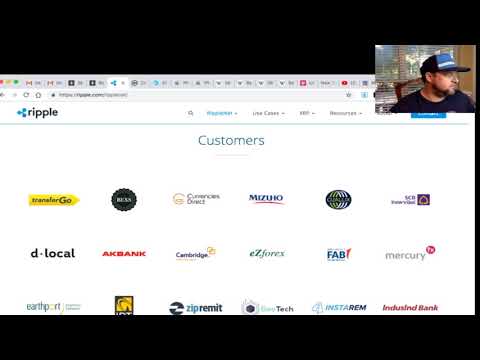

Explore New Stories Top Searched Forex Algorithmic Trading Xrp, RippleNet 100+ partnerships – XRP used in Forex Trading!.

RippleNet 100+ partnerships – XRP used in Forex Trading!

RippleNet 100+ partnerships – XRP used in Forex Trading!

Follow: Digital Asset Investor

Disclaimer:

I am not a licensed financial advisor.

All my videos on this channel are intended for entertainment purposes only.

You should not buy, sell, or invest in any asset based on what I say in these videos.

You should know that investing carries extreme risks.

You could lose your entire investment. This is not trading advice and I am in no way liable for any losses incurred.

Get your Leger Nano here:

https://www.ledger.com?r=c80ad78deb66

Thanks!

Finlē

Forex Algorithmic Trading Xrp, RippleNet 100+ partnerships – XRP used in Forex Trading!.

How can I become a quant investor?

A more typical profession path is starting out as an information research study analyst and becoming a quant after a few years. Education like a master’s level in financial design, a diploma in measurable financial modeling or electives in measurable streams throughout the normal MBA might provide prospects a head start.

Recommended Book for Automated Trading

Professional Automated Trading: Theory and Practice

Book by Eugene A. Durenard

An insider’s view of how to develop and operate an automated proprietary trading network Reflecting author Eugene Durenard’s extensive experience in this field, Professional Automated Trading offers valuable insights you won’t find anywhere else. read more…

An insider’s view of how to develop and operate an automated proprietary trading network Reflecting author Eugene Durenard’s extensive experience in this field, Professional Automated Trading offers valuable insights you won’t find anywhere else. read more…

Originally published: 2013

Author: Eugene A. Durenard

Advantages of algo Trading

Algo-trading offers the adhering to advantages:

Trades are performed at the most effective feasible costs.

Trade order positioning is instantaneous and exact (there is a high possibility of execution at the wanted levels).

Trades are timed appropriately and promptly to stay clear of significant price modifications.

Decreased deal prices.

Synchronised automated examine numerous market conditions.

Decreased risk of manual mistakes when placing professions.

Algo-trading can be backtested making use of offered historical and real-time information to see if it is a sensible trading technique.

Decreased the possibility of errors by human traders based on psychological and psychological factors.

A lot of algo-trading today is high-frequency trading (HFT), which attempts to take advantage of placing a lot of orders at fast speeds throughout numerous markets and numerous choice criteria based on preprogrammed instructions.

Algo-trading is utilized in lots of types of trading and financial investment tasks including:

Mid- to lasting financiers or buy-side companies– pension funds, mutual funds, insurer utilize algo-trading to buy supplies in big amounts when they do not wish to affect stock costs with distinct, large-volume financial investments.

Temporary traders and sell-side individuals market makers (such as broker agent houses), speculators, and arbitrageurs gain from automated profession execution; in addition, algo-trading help in creating enough liquidity for sellers on the market.

Methodical traders trend fans, hedge funds, or pairs traders (a market-neutral trading technique that matches a lengthy setting with a short setting in a pair of extremely associated tools such as two supplies, exchange-traded funds (ETFs) or money)– discover it a lot more reliable to program their trading rules and let the program profession immediately.

algo trading offers a much more methodical strategy to energetic trading than approaches based on investor intuition or reaction.

Explore Latest info Top Searched Forex Algorithmic Trading Xrp and Financial market news, evaluation, trading signals and Foreign exchange investor reviews.

Risk Notice:

“TradingForexGuide.com” TFG will not be held responsible for any kind of loss or damages arising from dependence on the information included within this internet site including market news, evaluation, trading signals and Foreign exchange broker reviews. The information included in this internet site is not necessarily real-time nor exact, and analyses are the opinions of the author and do not stand for the referrals of “TradingForexGuide.com” TFG or its employees. Currency trading on margin involves high risk, and is not appropriate for all financiers. As a leveraged item losses have the ability to surpass first deposits and capital is at risk. Prior to determining to trade Foreign exchange or any other financial tool you should meticulously consider your financial investment objectives, degree of experience, and risk hunger. We strive to supply you beneficial information regarding all of the brokers that we examine. In order to provide you with this totally free solution we obtain marketing charges from brokers, including several of those noted within our rankings and on this web page. While we do our utmost to make certain that all our information is up-to-date, we urge you to confirm our information with the broker directly.