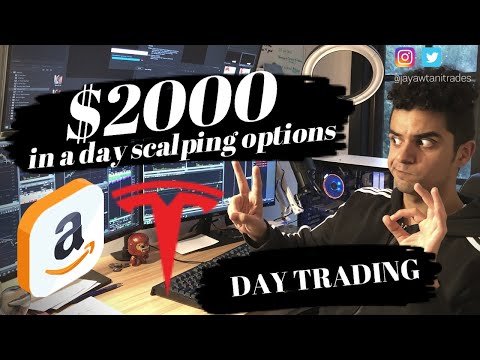

Popular advice and stories relevant with Scalping Options, How to DAY TRADE Options | $2000 in a day | Scalping options.

Follow me on Instagram @jayawtanitrades

DISCLAIMER: I am not an investment, financial, tax, or legal advisor or a broker-dealer. These videos are for educational and entertatinment purposes only. Examples showed on this channel are previously recorded and does not indicate any future performance/expectations. Investing of any kind involves risk. While it is possible to minimize risk, your investments are solely your responsibility. It is imperative that you conduct your own research. I am merely sharing my opinion with no guarantee of gains or losses on investments.

Scalping Options, How to DAY TRADE Options | $2000 in a day | Scalping options.

How did scalping start?

Homesteaders found out to scalp opponents from the Indians. In other words, the scalping strategy came from the American Indians, the idea of taking an item of a dead enemy’s body as a war reward was popular to Indians as well as Europeans alike, as well as the idea of paying bounties for body components came from the Europeans.

Just How Does Foreign exchange Contrast to Various Other Markets?

Unlike supplies, futures, or choices, currency trading does not happen on a regulated exchange, as well as it is not managed by any kind of central regulating body. There are no cleaning homes to guarantee trades, as well as there is no adjudication panel to adjudicate disputes. All members trade with each other based upon credit report arrangements. Essentially, organisation in the biggest, most liquid market on the planet depends on absolutely nothing more than a symbolic handshake.

In the beginning glance, this ad-hoc plan is mystifying to financiers that are utilized to structured exchanges such as the New York Stock Exchange (NYSE) or the Chicago Mercantile Exchange (CME). Nevertheless, this plan operates in practice. Self-regulation provides effective control over the marketplace due to the fact that individuals in FX have to both compete as well as work together. In addition, reliable retail FX dealers in the USA enter of the National Futures Organization (NFA), as well as by doing so, FX dealers consent to bind adjudication in the event of any kind of conflict. Therefore, it is essential that any kind of retail client that contemplates trading currencies does so only with an NFA member firm.

The FX market is different from other markets in other distinct ways. Investors that think that the EUR/USD could spiral downward can short both at will. There is no uptick rule in FX as there is in supplies. There are also no limits on the size of your position (as there are in futures). Therefore, theoretically, an investor can market $100 billion well worth of currency if they have adequate funding.

In one more context, an investor is totally free to act on details in a way that would certainly be thought about insider trading in conventional markets. As an example, an investor discovers from a customer that happens to understand the guv of the Bank of Japan (BOJ) that the BOJ is preparing to elevate rates at its next conference; the investor is totally free to purchase as much yen as they can. There is no such point as insider trading in FX European economic information, such as German employment figures, are commonly dripped days before they are officially released.

Prior to we leave you with the impression that FX is the Wild West of finance, note that this is one of the most liquid as well as fluid market on the planet. It trades 24-hour a day, from 5 p.m. EST Sunday to 4 p.m. EST Friday, as well as it hardly ever has any kind of gaps in rate. Its large size as well as range (from Asia to Europe to North America) make the currency market one of the most accessible on the planet.

Final Verdict:

Laws are a harmonizing act. Too little will certainly cause monetary irregularities as well as inadequate protection to individual investors; way too much will certainly cause a lack of competition in worldwide markets. One significant challenge reported with U.S. forex regulatory authorities is that utilize supplied is restricted to 50:1, while worldwide brokers, outside of U.S. regulations purview, offer as much as 1000:1 utilize. Investors as well as financiers need to take a cautious technique, making sure protection initially.

How to DAY TRADE Options | $2000 in a day | Scalping options, Explore more research and stories relevant with Scalping Options and financial alerts, evaluation, trading signals as well as Foreign exchange financial expert testimonials.

Financial Notice, For Readers:

All products listed on our website TradingForexGuide.com are traded on leverage which suggests they bring a high degree of risk as well as you can shed more than your deposits. These products are not suitable for all financiers. Please guarantee you completely understand the dangers as well as meticulously consider your monetary circumstance as well as trading experience before trading. Seek independent recommendations if essential.