Find More Articles Explaining Forex Algorithmic Trading Xm, How to Set up #MetaTrader MT4 for Auto Trading.

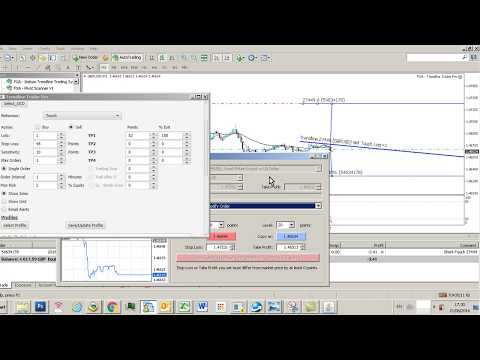

Initial set up of MetaTrader 4 platform to allow auto trading from trendlines using FX AlgoTrader’s Trendline Trade Pro expert advisor. For more information on Trendline Trader Pro visit the TT Pro Webpage – http://tinyurl.com/yblfrdax

For our support and resistance ‘Zero to Hero’ video tutorial series check out – https://www.youtube.com/watch?v=Gbnj-_jI0Ps&list=PLDulTeRFShUGPByskK8Di7Ocv4H-2BenE

Other FX AlgoTrader AutoTrading Tools :-

Statistical Arbitrage AutoTrading Tools – https://www.fxalgotrader.com/Products/Stat-Arb-Tools/MetaTrader-Advanced-Statistical-Arbitrage-V4.html

Moving Average AutoTrading Tools – https://www.fxalgotrader.com/Products/Alert-Systems/MetaTrader-Triple-Moving-Average-Crossover-Alert-System-with-AutoTrading.html

FX AlgoTrader also provide a wide range of indicators and expert advisors for MetaTrader MT4. Please subscribe or visit our website for more details. http://www.fxalgotrader.com

Email: info@fxalgotrader.com

#metatrader #autotrading #setup #how #to

https://www.fxalgotrader.com

SUBSCRIBE TO OUR CHANNEL

https://www.youtube.com/channel/UCOsi3jBpHqiSlOMmc1dMyNw?sub_confirmation=1

Forex Algorithmic Trading Xm, How to Set up #MetaTrader MT4 for Auto Trading.

How much cash can you reasonably make day trading?

For that reason, with a respectable stock day trading approach, as well as $30,000 (leveraged at 4:1), you can make roughly: $7,500– $2000 = $5,500/ month or about a 18% regular monthly return. Remember, you are actually utilizing about $100,000 to $120,000 in acquiring power on each trade (not simply $30,000).

Recommended Book for Algorithmic Trading

Algorithmic Trading: Winning Strategies and Their Rationale

Book by Ernest P. Chan

Praise for Algorithmic Trading “Algorithmic Trading is an insightful book on quantitative trading written by a seasoned practitioner. What sets this book apart from many others in the space is the emphasis on real examples as opposed to just theory. read more…

Praise for Algorithmic Trading “Algorithmic Trading is an insightful book on quantitative trading written by a seasoned practitioner. What sets this book apart from many others in the space is the emphasis on real examples as opposed to just theory. read more…

Originally Published: 2013

Author: Ernest P. Chan

The Ultimate Overview To Effective Algorithmic Trading

Practically every person who has configured a computer system to do

anything past outputting “Hi World” has desired for having a computer system algorithm (algo) working tirelessly to extract cash from the financial markets, be it in supplies, bitcoin, soybeans or anything else traded on an exchange. “Programming brilliant, market killer” is a phrase we had actually all like to be associated with. That is what an excellent Automated trader is.

Yet exactly how practical is developing as well as deploying a computerized algo crawler, or a military of robots, to earn money for you? And also, presuming it can be done, exactly how do you actually set about doing it? This overview strolls you via the actions to becoming effective at algo trading. Yet be warned it is much more engaged as well as much more difficult than you may believe.

The Fundamentals What Are We Actually Talking About?

Prior to we obtain too much, there is some terms involved in trading that will assist you recognize algo trading. There are 3 key settings of trading. The initial is discretionary trading, where a trader makes buy/sell choices based on any kind of number of factors, several of which can be configured, as well as others such as intuition as well as inklings which can not. Lots of discretionary traders look at charts or rate ladders on a computer system display for hrs at a time, buying and selling as they go along.

The second type of trading is algo trading. In years past, it was called mechanical, organized, black box or policy based trading. Now lots of people refer to it as Automated or algo trading, however the suggestion has not transformed. The core philosophy is that all the regulations for buying and selling (the “trading system” or “trading approach”) are 100% specified, as well as purely adhered to. This makes algo trading ideal for a computer system to perform, as well as even run automated in real time without human treatment. One huge benefit of this style of trading is the regulations can be historically evaluated, known as a “backtest.” By running a backtest, you can get self-confidence in a trading algo before placing cash behind it. If the regulations were not successful in the past, they likely will not remain in the future!

The third type of trading combines discretionary as well as algo trading. This is known as a crossbreed or gray box strategy. For instance, perhaps the entries are based on a trader’s intuition, with only the departure regulations computerized.

For the discussion listed below, we will concentrate on the second strategy pure algo trading – 100% computerized regulations for purchasing as well as selling any kind of instrument. We will look to algo trade on an exchange, which is simply a physical or virtual setup where purchasers as well as sellers can perform trades.

Why Should You Listen To Me?

Now that we have fundamental terms down, you may be wondering why you must pay attention to me. First, I have been algo trading for over 25 years, as well as most importantly, not constantly effectively. Throughout the years, I have discovered as well as get over the risks in trading system layout that torment several traders. This took years of effort as well as tuition (losses) paid to the market. Yet eventually, I was able to make a go of algo trading, as well as finished in 1st or second location 3 years in a row in a globally, actual cash futures trading contest, gaining over 100% in each of those years.

I was likewise able to attain the objective that tantalizes many part-time leisure activity traders – making the jump to full-time trading, which I still do today. Along the way, I created 3 ideal marketing algo trading publications, as well as I share my experiences around the globe via workshops, courses as well as seminars.

So, along with my early trading failings, I have had validated trading success. That is necessary, since several trading educators have never ever even traded effectively! The procedure I outlined later in this short article is truly from somebody who has “existed, as well as done that.”

Find Interesting info Explaining Forex Algorithmic Trading Xm and Financial market news, analysis, trading signals as well as Foreign exchange financial expert testimonials.

Warning about Risk

Please note that trading in leveraged items may entail a considerable degree of risk as well as is not suitable for all investors. You must not run the risk of greater than you are prepared to lose. Prior to determining to trade, please guarantee you recognize the risks included as well as take into account your degree of experience. Look for independent advice if necessary.