Get Latest Stories About Cfd Position Size Calculator, How to Calculate Position Size On CFDs Using a Basic Spreadsheet.

Connect with us here:

Web: http://www.learncfds.com

Twitter: https://twitter.com/learncfds

LinkedIn: http://www.linkedin.com/in/ashleyjessen

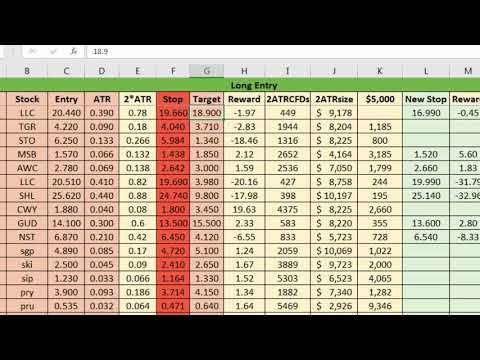

Cfd Position Size Calculator, How to Calculate Position Size On CFDs Using a Basic Spreadsheet.

What is a Position Investor?

Placement investor describes a person that holds a financial investment for a prolonged period of time with the expectation that it will certainly appreciate in value. The typical time frames for holding settings can be measured in weeks to months. They are less worried about temporary changes and also the information of the day unless it impacts the long-term sight of their setting. Placement traders do not trade actively, with a lot of putting less than 10 trades a year.

What tools do setting traders generally trade?

Placement trading is the style of trading that is most comparable to spending. Placement traders are seeking to profit from lasting movements and also are consequently a lot more interested in markets with clear fads, as opposed to markets that have a great deal of volatility however ultimately profession within a limited rate range.

Shares CFDs

Shares in companies are frequently traded by setting traders. As a general general rule, asset courses like shares are prone to a lot more steady fads when compared to very unstable markets such as cryptocurrencies and also particular forex markets. Despite particular occasions, such as market announcements and also more comprehensive relevant information, fundamental analysis of a company’s underlying business version and also accounts is a solid basis from which setting traders can examine the well worth of a company, and also consequently highlight opportunities. They can hypothesize on where they believe particular firms, and also even markets, will certainly end up in a year’s time.

Commodity CFDs

Similarly to shares, assets are a lot more vulnerable to longer term fads when compared to other markets, such as cryptocurrencies and also particular currency pairs. This is not to state that assets are not unstable. Assets can be unstable at times, however tend to stabilise faster than other markets, and also profession within tighter ranges. Difficult assets are drawn out therefore their supply is managed by mining companies, which implies they tend to have fairly steady fads. They are a lot more vulnerable to shocks popular, with supply being fairly steady.

Indices CFDs

Indices are comprised of numerous companies that, usually, aren’t associated. They tend to be from the exact same geographical location, whether that be a particular nation, profession group or continent. Consequently, indices normally have actually articulated fads and also are favoured by setting traders. For instance, the FTSE 250 is a good indication of the financial wellness of the UK the index is frequently untouched by brief dips in a particular industry. Trading indices enables less sound and also more clear fads (in either instructions), which is complementary to position trading.

Foreign exchange CFDs

Money pairs, partly because of their volatility, are favoured less by setting traders. That stated, there are particular more comprehensive political fads that can cause more clear and also longer-term fads in the forex market. For instance, speculation after the UK-EU vote result offered a clear fad for the following 6 months to one year duration.

Cryptocurrency CFDs

Cryptocurrencies, in spite of being reknowned for their extreme volatility, draw in some setting traders that employ buy and also hold strategies for certain cryptocurrencies that they anticipate to rise substantially in value. Placement traders of this kind are probably influenced by those traders that handled to acquire from the cryptocurrency bubble, getting out before it ruptured. Cryptocurrency markets are very unstable and also those that employ buy and also hold strategies ought to do so at their very own danger.

Is Placement Trading for You?

All investors and also traders ought to match their trading style with their very own personal goals, and also each style has its benefits and drawbacks. The very first consideration must be the reason you are purchasing the starting point. Are you developing a nest egg for the future? Do you plan to earn a living trading? Or do you just take pleasure in dabbling in the market based on your very own research study and also wish to possess an item of a company? And also how much time do you wish to dedicate each week or every day to tracking your profile?

You have to also comprehend the type of market in position. Is it a booming market with a solid fad? If so, setting trading is preferably fit. Nonetheless, if it is a bearish market, it is not. Likewise, if the market is level, moving laterally, and also just shaking about, day trading might have the advantage.

You might be a foreign exchange setting investor if:

- You are an independent thinker. You have to be able to ignore popular opinion and also make your very own informed assumptions regarding where the market is going.

- You have a fantastic understanding of fundamentals and also have great foresight right into just how they impact your currency set in the long run.

- You have thick skin and also can weather any type of retracements you face.

- You have enough funding to endure several hundred pips if the market violates you

You do not mind waiting for your grand benefit. Long term forex trading can net you several hundred to several hundreds of pips. If you get thrilled being up 50 pips and also already wish to exit your profession, take into consideration moving to a much shorter term trading style. - You are very patient and also calm.

You might NOT be a foreign exchange setting investor if:

- You quickly get persuaded by popular opinions on the markets.

- You do not have a mutual understanding of just how fundamentals impact the markets in the long run.

- You aren’t person. Even if you are rather patient, this still might not be the trading style for you. You have to be the utmost zen master when it comes to being this type of person!

- You do not have enough beginning funding.

- You do not like it when the market violates you.

- You like seeing your results fast. You might incline waiting a few days, however several months and even years is just too long for you to wait.

Final Words

Similar to seemingly everything in the economic sector, the technique of setting trading includes advantages and also disadvantages. Lots of people discover the opportunity of becoming aware large gains through capturing a pattern eye-catching, while others are wary of being subjected to the opportunity of an extensive economic collapse.

The decision of just how to involve the markets lies within the person. While setting trading is a fantastic fit for some, it can be a detriment to others. The duty for picking an ideal trading approach also lies with each striving investor or investor. If the ideal time, funding and also character is present, then a method of setting trading might be optimal.

Any type of point of views, information, research study, analyses, rates, other details, or web links to third-party sites are offered as basic market discourse and also do not make up financial investment guidance. FXCM will certainly decline liability for any type of loss or damages including, without restriction, to any type of loss of earnings which might arise straight or indirectly from use of or dependence on such details.

Get Latest Stories About Cfd Position Size Calculator and Financial market information, analysis, trading signals and also Foreign exchange broker reviews.

Risk Warning:

“TradingForexGuide.com” TFG will certainly not be held accountable for any type of loss or damages arising from dependence on the details included within this internet site including market information, analysis, trading signals and also Foreign exchange broker reviews. The data included in this internet site is not necessarily real-time neither precise, and also analyses are the point of views of the author and also do not represent the suggestions of “TradingForexGuide.com” TFG or its employees. Money trading on margin includes high danger, and also is not suitable for all investors. As a leveraged product losses are able to go beyond initial down payments and also funding goes to danger. Before choosing to trade Foreign exchange or any other economic instrument you ought to thoroughly consider your financial investment objectives, degree of experience, and also danger cravings. We work hard to supply you useful details about every one of the brokers that we assess. In order to offer you with this totally free service we receive advertising costs from brokers, including some of those provided within our positions and also on this web page. While we do our utmost to make certain that all our data is up-to-date, we encourage you to confirm our details with the broker straight.