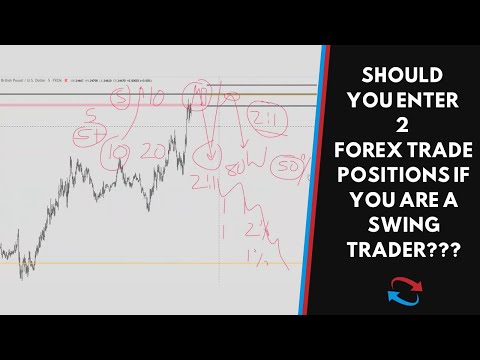

Search Users Posts Explaining Forex Swing Trading Course, SHOULD YOU ENTER 2 FOREX TRADE POSITIONS IF YOU ARE A SWING TRADER???.

#supplyanddemandforex #forex #trading180

FREE Supply And Demand AND Fundamental Analysis Course!

Go To https://www.trading180.com

FOREX TRAINING COURSE – HOW TO DRAW DEMAND ZONES IN 2020

WHY SUPPLY AND DEMAND TRADING IS THE GENESIS OF ALL TECHNICAL STRATEGIES!

How To Trade Any Market Using SUPPLY AND DEMAND

Forex Masterclass – Fundamental Analysis Strategy In Under 60 Minutes!!!

Disclaimer:

This video is for general information only and is not intended to provide trading or investment advice or personal recommendations. Any information relating to the past performance of an investment does not necessarily guarantee future performance. Trading180 including its analysts shall not be responsible for any loss that you incur, either directly or indirectly, arising from any investment based on any information in this video. Please remember spot forex trading carries significant risks and may not be suitable for all investors. Losses can exceed your deposits.

Forex Swing Trading Course, SHOULD YOU ENTER 2 FOREX TRADE POSITIONS IF YOU ARE A SWING TRADER???.

Just How Does Swing Trading Work?

With swing trading, you will keep your supplies for commonly a few days or weeks. This can open you up to the opportunity of larger profits that can be obtained from hanging on to the profession for a little bit longer. Given that swing trading involves a much shorter period, you will have the ability to concentrate only on the entrance and leave of that profession with the procedure. Generally with supplies that are kept longer, it can be simple to come to be careless and push off the choices.

Swing Trading Indicators

Swing profession indicators are important to focus on when selecting when to acquire, what to acquire, and when to trade. Check out some of the best mixes of indicators for swing trading below.

Relocating Standards

When you are looking at relocating standards, you will be looking at the computed lines based on past rates. This indicator is easy to understand, and it is important to check out whether you are day trading, swing trading, and even trading longer term. They are made use of to either verify a fad or identify a fad. To identify the average, you will need to add up every one of the closing rates along with the number for days the duration covers and afterwards split the closing rates by the number of days.

To properly utilize relocating standards, you will need to compute various amount of time and contrast them on a graph. This will give you a wider perspective of the market along with their typical modifications in time. When you have actually determined your relocating standards, you after that need to use them to weigh in on your profession choices. You can use them to:

Recognize the Strength of a Fad:

If the present cost of the supply and pattern are farther away from its relocating average, after that it is thought about to be a weaker pattern. Pattern toughness, integrated with an indicator like volume, can help you make better choices on your trades.

Establishing Pattern Reversals:

You can utilize relocating standards to help identify pattern turnarounds with crossovers. You need to look for instances where the current relocating standards cross the longer relocating standards after an uptrend. Be advised, however, that this is not the only tool you need to utilize to identify turnaround, yet it can help you identify whether you need to investigate it additionally.

Loved One Strength Index

One of the best technical indicators for swing trading is the relative toughness index or RSI. This indicator will give you with the details you need to identify when the optimal entrance right into the market might be. It allows you to check out brief signals better. This will help you identify if the market has been overbought or oversold, is range-bound, or is flat. The RSI will give you a relative evaluation of how safe and secure the present cost is by examining both the past volatility and performance. This indicator will be determined utilizing a variety of 1-100.

The RSI indicator is most helpful for:

Identifying the Conditions That Led to the Market Being Overbought or Oversold. You will need to be able to identify these conditions to make sure that you can discover both pattern corrections and turnaround. Overbuying can indicate a bearish pattern while overselling can be seen as even more favorable. Indicators around 70 might indicate that the safety was miscalculated or overbought. If the indicator is around 30, it can show an undervalue or oversold.

Recognizing Divergences.

Divergences are made use of to identify turnarounds in trends. When the cost strikes a brand-new reduced yet the RSI does not, it would be thought about a bullish divergent signal. If the cost strikes a brand-new high and the RSI doesn’t, that would be described a bearish signal.

Volume

A commonly neglected indicator that is easy to use, even for new investors, is volume. Considering volume is especially important when you are taking into consideration trends. Trends need to be supported by volume. You will intend to make sure that there is even more significant volume occurring when the pattern is going in that direction. Rising volume indicates cash sustaining the safety, and if you do not see the volume, it could be a sign that there are over or underestimated conditions at play.

Visual Analysis Indication

While technical indicators for swing trading are important to making the right choices, it is beneficial from numerous capitalists, both new and seasoned, to be able to check out aesthetic patterns. By creating visuals patterns, you can see the happenings in the marketplace with a fast look to help aid your decision.

Search Users Posts Explaining Forex Swing Trading Course.