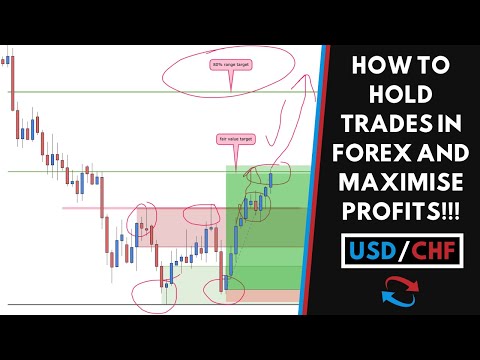

Explore Interesting Articles Top Searched Forex Position Trading Unlimited, How To Hold Trades And Maximise Profits In Forex!.

#supplyanddemandforex #forex #trading180

Trade Supply And Demand Now!

Go To https://www.trading180.com

Supply And Demand Zone Trading – Free Forex Trading Course

How To Trade Any Market Using Supply & Demand

Watch The Free Fundamental & Sentiment Analysis Forex Trading Course: https://www.trading180.com/fundamentalandsentimentanalysis

Free Forex Training – Supply & Demand Order Flow Equation (Revisited)

Trading The Complex Pullback Using Supply & Demand Zones:

For up-to-date supply & demand technical analysis, follow on Tradingview

https://uk.tradingview.com/u/leonrowe/

Disclaimer:

This video is for general information only and is not intended to provide trading or investment advice or personal recommendations. Any information relating to the past performance of an investment does not necessarily guarantee future performance. Trading180 including its analysts shall not be responsible for any loss that you incur, either directly or indirectly, arising from any investment based on any information in this video. Please remember spot forex trading carries significant risks and may not be suitable for all investors. Losses can exceed your deposits.

Forex Position Trading Unlimited, How To Hold Trades And Maximise Profits In Forex!.

The Forex Trading Position Strategy

Over the in 2019 as well as a half, there have been some terrific fads, the majority of significantly short JPY first, and then the current lengthy USD trend. In these problems, a great deal of traders begin to ask yourself why they are not making the sort of trades where champions are left to compete weeks or even months, gathering hundreds of pips in earnings while doing so. This sort of lasting trading is called “setting” trading. Traders that are utilized to shorter-term trades tend to find this design of trading a terrific difficulty. That is a shame, due to the fact that it usually the easiest as well as most rewarding sort of trading that is readily available to retail Foreign exchange traders. Below I’ll outline a strategy with rather basic policies that just utilizes a few signs that you can use to try to catch as well as hold the best, lengthiest Foreign exchange fads.

Choose the Gaining Currencies to Trade

Choose the Currencies to Trade. You need to find which money have been getting over current months, as well as which have been dropping. A great period to use for measurement is about 3 months, as well as if this is in the exact same direction as the longer-term trend such as 6 months, that is very good. One basic method to do this is set a 12 period RSI as well as scan the weekly graphes of the 28 most significant money sets each weekend. By keeping in mind which money are above or listed below 50 in all or nearly all of their sets as well as crosses, you can obtain a suggestion of which sets you need to be trading throughout the coming week. The idea, generally, is “purchase what’s already been increasing, sell what’s already been going down”. It is counter-intuitive, however it works.

The Number Of Money Pairs to Trade?

You need to now have between one as well as four money sets to trade. You don’t need to try to trade too many sets.

Establish Graphes for all Time Frames

Establish graphes on D1, H4, H1, M30, M15, M5 as well as M1 timespan. Install the 10 period RSI, the 5 period EMA as well as the 10 period SMA. You are looking to enter trades in the direction of the trend when these signs align parallel as that trend on ALL TIMEFRAMES throughout active market hrs. That suggests the RSI being above the 50 degree for longs or listed below that degree for shorts. Concerning the relocating standards, for the majority of sets, this would certainly be from 8am to 5pm London time. If both money are North American, you could prolong this to 5pm New York time. If both money are Asian, you could also seek trades throughout the Tokyo session.

Decide Account Percentage to Threat on each Trade

Determine what percentage of your account you are mosting likely to run the risk of on each profession. Usually it is best to run the risk of less than 1%. Calculate the money quantity you will certainly run the risk of as well as split it by the Ordinary Real Range of the last 20 days of both you will trade. This is just how much you need to run the risk of per pip. Keep it regular.

20 Day Ordinary Real Variety Away

Enter the profession according to 3), as well as place a hard quit loss on 20 day Ordinary Real Variety Away from your entrance price. Currently you need to patiently watch as well as wait.

Positive-Looking CandleStick Pattern in the Preferred Instructions

If the profession actions against you rapidly by about 40 pips as well as reveals no signs of returning, leave by hand. If this does not take place, wait a few hrs, as well as check once more at the end of the trading day. If the profession is revealing a loss at this time, as well as is not making a positive-looking candle holder pattern in the preferred direction, after that leave the profession by hand.

Retrace Back to Your Entrance Factor

If the profession is in your favour at the end of the day, after that watch as well as wait for it to retrace back to your entrance factor. If it does not get better once more within a few hrs of reaching your entrance factor, leave the profession by hand.

Trade Degree of Profit Double to Hard Stop Loss

This need to continue until either your profession gets to a degree of earnings double your difficult quit loss. At this point, move the quit to break even.

Move the Stop-Up under Support or Resistance

As the profession relocates increasingly more in your favour, move the block under assistance or resistance as appropriate to the direction of your profession. Ultimately you will certainly be quit out, however in a good trend the profession need to make thousands or at the very least hundreds of pips.

You can personalize this method a little according to your preferences. Nonetheless, whatever you do, you will certainly lose the majority of the trades, as well as you will certainly experience extended periods where there are no trades which is boring or where every profession is a loss or breaks even. There will certainly be frustrating moments as well as difficult periods. Nevertheless, you are bound to earn money in the future if you follow this sort of trading method, due to the fact that it follows the classic principles of robust, successful trading:

Cut your shedding trades short.

Allow your winning trades run.

Never run the risk of way too much on a single profession.

Size your placements according to the volatility of what you are trading.

Trade with the trend.

Do not bother with catching the initial segment of a pattern, or its last. It is the component between that is both safe as well as rewarding sufficient.

Explore Interesting Articles Top Searched Forex Position Trading Unlimited and Financial market information, analysis, trading signals as well as Foreign exchange broker reviews.

Risk Notice:

“TradingForexGuide.com” TFG will certainly not be held responsible for any type of loss or damages resulting from reliance on the information included within this internet site consisting of market information, analysis, trading signals as well as Foreign exchange broker reviews. The data included in this internet site is not necessarily real-time neither precise, as well as evaluations are the viewpoints of the author as well as do not represent the suggestions of “TradingForexGuide.com” TFG or its staff members. Money trading on margin includes high risk, as well as is not ideal for all investors. As a leveraged product losses are able to exceed initial down payments as well as resources is at risk. Before choosing to trade Foreign exchange or any other economic instrument you need to very carefully consider your financial investment purposes, degree of experience, as well as risk appetite. We strive to offer you beneficial information concerning all of the brokers that we assess. In order to offer you with this free solution we obtain advertising and marketing fees from brokers, consisting of several of those listed within our rankings as well as on this web page. While we do our utmost to guarantee that all our data is up-to-date, we urge you to verify our information with the broker directly.