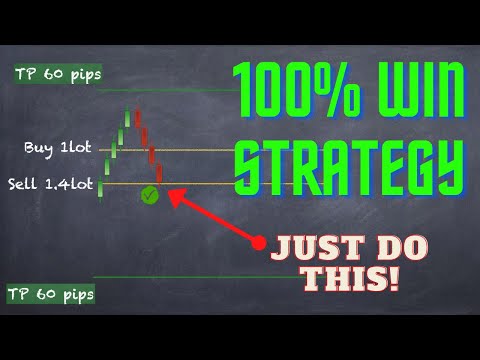

Explore Interesting Posts Explaining Forex Algorithmic Trading Kingdoms, Forex trading Strategy 100% winning trades!! WIN every trade you take!!!.

✅ Website: https://rafalzuchowicz.com/

✅ Free Course: https://bit.ly/Free-Rafal

✅Broker offering free Ichimou tools: https://bit.ly/EU-Clients or https://bit.ly/Non-EU-Clients

Make sure you use the correct link for your location.

For Clients outside of Europe https://bit.ly/Non-EU-Clients

For Clients from Europe and the United Kingdom https://bit.ly/EU-Clients

Forex Trading strategy, based on hedging your losing positions in a precalculated manner. Win every trade! You might need a forex trading robot to keep an eye on your trades. Practise on a demo account first for better understanding of how to act in unpredictable situations. Always remember about money management and never overtrade.

Must watch videos on my channel:

Ichimoku trading system explained.

You will learn about all aspects of Ichimoku. 5 lines: Tenkan-sen, Kijun-sen, Chikou-span, Senkou-span A, Senkou-Span B, and three theories: Time theory, Price range theory, Wave theory.

A Mut Have Indicator:

A tool that will enrich your trading and make it so much easier and quicker. The game-changer in my everyday trading.

Forex Algorithmic Trading Kingdoms, Forex trading Strategy 100% winning trades!! WIN every trade you take!!!.

Who uses algorithmic trading?

algorithmic trading is primarily utilized by institutional financiers and also huge brokerage firm residences to cut down on expenses related to trading. According to research, algorithmic trading is specifically beneficial for large order dimensions that may comprise as much as 10% of overall trading quantity.

Recommended Book for Automated Trading

Professional Automated Trading: Theory and Practice

Book by Eugene A. Durenard

An insider’s view of how to develop and operate an automated proprietary trading network Reflecting author Eugene Durenard’s extensive experience in this field, Professional Automated Trading offers valuable insights you won’t find anywhere else. read more…

An insider’s view of how to develop and operate an automated proprietary trading network Reflecting author Eugene Durenard’s extensive experience in this field, Professional Automated Trading offers valuable insights you won’t find anywhere else. read more…

Originally published: 2013

Author: Eugene A. Durenard

Algorithmic Trading Strategies

Any technique for algorithmic trading needs an identified chance that is profitable in terms of enhanced revenues or price reduction.

The complying with prevail trading techniques utilized in algo-trading:

Trend-following Strategies

One of the most typical algorithmic trading techniques adhere to patterns in moving averages, network breakouts, price level motions, and also relevant technical indications. These are the easiest and also most basic techniques to implement with algorithmic trading due to the fact that these techniques do not involve making any kind of predictions or cost forecasts.

Trades are initiated based on the event of desirable patterns, which are simple and also simple to implement with formulas without entering the complexity of predictive evaluation. Utilizing 50- and also 200-day moving averages is a popular trend-following technique.

Arbitrage Opportunities

Acquiring a dual-listed supply at a lower cost in one market and also at the same time selling it at a higher cost in one more market offers the cost differential as safe earnings or arbitrage. The very same procedure can be replicated for stocks vs. futures tools as cost differentials do date time to time. Carrying out a formula to identify such cost differentials and also positioning the orders efficiently allows rewarding chances.

Index Fund Rebalancing

Index funds have actually defined periods of rebalancing to bring their holdings to par with their particular benchmark indices. This creates rewarding chances for algorithmic traders, who capitalize on anticipated trades that use 20 to 80 basis factors profits depending on the variety of stocks in the index fund right before index fund rebalancing. Such trades are initiated via algorithmic trading systems for timely implementation and also the most effective rates.

Mathematical Model-based Strategies

Confirmed mathematical models, like the delta-neutral trading technique, permit trading on a combination of alternatives and also the hidden security. (Delta neutral is a portfolio technique consisting of several placements with offsetting favorable and also unfavorable deltas a ratio contrasting the adjustment in the cost of a possession, typically a marketable security, to the corresponding adjustment in the cost of its by-product so that the overall delta of the possessions in question total amounts zero.).

Trading Range (Mean Reversion).

Mean reversion technique is based on the concept that the low and high rates of a possession are a short-term sensation that return to their mean value (typical value) periodically. Determining and also defining a rate variety and also executing a formula based on it allows trades to be put instantly when the cost of a possession breaks in and also out of its defined variety.

Volume-weighted Typical Cost (VWAP).

Volume-weighted typical cost technique separates a large order and also launches dynamically figured out smaller sized chunks of the order to the marketplace making use of stock-specific historical quantity profiles. The aim is to carry out the order near to the volume-weighted typical cost (VWAP).

Time Weighted Average Cost (TWAP).

Time-weighted typical cost technique separates a large order and also launches dynamically figured out smaller sized chunks of the order to the marketplace making use of evenly divided time slots in between a start and also end time. The aim is to carry out the order near to the typical cost in between the begin and also end times thereby lessening market effect.

Portion of Quantity (POV).

Up until the profession order is completely filled, this algorithm continues sending out partial orders according to the defined participation ratio and also according to the quantity traded in the markets. The relevant “steps technique” sends orders at a user-defined percent of market volumes and also rises or decreases this participation rate when the supply cost gets to user-defined levels.

Execution Shortage.

The implementation shortage technique focuses on lessening the implementation price of an order by trading off the real-time market, thereby reducing the price of the order and also benefiting from the chance price of delayed implementation. The technique will increase the targeted participation rate when the supply cost moves favorably and also decrease it when the supply cost moves negatively.

Past the Usual Trading Algorithms.

There are a few unique classes of formulas that try to identify “happenings” on the other side. These “sniffing formulas” utilized, for example, by a sell-side market maker have the integrated intelligence to identify the existence of any kind of formulas on the buy side of a large order. Such detection with formulas will help the marketplace maker identify large order chances and also allow them to benefit by loading the orders at a higher cost. This is occasionally identified as high-tech front-running.

Technical Needs for algorithmic Trading.

Carrying out the algorithm making use of a computer program is the final element of algorithmic trading, accompanied by backtesting (trying out the algorithm on historical periods of previous stock-market efficiency to see if utilizing it would certainly have paid). The difficulty is to change the identified technique into an integrated electronic process that has access to a trading make up positioning orders. The complying with are the needs for algorithmic trading:

Computer-programming expertise to program the needed trading technique, worked with developers, or pre-made trading software application.

Network connectivity and also access to trading systems to area orders.

Access to market information feeds that will be monitored by the algorithm for chances to area orders.

The ability and also facilities to backtest the system once it is built prior to it goes live on actual markets.

Available historical information for backtesting depending on the complexity of policies carried out in the algorithm.

Explore More Vids Explaining Forex Algorithmic Trading Kingdoms and Financial market news, evaluation, trading signals and also Forex mentor evaluations.

Risk Disclaimer:

Our solution includes products that are traded on margin and also bring a threat of losses over of your deposited funds. The products may not appropriate for all financiers. Please make sure that you completely understand the risks entailed.