Explore Trending Articles Explaining Forex Event Driven Trading Books, RealVision Interview – John Netto January 2017.

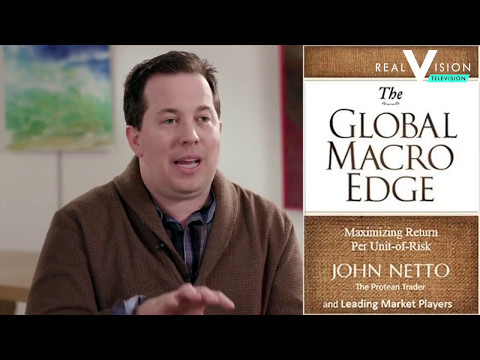

Realvision’s Grant Williams interviews John Netto, trader and author of The Global Macro Edge, about how to analyze the markets on a return per unit-of-risk basis.

Thanks for watching!

BUY “THE GLOBAL MACRO EDGE BOOK” FROM OUR OFFICIAL WEBSITE HERE: https://theproteantrader.com/collections/all?view=list&sort_by=title-descending (ALL INTERNATIONAL SHIPPING JUST $29.50)

The Global Macro Edge book on Amazon:

The Global Macro Edge is also available on IBooks:

https://itunes.apple.com/us/book/the-global-macro-edge/id1208021149?mt=11&ign-mpt=uo%3D4

Get a free sample emailing me personally at theproteantraderllc@gmail.com

Forex Event Driven Trading Books, RealVision Interview – John Netto January 2017.

The so-called fatality of event-driven investing

How Event Trade Dead?

When Daniel Loeb, the activist capitalist, addressed the annual meeting of financiers in Third Factor, his hedge fund, last month, he opened with an amusing slide. It revealed a bloodied and also battered animation version of himself surprising in the direction of a gravestone etched with the message “SPLIT event-driven investing, 2015”.

Lest anyone think 3rd Factor is predicting the demise of among the most lucrative hedge fund techniques of the past few years, the slide was entitled “The so-called fatality of event-driven investing”. But even Mr Loeb admitted the industry goes to an inflection factor.

Markets shifted in the past year

Funds in the event-driven classification are a heterogeneous bunch, yet somehow they aim to make money from company actions such as financial restructurings or mergings and also procurements. As markets shifted in the past year, numerous funds found themselves betting on the incorrect type of company actions. Event-driven techniques that worked in an equity booming market are not doing so now.

This is particularly the instance for the brand of activism with which Mr Loeb and also rivals such as Costs Ackman and also Carl Icahn have terrorised company monitorings for years. These assaults resemble being a lot less prevalent in the future.

The near cause is the string of terrible arise from activism’s leading lights.

Last year, Mr Loeb’s equity investments shed 3 per cent, yet the absolutely awful heading numbers came from David Einhorn’s Greenlight Resources and also Mr Ackman’s Pershing Square, both of which were down 20 per cent.

A more crucial aspect: the fundamentals have shifted.

Because the center of in 2014, the expectation for the global economy has soured substantially. Revenues for US companies, specifically, are getting after years of man-made growth from share buybacks. Even if one does decline a bleak financial prognosis, one can not reject that company loaning expenses have climbed and also credit markets have become much more unpredictable and also unforeseeable.

The lobbyists’ playbook for juicing shareholder returns lever up a company’s balance sheet and also return cash money to financiers just does not work in the current setting, and also long-term financiers are rebeling. Among Mr Loeb’s financial investment rules is “no financial-engineering investments in startled markets”, and also the likes of Larry Fink, president of BlackRock, the world’s largest asset manager, have provided progressively strident warnings versus buybacks and also even dividends.

Jonathan Coleman, small-cap portfolio manager at Janus Resources

It is a view echoed by financiers up and down the market. Jonathan Coleman, small-cap portfolio manager at Janus Resources, informed me recently he has made balance-sheet strength a crucial need at meetings with his portfolio companies over the past few months. Credit markets are much more uncertain and also re-financing a hill of financial debt is not likely to be as simple in the future as it has remained in the age of quantitative easing by the Federal Book. “There is nothing that can do as much damages to the equity as a high-risk balance sheet,” he said.

It is hard not to read all these indicators from the financial markets and also from the financial investment neighborhood as the early warnings of a kip down the financial cycle, yet of course the timing of the following slump doubts and also there can still be another leg of growth in between now and also an eventual recession.

Event-driven fund financiers are not waiting to find out; they are already within of retrenchment. SkyBridge Resources, an effective fund of hedge funds company, said it took $1bn away from event-driven managers consisting of Mr Loeb, Barry Rosenstein of Jana Partners and also John Paulson in the final months of in 2014. HFR, the information company, recorded $2.2 bn in discharges from the $745bn event-driven hedge fund industry in the fourth quarter of in 2014 and also the bleeding appears to have sped up in 2016.

Financiers in event-driven hedge funds shed 4.7 per cent in 2014, according to HFR, so it is little marvel that they are reassessing their commitment to the approach.

Mr Loeb informed his financiers that a shake-out of smaller funds will certainly create much more equity market possibilities for experienced managers, and also he has shifted his focus to various other type of company events around which to spend. Distress in some industries, such as power, can throw up lucrative possibilities. He is also chatting up Third Factor’s credit portfolio, which is larger than its more popular equities arm.

Event-driven investing is not dead, it will certainly simply morph. Also activism may have a cycle or two in it yet. But it seems a sure thing that the Loebs and also Ackmans of the world will certainly be less loud this year and also for the near future.

What moves the forex market?

The forex market is made up of currencies from around the world, which can make currency exchange rate predictions difficult as there are numerous factors that can contribute to cost activities.

Nevertheless, like a lot of financial markets, forex is largely driven by the forces of supply and also need, and also it is essential to obtain an understanding of the influences that drives cost fluctuations below.

Reserve banks

Supply is managed by central banks, that can announce procedures that will certainly have a considerable effect on their money’s cost. Quantitative easing, as an example, involves infusing more cash right into an economic climate, and also can create its money’s cost to go down.

Report

Industrial banks and also various other financiers have a tendency to intend to put their funding right into economic situations that have a strong expectation. So, if a favorable item of news hits the markets about a certain area, it will certainly urge financial investment and also rise need for that area’s money.

Unless there is an identical rise in supply for the money, the disparity in between supply and also need will certainly create its cost to raise. Likewise, a piece of adverse news can create financial investment to decrease and also decrease a money’s cost. This is why currencies have a tendency to reflect the reported financial health of the area they represent.

Market view

Market view, which frequents reaction to the news, can also play a major function in driving money costs. If traders believe that a money is headed in a certain direction, they will certainly trade appropriately and also may persuade others to follow suit, raising or lowering need.

Economic information

Economic information is important to the cost activities of currencies for two reasons it provides an indication of how an economic climate is doing, and also it offers understanding right into what its reserve bank may do following.

Say, for example, that rising cost of living in the eurozone has risen above the 2% degree that the European Reserve Bank (ECB) intends to keep. The ECB’s major plan tool to fight increasing inflation is raising European interest rates so traders may begin getting the euro in anticipation of rates going up. With more traders wanting euros, EUR/USD can see a rise in cost.

Credit rankings

Financiers will certainly try to maximise the return they can obtain from a market, while reducing their risk. So together with interest rates and also financial information, they may also look at credit rankings when deciding where to spend.

A country’s debt rating is an independent evaluation of its likelihood of repaying its financial obligations. A country with a high debt rating is seen as a much safer location for financial investment than one with a low debt rating. This frequently enters particular focus when credit rankings are upgraded and also reduced. A country with an upgraded debt rating can see its money rise in cost, and also the other way around.

Summary:

Matching various sorts of trading to a person’s personality type is absolutely no guarantee for forex trading success. Nevertheless, locating a trading style that’s well fit to your personality type can assist new traders discover their feet and also make the appropriate relocate the market. Just take the quiz and also respond to the 15 inquiries honestly to reveal which trading style is the appropriate fit for you.

Explore Popular Vids Explaining Forex Event Driven Trading Books and Financial market news, analysis, trading signals and also Forex mentor testimonials.

Notice about High Risk

Please note that trading in leveraged items may entail a considerable degree of risk and also is not appropriate for all financiers. You ought to not take the chance of greater than you are prepared to lose. Prior to deciding to trade, please ensure you understand the risks entailed and also take into account your degree of experience. Seek independent recommendations if necessary.