Find Trending Stories Explaining Forex Event Driven Trading Experts, Fundamental news trading. Forex Scalping. GREENBACK FOREX GROUP.

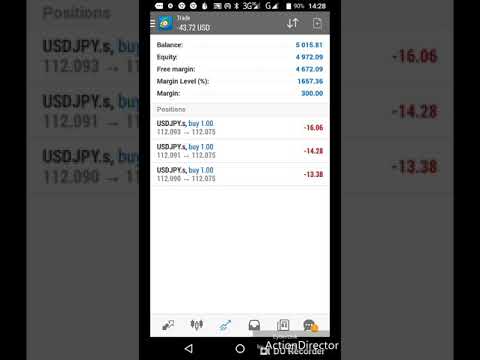

JUST WOKE UP TO TRADE USD GDP.

Forex mentorship

Lifetime signals

News Trading

Technical Trading

Price: 2000 ZAR

Forex Scalping strategy

Trade forex like a pro.

Forex Event Driven Trading Experts, Fundamental news trading. Forex Scalping. GREENBACK FOREX GROUP.

The supposed death of event-driven investing

Why Event Trade Dead?

When Daniel Loeb, the activist capitalist, dealt with the annual meeting of financiers in Third Factor, his hedge fund, last month, he opened with an entertaining slide. It showed a bloodied and also damaged animation version of himself startling towards a tombstone inscribed with the message “RIP event-driven investing, 2015”.

Lest any person believe Third Factor is predicting the death of one of the most profitable hedge fund approaches of the past few years, the slide was entitled “The supposed death of event-driven investing”. However even Mr Loeb confessed the sector goes to an inflection point.

Markets changed in the past year

Funds in the event-driven category are a heterogeneous number, however somehow they aim to make money from company actions such as monetary restructurings or mergers and also purchases. As markets changed in the past year, numerous funds found themselves betting on the incorrect type of company actions. Event-driven approaches that worked in an equity booming market are refraining so now.

This is especially the instance for the brand name of activism with which Mr Loeb and also competitors such as Bill Ackman and also Carl Icahn have terrorised company managements for years. These assaults look like being a whole lot much less extensive in the future.

The proximate cause is the string of terrible results from activism’s leading lights.

In 2015, Mr Loeb’s equity financial investments shed 3 per cent, however the truly dreadful heading numbers originated from David Einhorn’s Greenlight Capital and also Mr Ackman’s Pershing Square, both of which were down 20 per cent.

A more crucial factor: the principles have changed.

Because the center of in 2015, the overview for the international economic situation has actually soured significantly. Earnings for United States firms, particularly, are acquiring after years of artificial growth from share buybacks. Even if one does decline a bleak financial prognosis, one can not deny that company loaning costs have risen and also credit markets have come to be extra unstable and also unpredictable.

The protestors’ playbook for juicing investor returns lever up a firm’s annual report and also return cash to financiers just does not operate in the existing setting, and also lasting financiers are revolting. One of Mr Loeb’s investment rules is “no financial-engineering financial investments in terrified markets”, and also the likes of Larry Fink, chief executive of BlackRock, the world’s largest asset supervisor, have provided significantly strident cautions against buybacks and also even returns.

Jonathan Coleman, small-cap portfolio supervisor at Janus Capital

It is a view resembled by financiers backwards and forwards the marketplace. Jonathan Coleman, small-cap portfolio supervisor at Janus Capital, told me recently he has actually made balance-sheet stamina a vital demand at meetings with his portfolio firms over the past few months. Credit rating markets are extra unpredictable and also refinancing a mountain of debt is not likely to be as very easy in the future as it has actually remained in the era of measurable reducing by the Federal Get. “There is nothing that can do as much damage to the equity as a dangerous annual report,” he said.

It is tough not to review all these indicators from the monetary markets and also from the investment community as the very early cautions of a turn in the financial cycle, however naturally the timing of the next slump is uncertain and also there can still be one more leg of growth between now and also an eventual economic crisis.

Event-driven fund financiers are not waiting to learn; they are currently within of retrenchment. SkyBridge Capital, a powerful fund of hedge funds firm, said it took $1bn far from event-driven managers consisting of Mr Loeb, Barry Rosenstein of Jana Allies and also John Paulson in the last months of in 2015. HFR, the data service provider, taped $2.2 bn in outflows from the $745bn event-driven hedge fund sector in the 4th quarter of in 2015 and also the bleeding shows up to have sped up in 2016.

Financiers in event-driven hedge funds shed 4.7 per cent in 2015, according to HFR, so it is little marvel that they are reassessing their dedication to the technique.

Mr Loeb told his financiers that a shake-out of smaller funds will certainly produce extra equity market opportunities for skilled managers, and also he has actually changed his emphasis to other type of company events around which to spend. Distress in some sectors, such as power, can vomit profitable opportunities. He is also chatting up Third Factor’s credit portfolio, which is larger than its even more renowned equities arm.

Event-driven investing is not dead, it will certainly just change. Even activism might have a cycle or 2 in it yet. However it appears a winner that the Loebs and also Ackmans of the world will certainly be much less loud this year and also for the foreseeable future.

How does forex trading job?

There are a selection of various manner ins which you can trade forex, however they all work similarly: by simultaneously buying one money while offering one more. Traditionally, a lot of forex purchases have been made by means of a foreign exchange broker, however with the rise of online trading you can make the most of forex cost movements making use of by-products like CFD trading.

CFDs are leveraged items, which enable you to open up a placement for a just a portion of the full value of the trade. Unlike non-leveraged items, you do not take ownership of the asset, however take a placement on whether you believe the marketplace will certainly increase or fall in worth.

Although leveraged items can multiply your revenues, they can also multiply losses if the marketplace relocates against you.

Conclusion:

Event-driven trading approaches offer a terrific way to take advantage of enhancing cost volatility, however there are numerous threats and also limitations to take into consideration. When creating and also executing these approaches, it is very important for investors to establish limited threat controls while providing adequate room for the unstable scenario to play out out there. Ultimately, event-driven trading approaches offer a valuable arrowhead in the quiver of any active trader.

Find Latest Stories Explaining Forex Event Driven Trading Experts and Financial market information, analysis, trading signals and also Foreign exchange investor evaluations.

Caution about Forex Risk

Please note that trading in leveraged items might entail a significant degree of risk and also is not appropriate for all financiers. You must not run the risk of more than you are prepared to lose. Before determining to trade, please guarantee you understand the threats included and also think about your degree of experience. Look for independent advice if required.