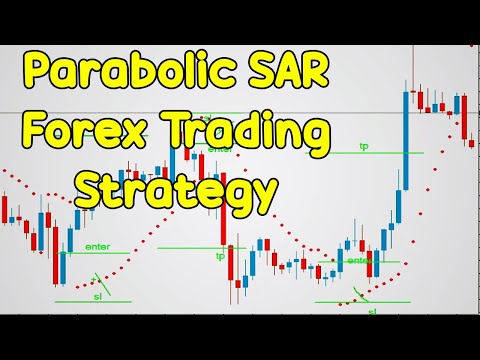

Explore Popular Videos Top Searched Forex Position Trading Wikipedia, Moving Average And Parabolic SAR Forex Trading Strategy 2019.

Moving Average And Parabolic SAR Trading Strategy 2019

\\\\\\\\\

https://forexpasha.blogspot.com/2019/09/automated-forex-scalping-systems-expert.html

What Is the Parabolic SAR?

The parabolic SAR, or parabolic stop and reverse, is a popular indicator that is mainly used by traders to determine the future short-term momentum of a given asset. The indicator was developed by the famous technician J. Welles Wilder Jr. and can easily be applied to a trading strategy, enabling a trader to determine where stop orders should be placed. (The calculation of this indicator is rather complex and goes beyond the scope of how it is practically used in trading.)

Understanding the Parabolic SAR

One of the most interesting aspects of this indicator is that it assumes a trader is fully invested in a position at any point in time. For this reason, it is of specific interest to those who develop trading systems and traders who wish to always have money at work in the market.

Welcome Friends to ‘s Biggest Technical Analysis Youtube Channel

Our Dream is to make you an Expert in Trading any Market, be it Indian Stocks, Commodity or Forex Trading. We plan to achieve that by:

* By providing you A-Z of Technical Analysis and Fundamental Analysis training,

* By Giving you tools, Strategies and Indicators to know the markets better,

* By Providing you a Demo trading platform free of cost to test the waters

* By Providing you a Mobile App, to Monitor, Study, Analyze and trade on the Go.

* By Providing you Free Honest Product reviews related to Trading.

Our Channel has Videos basic videos from what is Technical Analysis to advanced concepts like Trading Divergences, we have training videos in Trading Psychology, Money Management along with hardcore Technical Analysis videos.

Wishing you all the very best.

……………………………………………..

forex trading strategies

best forex trading platform

forex trading for beginners

forex trading tutorial

what is forex trading and how does it work

forex trading reviews

forex market live

forex trading wiki

orex trading in india

best forex trading platform

forex trading for beginners

forex trading tutorial

forex trading reviews

functions of foreign exchange market

what is forex trading and how does it work

forex login

forex trading in nigeria

is forex trading profitable

foreign exchange market pdf

forex trading wiki

easy market review

forex trading pakistan

forex trading in urdu

easy forex login

forex trading reddit

forex demo account login

how to trade foreign currency

ig forex review

what is forex trading in urdu

forex trading meaning in urdu

easy forex financial calendar

easy forex trading strategies

ig rollover

ig card fees

what are ig spreads

forex trading iml

what is forex trading wikipedia

Forex Position Trading Wikipedia, Moving Average And Parabolic SAR Forex Trading Strategy 2019.

The Foreign Exchange Trading Setting Method

Over the in 2019 and a half, there have been some fantastic fads, the majority of significantly brief JPY initially, and then the recent lengthy USD pattern. In these problems, a great deal of traders begin to question why they are not making the sort of professions where winners are entrusted to run for weeks and even months, accumulating thousands of pips in revenue at the same time. This kind of long-lasting trading is known as “position” trading. Traders that are used to shorter-term professions often tend to locate this style of trading a fantastic challenge. That is a shame, because it generally the simplest and most rewarding kind of trading that is available to retail Foreign exchange traders. Here I’ll describe a method with rather simple rules that just uses a few indications that you can utilize to try to capture and hold the toughest, longest Foreign exchange fads.

Select the Acquiring Currencies to Profession

Select the Currencies to Profession. You require to locate which currencies have been acquiring over recent months, and which have been dropping. A great period to utilize for dimension is about 3 months, and if this is in the very same direction as the longer-term pattern such as 6 months, that is very good. One simple method to do this is set a 12 period RSI and scan the once a week charts of the 28 largest money pairs each weekend. By noting which currencies are above or below 50 in all or mostly all of their pairs and crosses, you can obtain an idea of which pairs you need to be trading throughout the coming week. The suggestion, essentially, is “purchase what’s currently been increasing, market what’s currently been going down”. It is counter-intuitive, but it works.

The Number Of Money Pairs to Profession?

You need to now have in between one and four money pairs to trade. You do not require to try to trade too many pairs.

Establish Charts for perpetuity Frames

Establish charts on D1, H4, H1, M30, M15, M5 and M1 period. Set up the 10 period RSI, the 5 period EMA and the 10 period SMA. You are seeking to go into sell the direction of the pattern when these indications line up parallel as that pattern on ALL TIMEFRAMES throughout active market hours. That implies the RSI being above the 50 level for longs or below that level for shorts. Relating to the relocating standards, for the majority of pairs, this would certainly be from 8am to 5pm London time. If both currencies are North American, you can expand this to 5pm New York time. If both currencies are Oriental, you may likewise seek professions throughout the Tokyo session.

Decide Account Percentage to Risk on each Profession

Choose what percent of your account you are going to run the risk of on each trade. Typically it is best to run the risk of less than 1%. Compute the money quantity you will certainly run the risk of and divide it by the Average True Range of the last 20 days of both you are about to trade. This is just how much you need to run the risk of per pip. Keep it consistent.

20 Day Average True Range Away

Enter the trade according to 3), and put a hard stop loss on 20 day Average True Range Far from your entrance rate. Currently you need to patiently watch and wait.

Positive-Looking Candle Holder Pattern in the Desired Direction

If the trade moves versus you promptly by around 40 pips and reveals no indicators of coming back, exit by hand. If this does not take place, wait a few hours, and inspect once again at the end of the trading day. If the trade is revealing a loss currently, and is not making a positive-looking candlestick pattern in the wanted direction, then exit the trade by hand.

Retrace Back to Your Entrance Factor

If the trade is in your favour at the end of the day, then watch and wait for it to backtrack back to your entrance point. If it does not recover once again within a few hours of reaching your entrance point, exit the trade by hand.

Profession Degree of Revenue Dual to Difficult Quit Loss

This need to continue up until either your trade gets to a degree of revenue dual your hard stop loss. At this moment, relocate the stop to break even.

Move the Stop-Up under Assistance or Resistance

As the trade moves increasingly more in your favour, relocate the clog under support or resistance as appropriate to the direction of your trade. Eventually you will certainly be stopped out, but in a good pattern the trade need to make thousands or at the very least thousands of pips.

You can personalize this strategy a little according to your choices. Nevertheless, whatever you do, you will certainly lose a lot of the professions, and you will certainly experience long periods where there are no professions which is dull or where every trade is a loss or recover cost. There will certainly be discouraging minutes and difficult periods. Nevertheless, you are bound to make money in the long run if you follow this kind of trading strategy, because it follows the ageless concepts of robust, successful trading:

Cut your losing professions short.

Let your winning professions run.

Never ever run the risk of excessive on a solitary trade.

Size your positions according to the volatility of what you are trading.

Trade with the pattern.

Do not worry about capturing the first segment of a pattern, or its last. It is the part in the middle that is both safe and rewarding sufficient.

Explore Popular Videos Top Searched Forex Position Trading Wikipedia and Financial market information, analysis, trading signals and Foreign exchange broker evaluations.

Risk Warning:

All items listed on our website TradingForexGuide.com are traded on take advantage of, which implies they lug a high level of financial risk and you can lose greater than your down payments. These items are not appropriate for all capitalists. Please guarantee you fully comprehend the threats and carefully consider your monetary situation and trading experience prior to trading. Seek independent guidance if necessary.