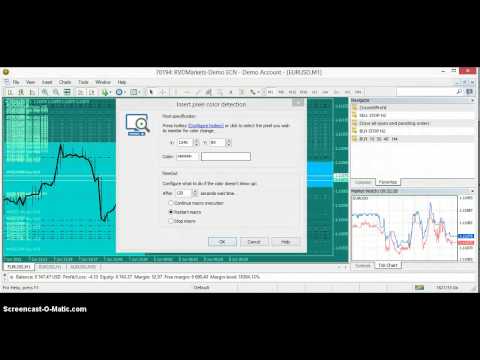

Read Interesting Review Explaining Forex Event Driven Trading Roblox, Mouse Bot Trading Assistant.

MT4 EA Hack

http://www.mouserecorder.com/

Forex Event Driven Trading Roblox, Mouse Bot Trading Assistant.

Event-Driven Strategy

What is an Event-Driven Strategy?

An event-driven method is a type of financial investment method that tries to make the most of short-lived stock mispricing, which can happen before or after a business event happens. It is usually utilized by exclusive equity or hedge funds since it needs required knowledge to examine business occasions for successful implementation. Instances of business occasions include restructurings, mergers/acquisitions, personal bankruptcy, offshoots, takeovers, and others. An event-driven method makes use of the propensity of a business’s stock rate to suffer throughout a period of adjustment.

An event-driven method describes a financial investment method in which an institutional capitalist efforts to make money from a stock mispricing that might happen throughout or after a business event.

Generally investors have groups of specialists that examine business activities from multiple viewpoints, before advising activity.

Instances of business occasions include mergers and procurements, regulatory changes, and incomes calls.

Understanding Event-Driven Techniques

Event-driven techniques have multiple techniques of implementation. In all circumstances, the objective of the capitalist is to make the most of short-lived mispricings brought on by a business reorganization, restructuring, merging, acquisition, personal bankruptcy, or an additional significant event.

Investors that use an event-driven method utilize groups of specialists that are specialists in examining business activities and figuring out the impact of the activity on a business’s stock rate. This evaluation consists of, among other things, a consider the present regulatory setting, feasible harmonies from mergers or procurements, and a brand-new rate target after the activity has taken place. A choice is after that made concerning how to spend, based on the present stock rate versus the likely rate of the stock after the activity happens. If the evaluation is right, the method will likely earn money. If the evaluation is incorrect, the method might set you back money.

Example of an Occasion Driven Strategy

The stock rate of a target business commonly rises when an acquisition is introduced. A skilled expert group at an institutional capitalist will judge whether or not the acquisition is likely to happen, based on a host of aspects, such as rate, regulatory setting, and fit between the services (or items) provided by both firms. If the acquisition does not happen, the rate of the stock might suffer. The expert group will after that determine the likely landing place of the stock rate if the acquisition does happen, based on a careful evaluation of the target and getting firms. If there suffices capacity for upside, the capitalist might buy shares of the target business to market after the business activity is full and the target business’s stock rate adjusts.

How does a stop-loss order job?

When you position a stop-loss order, sometimes described merely as a ‘quit order’, you’re instructing your broker to implement a trade on your behalf at a less good degree than the present market price.

You’ll generally do this to limit your losses on a position, on the occasion that the market relocates versus you. Establish your stop-loss at a specific degree, and your broker will close your placement for you when the market strikes that degree so you don’t need to enjoy the markets continuously.

It deserves keeping in mind that stop-loss orders do not secure versus slippage arising from markets ‘gapping’, or relocating a big range in a fraction of a second as a result of unforeseen outside influences. You can guarantee your trade is executed at precisely the degree specified by utilizing a guaranteed quit. With IG they’re free to place, and lug a small costs if set off.

If you’re positioning a stop-loss order on a lengthy trade a trade where you’ve purchased a market in the assumption that its rate will increase your stop-loss order will be a guideline to cost an even worse rate than the one you opened your trade at. Conversely, a stop-loss order on a short trade (where you’re offering a market) is a guideline to buy at an even worse rate than you opened up at.

What’s implied by ‘danger’ in trading?

In trading, ‘take the chance of’ describes the possibility of your options not leading to the outcome that you anticipated. This can take the kind of a trade not executing as you ‘d believed it would, meaning that you earn less or certainly, lose even more than initially anticipated.

Trading danger comes in a range of forms. The most usual is ‘market danger’, the general danger that your professions may not execute based on unfavourable rate motions impacted by a range of outside aspects like economic crises, political unrest and more.

Traders are generally prepared to tackle some degree of danger in order to participate in the markets, and ideally make their trading profitable gradually. Just how much trading danger they’ll tackle relies on their method, and the risk-reward ratio they’ve established on their own.

It’s as a result essential to recognise how much funding you can stand to take the chance of, both on a per-trade basis and also in its entirety gradually.

So Bottom line:

Event-driven trading techniques provide a wonderful means to maximize raising rate volatility, yet there are several threats and limitations to consider. When creating and performing these techniques, it’s important for traders to set up tight danger controls while giving sufficient room for the unpredictable circumstance to play out out there. Ultimately, event-driven trading techniques provide an useful arrowhead in the quiver of any energetic investor.

Read More Stories Explaining Forex Event Driven Trading Roblox and Financial market information, evaluation, trading signals and Foreign exchange investor evaluations.

Warning about Forex Risk

Please note that trading in leveraged items might include a significant degree of risk and is not suitable for all investors. You ought to not take the chance of more than you are prepared to lose. Prior to determining to trade, please guarantee you comprehend the threats involved and consider your degree of experience. Look for independent guidance if required.