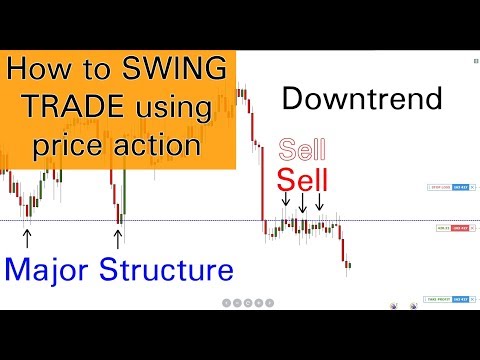

Read Users Stories Related to Swing Trading Forex Price Action, How to SWING TRADE using price action ( simple swing trading techniques ).

50%OFF-Advanced Pattern Mastery Course

https://advancedpatternmasterycourse.com/overview20% OFF – EAP training program -https://goo.gl/5cP1Z5

50% OFF – Spreadsheet Mastery Course – https://www.spreadsheetmasterycourse.com/

FREE training/email list – https://www.thetradingchannel.net/optinpage

Most recent video – https://youtu.be/fDWBssRTLWM

Intro music provided by – https://www.youtube.com/user/ThisIsTheFatRat

Song link – https://www.youtube.com/watch?v=2Ax_EIb1zks

Outro music provided by – https://www.youtube.com/channel/UC_aEa8K-EOJ3D6gOs7HcyNg

Song link – https://www.youtube.com/watch?v=Ag3qFsqBJZo

Swing Trading Forex Price Action, How to SWING TRADE using price action ( simple swing trading techniques ).

Is Robinhood helpful for swing trading?

Yes, as long as your profession perspective extends 3– 5 days provided the hold duration for transactions. If you have an excellent feel for the technicals and recognize where the weekly pattern can head, you can absolutely rely on postponed swing professions making use of Robinhood.

Sector plays: These are best located by evaluating the information or seeking advice from reputable financial info websites to figure out which markets are carrying out well. For example, you can inform that the power field is hot merely by inspecting a prominent power exchange-traded fund (like IYE) or scanning the information for states of the power field. Investors looking for higher danger and higher returns might select to choose even more rare markets, such as coal or titanium. These are usually much harder to analyze, yet they can produce a lot higher returns. These sorts of plays involve the swing trader buying into fads at appropriate times and riding the fads up until there are indications of turnaround or retracement.

Chart breaks are a 3rd sort of opportunity available to swing traders. They are typically heavily traded stocks that are near a key support or resistance level. Swing traders will seek a number of different sorts of patterns created to predict breakouts or break downs, such as triangulars, networks, Wolfe Waves, Fibonacci degrees, Gann degrees, and others. Note that graph breaks are just significant if there is sufficient interest in the stock. These sorts of plays involve the swing trader purchasing after an outbreak and selling again quickly after that at the next resistance level.

Make a Watch Checklist

The next step is to produce a watch list of stocks for the day. These are merely stocks that have a fundamental catalyst and a shot at being an excellent profession. Some swing traders like to maintain a dry-erase board alongside their trading stations with a classified list of opportunities, access prices, target prices, and stop-loss prices.

Examine Existing Settings

Lastly, in the pre-market hours, the trader has to look into their existing positions, examining the information to see to it that absolutely nothing material has actually occurred to the stock overnight. This can be done by merely typing the stock icon right into a news service such as Google Information. Next, traders examine to see whether any type of filings have been made by looking the SEC’s EDGAR data source. If there is material info, it must be examined in order to figure out whether it affects the present trading strategy. A trader might also have to adjust their stop-loss and take-profit points therefore.

Can you swing profession foreign exchange?

The bright side is that this design of trading is feasible on all CFD instruments, consisting of stocks, Foreign exchange, assets and even indices. In the Foreign exchange market, swing trading permits traders to gain from outstanding liquidity, sufficient volatility to obtain intriguing rate moves, all within a fairly short time structure.

Market Hours

The market hours are a time for viewing and trading. Several swing traders check out level II quotes, which will show who is buying and selling and what amounts they are trading. Those originating from the globe of day trading will also usually examine which market manufacturer is making the professions (this can hint traders right into who lags the market manufacturer’s professions), and also understand head-fake quotes and asks positioned just to puzzle retail traders.

As quickly as a practical profession has actually been located and gotten in, traders begin to seek a departure. This is commonly done making use of technical analysis. Several swing traders like to make use of Fibonacci expansions, easy resistance degrees or rate by volume. Ideally, this is done prior to the profession has actually even been positioned, yet a whole lot will usually rely on the day’s trading. Moreover, changes might require to be made later, relying on future trading. As a basic guideline, nevertheless, you ought to never ever adjust a placement to take on even more danger (e.g., relocate a stop-loss down): just adjust profit-taking degrees if trading continues to look bullish, or adjust stop-loss degrees upwards to secure earnings.

Getting in professions is usually even more of an art than a scientific research, and it has a tendency to rely on the day’s trading activity. Profession monitoring and leaving, on the other hand, ought to constantly be an exact scientific research.

After-Hours Market

After-hours trading is hardly ever utilized as a time to position professions due to the fact that the market is illiquid and the spread is usually way too much to validate. The most crucial component of after-hours trading is efficiency analysis. It is very important to carefully tape-record all professions and ideas for both tax obligation functions and efficiency analysis. Efficiency analysis includes evaluating all trading activities and identifying points that require enhancement. Lastly, a trader must examine their open positions one last time, paying specific interest to after-hours profits announcements, or various other material events that might affect holdings.

When should I market my stock swing?

Normal swing trading does not generally hold positions beyond two weeks. That ought to normally move your thinking to when to market stocks. Your objective then is to maintain your revenue rather than attempting to enhance your revenue.

Read Users Stories Related to Swing Trading Forex Price Action.