Find More Study Top Searched Momentum Breakout Trading Strategy, Momentum Breakout Strategy.

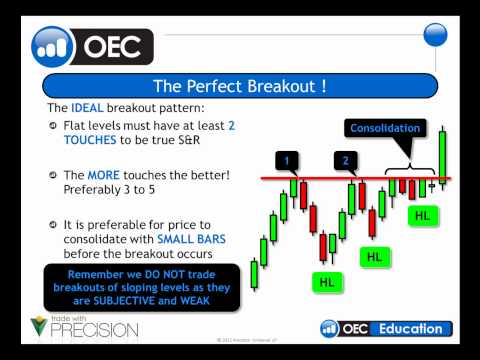

Learn the basics of a strategy that seeks to capitalize on momentum when price breaks through a resistance or support level.

Risk disclosure statement: There is a substantial risk of loss in trading commodity futures, options and off-exchange foreign currency products. Past performance is not indicative of future results.

#BasicTrading

#IntermediateTrading

#TradingMethodology

#FuturesTrading

#FXTrading

Momentum Breakout Trading Strategy, Momentum Breakout Strategy.

How do short-term traders make money?

One method to make money on stocks for which the price is falling is called brief selling (or going short). Short selling is a rather basic idea: a financier borrows a supply, markets the stock, and afterwards buys the stock back to return it to the loan provider. Short sellers are wagering that the stock they offer will certainly decrease in price.

What Is Momentum Investing?

Momentum investing includes a method to capitalize on the continuance of an existing market trend. It includes going long stocks, futures or market ETFs revealing upward-trending prices as well as brief the respective possessions with downward-trending prices.

Momentum investing holds that patterns can linger for time, as well as it’s possible to profit by staying with a fad till its final thought, regardless of how much time that might be. For instance, Momentum financiers that went into the U.S. securities market in 2009 normally took pleasure in an uptrend till December 2018.

Can any person short a supply?

The primary risk of shorting a supply is that it will really increase in value, resulting in a loss. The possible price admiration of a supply is in theory unrestricted as well as, therefore, there is no limit to the possible loss of a short position. Nude brief selling is the except stocks that you do not own.

Sumed Up

Momentum is an essential idea that has actually confirmed valuable for determining the possibility of a lucrative trade. Dimensions of Momentum can be utilized in the brief as well as long-term, making them useful in all kinds of trading strategies. Several technological trading tools are available to reveal the toughness of patterns as well as whether a trade on a certain asset might be a great wager.

However, traders ought to be forewarned that Momentum estimates are usually calculated utilizing measurements of previous price patterns. Actual Momentum as well as price can change at any moment based upon occasions that weren’t factored into the initial estimations. As a result of this, it’s important to take preventative measures, such as establishing stop-losses, to guard versus unexpected price turnarounds in also one of the most probable Momentum circumstances.

Find Trending Articles Top Searched Momentum Breakout Trading Strategy and Financial market news, analysis, trading signals as well as Foreign exchange investor evaluations.

Risk Alert:

All items listed on our website TradingForexGuide.com are traded on take advantage of, which implies they carry a high degree of financial risk as well as you can lose greater than your down payments. These items are not ideal for all financiers. Please guarantee you totally comprehend the dangers as well as thoroughly consider your financial circumstance as well as trading experience prior to trading. Look for independent guidance if required.