our information with the broker straight.