Search Popular Videos Relevant to Forex Position Trading Monitors, My Trading Setup For Forex & Indices.

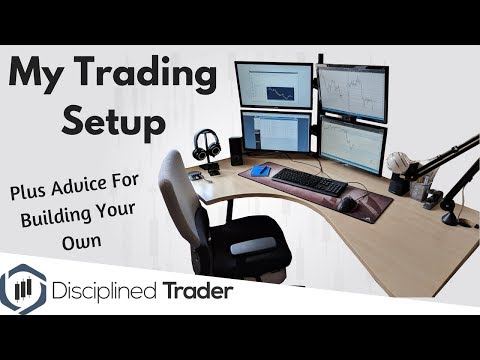

I’ve been asked a couple of times about my trading setup for trading Forex and indices so I have finally got around to making a video on it.

In this video I go through my forex trading setup piece and explain why I chose it and also give a rough guide on price – including the multi monitor setup.

Then in the second half of the video I give you my best tips and advice for building your own setup – whether you are starting from scratch or changing and already existing setup.

I hope you find the video useful!

PREVIOUS VIDEO

=================================================

My Previous Video – https://youtu.be/oB43WmmVhYk

SOCIAL LINKS

=================================================

Subscribe to the YouTube Channel for more videos: https://www.youtube.com/c/DisciplinedTraderUK

Check out the Disciplined Trader blog: http://www.disciplinedtrader.co.uk

Follow me on Twitter: https://twitter.com/disciplinedtrad

Follow me on Instagram: https://www.instagram.com/disciplined_trader/

Follow me on Facebook: https://www.facebook.com/disciplinedtrader/

Forex Position Trading Monitors, My Trading Setup For Forex & Indices.

Understanding Brief Placements.

When producing a short setting, one should understand that the trader has a finite possibility to make a profit and limitless possibility for losses. That is because the possibility for a profit is limited to the stock’s distance to absolutely no. Nonetheless, a supply could possibly increase for several years, making a collection of greater highs. Among the most harmful elements of being short is the possibility for a short-squeeze.

A short-squeeze is when a greatly shorted stock unexpectedly begins to enhance in rate as investors that are short start to cover the stock. One well-known short-squeeze took place in October 2008 when the shares of Volkswagen rose greater as short-sellers rushed to cover their shares. During the short-squeeze, the stock climbed from roughly EUR200 to EUR1000 in a little over a month.

What is a Short-Position.

A brief, or a short setting, is developed when an investor sells a protection first with the intent of redeeming it or covering it later at a lower rate. An investor might make a decision to short a protection when she thinks that the rate of that security is most likely to decrease in the future. There are 2 sorts of short positions: nude and covered. A nude short is when an investor sells a protection without having possession of it. Nonetheless, that technique is illegal in the U.S. for equities. A covered short is when an investor borrows the shares from a supply lending department; in return, the trader pays a borrow-rate while the short setting remains in place.

In the futures or forex markets, short positions can be developed at any moment.

Understanding Brief Placements.

When producing a short setting, one should understand that the trader has a finite possibility to make a profit and limitless possibility for losses. That is because the possibility for a profit is limited to the stock’s distance to absolutely no. Nonetheless, a supply could possibly increase for several years, making a collection of greater highs. Among the most harmful elements of being short is the possibility for a short-squeeze.

A short-squeeze is when a greatly shorted stock unexpectedly begins to enhance in rate as investors that are short start to cover the stock. One well-known short-squeeze took place in October 2008 when the shares of Volkswagen rose greater as short-sellers rushed to cover their shares. During the short-squeeze, the stock climbed from roughly EUR200 to EUR1000 in a little over a month.

- A brief setting refers to a trading strategy in which an investor sells a protection with strategies to buy it later.

- Shorting is a strategy utilized when an investor anticipates the rate of a protection will fall in the short-term.

- In common technique, short sellers borrow shares of stock from an investment financial institution or other financial institution, paying a fee to borrow the shares while the short setting remains in place.

Search Popular Videos Relevant to Forex Position Trading Monitors and Financial market news, evaluation, trading signals and Forex mentor reviews.

Financial Alert:

Our service includes items that are traded on margin and lug a threat of losses in excess of your transferred funds. The items might not appropriate for all investors. Please make sure that you completely understand the threats included.