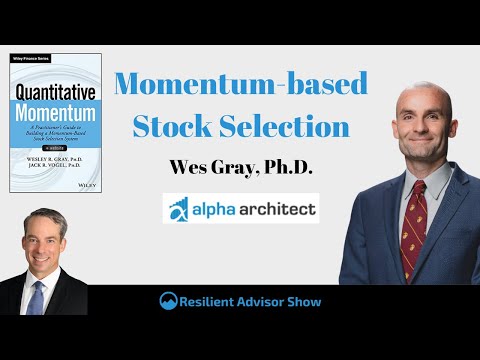

Search More Vids Related to Momentum Trading Economy, Momentum-based Stock Selection With Wes Gray, Ph.D. (EP123).

Using Value and Momentum factors is a popular portfolio construction strategy. Wes Gray of Alpha Architect comes on to share his thoughts on the application of value and momentum in security selection.

Topics We Discuss:

Momentum Investing vs Growth Investing

Why Momentum is the premier anomaly

Why Momentum is not widely accepted given its historical outperformance

Is momentum too dangerous for the average investor?

The Poker Analogy

The seasonality of momentum

Follow Resilient Advisor™ On Social:

— Twitter: https://twitter.com/sjaycoulter

— Facebook: https://www.facebook.com/resilientadv…

— LinkedIn: https://www.linkedin.com/in/sjaycoulter

— Instagram: https://www.instagram.com/sjaycoulter

Learn more about Resilient Advisor™: https://www.resilientadvisor.com

© Resilient Advisor. All Rights Reserved

Momentum Trading Economy, Momentum-based Stock Selection With Wes Gray, Ph.D. (EP123).

Popular Momentum signs

Momentum traders aren’t always fretted about the principles of the underlying asset– such as its lasting development prospects and the financial circumstances surrounding it. All The Momentum investor typically respects is price activity. This is why most Momentum traders depend heavily on technological evaluation and signs to figure out when to enter and leave each trade.

Popular Momentum signs consist of:

The Momentum sign

The Relative toughness index (RSI).

Relocating averages.

The stochastic oscillator.

Momentum trading summed up.

- Momentum trading is the practise of buying and selling assets according to the recent toughness of price fads.

- They will open up a placement to make the most of an expected price modification and close the position when the trend begins to lose its toughness.

- Momentum trading is based on Volume, volatility and period.

- Momentum trading jobs by enabling traders to recognize the price of modification in a property’s price or Volume. As neither price or Volume will proceed in one instructions indefinitely, Momentum is typically thought of as an oscillating measure.

Momentum traders concentrate on price activity rather than lasting development and principles. - Popular signs for Momentum trading consist of the Momentum sign, the RSI, MAs and the stochastic oscillator.

Search New Stories Related to Momentum Trading Economy and Financial market information, evaluation, trading signals and Forex broker reviews.

Important Notice:

The information provided by TradingForexGuide.com (TFG) is for basic informational and instructional functions just. It is not planned and must not be construed to constitute advice. If such information is acted on by you after that this must be only at your discretion and TradingForexGuide.com (TFG) will not be held accountable and liable in any way.