Explore Trending Study Relevant to Momentum Trading Houses, Momentum Investing, Like Value Investing, is Simple, but NOT Easy.

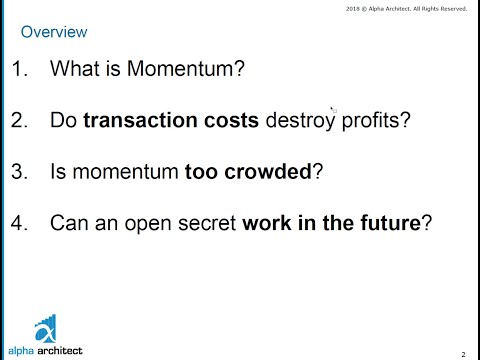

Wes Gray will address 3 key questions related to momentum-based stock selection systems:

1) Is momentum capacity too low?

2) Is momentum too crowded?

3) Can this “open secret” work in the future?

Tools cited:

https://tools.alphaarchitect.com/

PPT:

https://alphaarchitect.com/wp-content/uploads/2018/09/momentum_investing.pdf

Venue:

This is a presentation from the CMT Annual Symposium in 2018.

https://cmtassociation.org/events/symposium/

Momentum Trading Houses, Momentum Investing, Like Value Investing, is Simple, but NOT Easy.

Momentum Indicators

The Momentum indication is a typical tool utilized for establishing the Momentum of a certain asset. They are graphic devices, frequently in the form of oscillators that can show how rapidly the price of a provided asset is moving in a certain direction, along with whether the price motion is likely to continue on its trajectory.

The concept behind the tool is that as a possession is traded, the rate of the price motion reaches an optimum when the entryway of brand-new capitalists or cash right into a certain trade nears its peak. When there is much less potential brand-new financial investment readily available, the propensity after the peak is for the price fad to squash or turn around direction.

How do you know if a stock is short term?

The overall concept is to show whether a stock is trending upward or downward. Normally, an excellent prospect will have a relocating average that is sloping upward. If you are trying to find an excellent supply to brief, you typically wish to locate one with a relocating average that is flattening out or declining.

The direction of Momentum, in an easy way, can be figured out by deducting a previous price from an existing price. A positive outcome is a signal of favorable Momentum, while an unfavorable outcome is a signal of an unfavorable Momentum.

Momentum devices usually appear as rate-of-change (ROC) signs, which divide the Momentum outcome by an earlier price. Increasing this total by 100, investors can locate a portion ROC to plot highs and lows in trends on a graph. As the ROC approaches one of these extremes, there is an enhancing possibility the price fad will deteriorate and turn around directions.

Exists an unfavorable Momentum Trading?

Description: Momentum Trading is a vector quantity, given by the product of an item’s mass and rate. If the rate of the item is negative, i.e. the item is taking a trip in what has actually been picked as the negative direction, the Momentum Trading will additionally be negative.

Explore Trending Stories Relevant to Momentum Trading Houses and Financial market information, analysis, trading signals and Foreign exchange broker evaluations.

Disclaimer:

Any kind of viewpoints, information, research study, analyses, rates, other information, or links to third-party sites included on this web site are given on an “as-is” basis, as general market commentary and do not make up financial investment advice. The marketplace commentary has actually not been prepared based on lawful demands developed to promote the independence of financial investment research study, and it is consequently not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, “TradingForexGuide.com” TFG takes all sufficient actions to get rid of or stop any problems of rate of interests arising out of the manufacturing and dissemination of this communication.