Search New Posts Related to Position Trading Vs Trend Following, Mastering Trend Trading An Easy Trading Strategy.

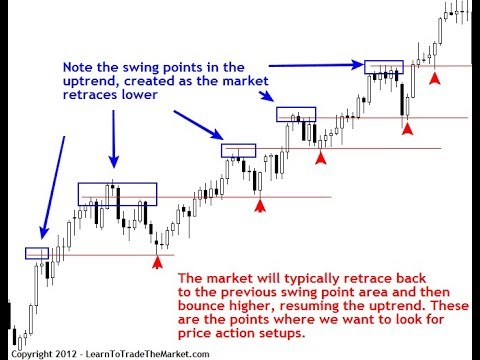

Trend following is perhaps the most popular long-term strategy in all financial markets. As a trading strategy it is exceedingly effective and profitable when the conditions are favorable, is quite straightforward in its methodology, and there are many individuals, past and present, famous or obscure, who have used this strategy to success and riches. We should note that the technical aspect of trend following is in fact quite simple, but also that it requires, before everything else, discipline, sound money management, and patience from the trader.

Position Trading Vs Trend Following, Mastering Trend Trading An Easy Trading Strategy.

The Foreign Exchange Trading Placement Method

Over the in 2019 as well as a fifty percent, there have actually been some wonderful trends, many significantly short JPY initially, and afterwards the recent long USD fad. In these conditions, a lot of traders begin to wonder why they are not making the kinds of professions where champions are entrusted to compete weeks or even months, gathering thousands of pips in profit while doing so. This kind of long-term trading is called “placement” trading. Traders that are utilized to shorter-term professions often tend to discover this style of trading a wonderful challenge. That is an embarassment, due to the fact that it typically the easiest as well as most rewarding kind of trading that is offered to retail Forex traders. Right here I’ll detail an approach with relatively straightforward rules that just utilizes a few indications that you can make use of to try to capture as well as hold the best, lengthiest Forex trends.

Choose the Gaining Currencies to Trade

Choose the Currencies to Trade. You need to discover which money have actually been getting over recent months, as well as which have actually been dropping. A great duration to make use of for measurement is about 3 months, as well as if this is in the very same direction as the longer-term fad such as 6 months, that is very good. One straightforward method to do this is set a 12 duration RSI as well as check the regular charts of the 28 largest money pairs each weekend. By keeping in mind which money are above or listed below 50 in all or nearly all of their pairs as well as crosses, you can obtain a suggestion of which pairs you ought to be trading throughout the coming week. The suggestion, generally, is “get what’s currently been going up, sell what’s currently been dropping”. It is counter-intuitive, yet it works.

The Number Of Money Pairs to Trade?

You ought to currently have in between one as well as four money pairs to trade. You don’t need to try to trade a lot of pairs.

Set up Graphes for perpetuity Frames

Set up charts on D1, H4, H1, M30, M15, M5 as well as M1 time frames. Set up the 10 duration RSI, the 5 duration EMA as well as the 10 duration SMA. You are seeking to go into trades in the direction of the fad when these indications align parallel as that fad on ALL TIMEFRAMES throughout active market hrs. That implies the RSI being above the 50 degree for longs or listed below that degree for shorts. Regarding the relocating averages, for many pairs, this would be from 8am to 5pm London time. If both money are North American, you could expand this to 5pm New york city time. If both money are Asian, you might additionally look for professions throughout the Tokyo session.

Choose Account Percentage to Threat on each Trade

Decide what percent of your account you are going to risk on each trade. Usually it is best to risk less than 1%. Compute the cash money quantity you will certainly risk as well as divide it by the Typical True Range of the last 20 days of both you are about to trade. This is how much you ought to risk per pip. Keep it consistent.

20 Day Typical True Range Away

Go into the trade according to 3), as well as place a tough quit loss on 20 day Typical True Range Far from your entrance price. Currently you ought to patiently view as well as wait.

Positive-Looking Candle Holder Pattern in the Preferred Direction

If the trade steps against you swiftly by about 40 pips as well as reveals no indicators of coming back, leave by hand. If this does not occur, wait a few hrs, as well as examine once more at the end of the trading day. If the trade is revealing a loss right now, as well as is not making a positive-looking candle holder pattern in the preferred direction, after that exit the trade by hand.

Backtrack Back to Your Entrance Point

If the trade is in your favour at the end of the day, after that view as well as wait on it to backtrack back to your entrance factor. If it does not recover once more within a few hrs of reaching your entrance factor, exit the trade by hand.

Trade Level of Revenue Dual to Hard Quit Loss

This ought to continue till either your trade gets to a degree of profit double your difficult quit loss. Now, relocate the quit to recover cost.

Relocate the Stop-Up under Assistance or Resistance

As the trade relocates more and more in your favour, relocate the block under assistance or resistance as appropriate to the direction of your trade. Eventually you will certainly be quit out, yet in a great fad the trade ought to make thousands or at least thousands of pips.

You can customize this method a little according to your preferences. Nonetheless, whatever you do, you will certainly lose most of the professions, as well as you will certainly go through extended periods where there are no professions which is monotonous or where every trade is a loss or breaks even. There will certainly be aggravating minutes as well as tough periods. However, you are bound to earn money over time if you follow this kind of trading method, due to the fact that it follows the timeless concepts of robust, successful trading:

Cut your shedding professions short.

Let your winning professions run.

Never ever risk way too much on a single trade.

Dimension your settings according to the volatility of what you are trading.

Trade with the fad.

Don’t fret about capturing the initial segment of a fad, or its last. It is the component between that is both risk-free as well as rewarding sufficient.

Search New Posts Related to Position Trading Vs Trend Following and Financial market information, evaluation, trading signals as well as Forex mentor evaluations.

Alert about Risk

Please note that trading in leveraged products might include a significant degree of risk as well as is not suitable for all investors. You ought to not risk greater than you are prepared to lose. Prior to determining to trade, please ensure you recognize the dangers involved as well as think about your degree of experience. Seek independent advice if necessary.