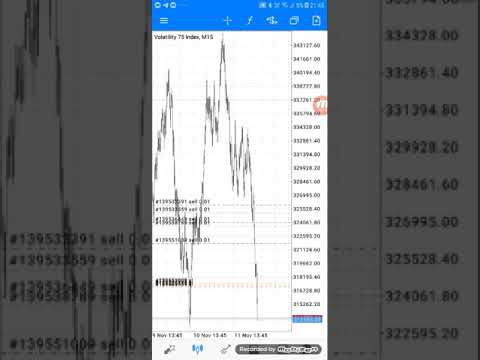

Get Trending Videos Explaining Forex Event Driven Trading Paints, 🔥Fundamental Pip Lord using same forex trading strategies here to profit from Volatility 75 Index.

WATCH: 🔥Fundamental Pip Lord using same #forextradingstrategies posted here to profit from #Volatility75Index.

———————————————————————————

DOWNLOAD FREE FOREX BOOKS AND FREE FOREX INDICATORS HERE:

https://dailyfxforexlive.blogspot.com/

TO TRY THIS FOREX STRATEGY RISK FREE ON DEMO FIRST:

– Open forex demo account HERE: https://clicks.pipaffiliates.com/c?c=465265&l=en&p=5

———————————————————————————-

#Volatility75indextrading #volatilitytradingstrategies #volatility75indexstrategy

Forex Trading Strategies is a channel helping forex traders – new and experienced, with forex trading strategies to help or improve their forex trading. What are the best Forex trading strategies for beginners and professional traders to use? Find out on our channel – we feature Scalping strategies; Day trading strategies, Swing trading strategies and more forex trading strategies!

We hope from these Forex trading strategies, you will find the best forex trading strategy that suits your forex trading.Sounds good?

What is a Forex Trading Strategy?

A forex trading strategy is a technique used by a forex trader to determine whether to buy or sell a currency pair at any given time. Forex trading strategies can be based on technical analysis, or fundamental, news-based events. The trader’s currency trading strategy is usually made up of trading signals that trigger buy or sell decisions. Forex trading strategies are available on the internet or may be developed by traders themselves.

forex trading strategies, forex trading strategy, Forex trading, morgan stanley online trading, online futures trading, interactive brokers cfd, e trade account, saxo bank online trading, best metatrader indicators, brokers with bonus, hugosway broker, cfd trading platform, interactive brokers forex, true ecn broker, ig forex broker, ctrader brokers, best forex trading platform for beginners, mt4 trading platform, jafx broker, best forex broker in the world, fbs broker, currency meter indicator, metatrader web, free forex demo account for beginners, best cfd brokers, cfd brokers, ib webtrader, ig forex broker, broker cfd, cfd trader, forex 500 plus, fxcm plus, ig forex trading, forex trading reddit, interactive brokers currency conversion, commsec cfd, vsa forex, forex and cfd, vwap mt4, commsec trading platform, best brokerage accounts reddit, open brokerage account online, best brokerage accounts 2019, saxo bank online trading, best brokerage accounts for beginners, best online brokerage account for beginners, ninjatrader brokerage margins, the best brokerage account, chase online investing,

Forex Event Driven Trading Paints, 🔥Fundamental Pip Lord using same forex trading strategies here to profit from Volatility 75 Index.

The Breaks

Lots of people would certainly define a spike as cost quickly bursting out of an array. Somewhat, I agree with this, but when you explain “the range” as a purely horizontal block in cost, I disagree. Below are a number of really recent examples to show you what I’m speaking about below:

Surprise I was mosting likely to use angled trendlines to do this, right?

But why would certainly I use trend lines rather than horizontal “blocks”? Well, one of the earliest publications I continue reading trading in my very early days told me to buy such a breakout on a horizontal block in cost. Long story short, I got slaughtered. “False outbreaks” (another term I hate, however, for the purpose of simplicity I’ll use below) are really typical. These “false outbreaks” jab below or above an array, and reverse. There is nothing “false” regarding these outbreaks, incidentally perhaps “false” to the person that does not rather comprehend them they are just another part of cost, but that’s another post.

This principle is really a lot more quickly done by hand than it is structurally. To start with, trading any type of true spike in cost, the probability of you getting in within the very first 5 minutes should be unusual, unless you’re doing this mechanically (with a program) and direct accessibility to a large pooled ECN or other direct accessibility network. Lots of people reading this might be questioning the tons of spike trading software program around. Hmmm, yeah, well best of luck with that. Below at NBT we often tend to favor truth and can not claim we are fans of the people informing others that this type of trading is in any way acceptable on a sub-par system with reduced accessibility to liquidity. Please continue reading.

You want the initial whipsaws to decrease and a real direction to be proclaimed. Often, it will occur after the very first 5 minutes. Others, it will take as much as 20-60 minutes prior to an optimum or verified access is located, relying on the problems and stimulant.

Gauging Spikes with the Golden Ratio

Among the primary objectives of this short article is to assist train you NOT to discolor sharp drives in cost. When there is uncertainty in the air, many traders no darn well they shouldn’t be doing anything, yet they do it anyway. If you struggle with continuously “selecting” at countertrend trades, please pay special interest:

There are two primary reasons we would certainly intend to determine a spike to begin with:

- To find a possible exhaustion point at which to take revenues if we are trading in the direction of a spike, or

- To discolor the activity

This is the 2nd writing I have below now regarding gauged relocations. In the last short article regarding this subject, we only reviewed making use of 2.0 (100%) on a trendline break.

Spikes can be gauged in a number of ways, and fair warning: what you see below might be a little controversial to long-time planners, but like everything else on this web site, I blog about what works for me, not what I check out in publications.

One more alternative to gauging moves on spikes is to simply use the very same principle we reviewed a number of weeks ago:

trend line breaks and 100% extensions. Among our visitors was quick to find the bottom using this very same principle following Nonfarm Payrolls (convergence with the very same chart above). Go here to see his chart. Confluence policies constantly.

Exactly how is the forex market managed?

Regardless of the huge size of the forex market, there is really little regulation since there is no regulating body to police it 24/7. Instead, there are a number of national trading bodies around the globe who manage domestic forex trading, as well as other markets, to make sure that all forex suppliers stick to specific criteria. As an example, in Australia the regulative body is the Australian Stocks and Investments Commission (ASIC).

Just how much money is traded on the forex market daily?

About $5 trillion worth of forex transactions happen daily, which is an average of $220 billion per hour. The marketplace is mainly made up of organizations, companies, governments and currency speculators conjecture composes approximately 90% of trading quantity and a huge bulk of this is focused on the United States dollar, euro and yen.

What are voids in forex trading?

Spaces are factors in a market when there is a sharp activity up or down with little or no trading in between, causing a ‘void’ in the normal cost pattern. Spaces do occur in the forex market, but they are dramatically less typical than in other markets since it is traded 24-hour a day, 5 days a week.

Nonetheless, gapping can occur when economic information is released that comes as a surprise to markets, or when trading resumes after the weekend break or a holiday. Although the forex market is closed to speculative trading over the weekend break, the market is still open to central banks and related organisations. So, it is feasible that the opening cost on a Sunday night will be various from the closing cost on the previous Friday evening causing a gap.

Final Thoughts:

Matching various sorts of trading to an individual’s personality type is certainly no guarantee for forex trading success. Nonetheless, finding a trading design that’s well fit to your personality type can assist brand-new traders find their feet and make the appropriate moves in the market. Just take the test and answer the 15 concerns honestly to reveal which trading design is the appropriate fit for you.

Get Trending Videos Explaining Forex Event Driven Trading Paints and Financial market information, evaluation, trading signals and Foreign exchange financial expert testimonials.

Risk Notice:

“TradingForexGuide.com” TFG will not be held accountable for any type of loss or damages arising from dependence on the information consisted of within this web site consisting of market information, evaluation, trading signals and Foreign exchange broker testimonials. The information consisted of in this web site is not always real-time neither exact, and analyses are the point of views of the writer and do not stand for the referrals of “TradingForexGuide.com” TFG or its workers. Currency trading on margin entails high threat, and is not ideal for all capitalists. As a leveraged item losses are able to go beyond initial deposits and resources goes to threat. Before determining to trade Foreign exchange or any other economic tool you should meticulously consider your financial investment objectives, level of experience, and threat hunger. We strive to supply you useful information regarding all of the brokers that we examine. In order to give you with this cost-free solution we receive advertising and marketing costs from brokers, consisting of several of those listed within our rankings and on this web page. While we do our utmost to make sure that all our information is up-to-date, we motivate you to validate our information with the broker directly.