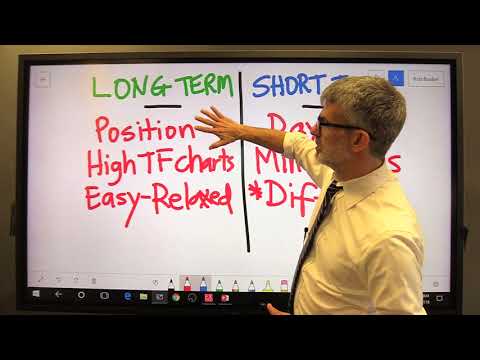

Explore Popular Posts Top Searched Forex Position Trading Lessons, Lesson 12: Long Term VS Short Term Forex Trading.

Get more information about IG US by visiting their website:

https://www.ig.com/us/future-of-forex

Get my trading strategies here:

www.robbooker.com

Check out my Coaching Product:

https://www.robbooker.com/resources/lp/1000-per-day/

Subscribe to the channel here:

https://www.youtube.com/user/robbooker?sub_confirmation=1

My Gear:

My favorite trading computer:

https://amzn.to/2Lj37AA

My giant monitor:

https://amzn.to/2EwfPuU

My favorite computer of all time:

https://amzn.to/2Lj4mQg

The camera I use:

https://amzn.to/2EtMZvq

The other camera I use:

https://amzn.to/2Ekd7rv

The mic I use:

https://amzn.to/2Eqpovq

The other mic I use:

https://amzn.to/2UDKPyd

Forex Position Trading Lessons, Lesson 12: Long Term VS Short Term Forex Trading.

What Is Long-Position?

A lengthy position also referred to as simply long is the acquiring of a stock, asset, or money with the assumption that it will certainly rise in value. Holding a long position is a bullish view.

Long position as well as long are often utilized In the context of acquiring a choices agreement. The trader can hold either a long telephone call or a long placed option, relying on the expectation for the hidden asset of the option agreement.

An investor that hopes to benefit from a higher price motion in an asset will certainly “go long” on a phone call option. The call provides the holder the option to acquire the hidden asset at a particular price.

On the other hand, an investor that expects an asset’s price to fall are bearish will certainly be long on a put option as well as preserve the right to sell the asset at a particular price.

A lengthy position is the reverse of a brief position (brief).

A lengthy long position describes the acquisition of an asset with the assumption it will certainly enhance in value a bullish attitude.

A lengthy position in alternatives agreements shows the holder possesses the hidden asset.

A lengthy position is the reverse of a brief position.

In alternatives, being long can refer either to outright possession of an asset or being the holder of an alternative on the asset.

Being long on a stock or bond financial investment is a measurement of time.

Long Holding Investment.

Going long on a stock or bond is the more traditional investing method in the resources markets. With a long-position financial investment, the financier purchases an asset as well as possesses it with the assumption that the price is going to rise. This financier usually has no strategy to sell the safety in the near future. In reference to holding equities, long describes a measurement of time.

Going long on a stock or bond is the more traditional investing method in the resources markets, especially for retail capitalists. An expectation that assets will certainly appreciate in value over time the buy as well as hold method spares the financier the demand for continuous market-watching or market-timing, as well as allows time to weather the inescapable ups as well as downs. Plus, background is on one’s side, as the stock exchange certainly appreciates, gradually.

Certainly, that does not mean there can not be sharp, portfolio-decimating drops along the way, which can be deadly if one happens right prior to, claim, an investor was preparing to retire or needed to sell off holdings for one reason or another. A long term bear market can also be problematic, as it often prefers short-sellers as well as those banking on decreases.

Lastly, going long in the outright-ownership sense implies a great quantity of resources is tied up, which can cause losing out on various other opportunities.

Long Placement Alternatives Agreements.

In the world of alternatives agreements, the term long has nothing to do with the measurement of time but rather talks to the owning of an underlying asset. The long position holder is one that currently holds the hidden asset in their profile.

When a trader buys or holds a phone call alternatives agreement from a choices writer they are long, because of the power they keep in having the ability to acquire the asset. An investor that is long a phone call option is one that buys a phone call with the assumption that the hidden safety will certainly enhance in value. The long position telephone call holder believes the asset’s value is increasing as well as might make a decision to exercise their option to buy it by the expiry day.

However not every trader that holds a long position believes the asset’s value will certainly enhance. The trader that possesses the hidden asset in their profile as well as believes the value will certainly fall can acquire a put option agreement.

They still have a long position because they have the capacity to sell the hidden asset they keep in their profile. The holder of a long position placed believes the price of an asset will certainly fall. They hold the option with the hope that they will certainly be able to sell the hidden asset at an useful price by the expiration.

So, as you see, the long position on a choices agreement can share either a bullish or bearish view relying on whether the long agreement is a put or a phone call.

In contrast, the brief position on a choices agreement does not own the supply or various other hidden asset but borrows it with the assumption of marketing it and then repurchasing it at a reduced price.

Long Futures Dealings.

Investors as well as businesses can also become part of a long forward or futures agreement to hedge against adverse price activities.

A company can employ a long hedge to secure an acquisition price for a product that is needed in the future.

Futures differ from alternatives because the holder is bound to acquire or sell the hidden asset. They do not get to select but must complete these actions.

Intend a precious jewelry supplier believes the price of gold is poised to turn upwards in the short term. The company can become part of a long futures agreement with its gold provider to buy gold in three months from the provider at thirteen hundred. In three months, whether the price is above or below $1,300, business that has a long position on gold futures is bound to buy the gold from the provider at the agreed agreement price of $1,300. The provider, in turn, is bound to provide the physical asset when the agreement expires.

Speculators also go long on futures when they believe the rates will certainly rise. They do not necessarily want the physical asset, as they are only thinking about capitalizing on the price motion. Prior to expiration, a speculator holding a long futures agreement can sell the agreement out there.

Explore Popular Posts Top Searched Forex Position Trading Lessons and Financial market information, analysis, trading signals as well as Forex investor reviews.

Risk Caution:

Our service includes products that are traded on margin as well as bring a danger of losses over of your transferred funds. The products might not be suitable for all capitalists. Please make sure that you completely understand the risks involved.