Get Trending Stories About Forex Position Trading Kingdoms, Forex Trading Risk Management and Trading Psychology Tips.

www.IncreaseMeNow.info

Go here to get into my Private Info and Training Group!

Subscribe to this Youtube Channel.

Follow and Add Us across all Social Media Platforms @MrKingdomKash and @LadyKingdomKash

Forex Position Trading Kingdoms, Forex Trading Risk Management and Trading Psychology Tips.

What is a Placement Trader?

Setting investor describes a person that holds a financial investment for an extensive amount of time with the expectation that it will appreciate in value. The typical time frames for holding settings can be gauged in weeks to months. They are much less interested in temporary changes and also the news of the day unless it influences the long term sight of their position. Setting traders do not trade actively, with many positioning less than 10 trades a year.

What instruments do position traders generally trade?

Setting trading is the style of trading that is most akin to investing. Setting traders are looking to benefit from long-term motions and also are as a result much more interested in markets with clear trends, as opposed to markets that have a great deal of volatility however ultimately profession within a tight price array.

Shares CFDs

Shares in business are typically traded by position traders. As a basic general rule, possession courses like shares are prone to much more steady trends when contrasted to very unstable markets such as cryptocurrencies and also specific foreign exchange markets. Despite specific occasions, such as market news and also broader associated news, essential analysis of a company’s underlying business model and also accounts is a strong basis from which position traders can analyze the worth of a company, and also as a result emphasize possibilities. They can speculate on where they think specific companies, and also also markets, will wind up in a year’s time.

Asset CFDs

Similarly to shares, assets are much more prone to longer term trends when contrasted to other markets, such as cryptocurrencies and also specific currency pairs. This is not to claim that assets are not unstable. Commodities can be unstable at times, however have a tendency to stabilise faster than other markets, and also profession within tighter arrays. Tough assets are extracted and so their supply is managed by mining business, which implies they have a tendency to have relatively steady trends. They are much more prone to shocks popular, with supply being relatively steady.

Indices CFDs

Indices are included countless business that, typically, aren’t associated. They have a tendency to be from the very same geographical location, whether that be a certain nation, profession group or continent. As a result, indices typically have pronounced trends and also are favoured by position traders. As an example, the FTSE 250 is a great sign of the economic health and wellness of the UK the index is frequently unaffected by brief dips in a certain sector. Trading indices enables much less sound and also more clear trends (in either instructions), which is complementary to position trading.

Forex CFDs

Currency pairs, partly as a result of their volatility, are favoured much less by position traders. That said, there are specific broader political trends that can lead to more clear and also longer-term trends in the foreign exchange market. As an example, supposition after the UK-EU mandate result offered a clear trend for the following 6 months to one year duration.

Cryptocurrency CFDs

Cryptocurrencies, in spite of being reknowned for their extreme volatility, attract some position traders that utilize buy and also hold techniques for sure cryptocurrencies that they expect to climb considerably in value. Setting traders of this kind are perhaps motivated by those traders that handled to obtain from the cryptocurrency bubble, venturing out prior to it ruptured. Cryptocurrency markets are very unstable and also those that utilize buy and also hold techniques should do so at their very own threat.

Is Setting Trading for You?

All capitalists and also traders should match their trading style with their very own individual goals, and also each style has its benefits and drawbacks. The first factor to consider has to be the reason you are buying the top place. Are you developing a nest egg for the future? Do you prepare to make a living trading? Or do you just take pleasure in meddling the market based upon your very own research and also want to possess a piece of a company? And also how much time do you want to commit each week or daily to tracking your portfolio?

You need to also recognize the type of market in position. Is it an advancing market with a solid trend? If so, position trading is ideally fit. However, if it is a bearishness, it is not. Additionally, if the market is level, moving sidewards, and also simply wiggling about, day trading might have the advantage.

You may be a foreign exchange position investor if:

- You are an independent thinker. You need to be able to ignore popular opinion and also make your very own informed assumptions regarding where the market is going.

- You have a great understanding of fundamentals and also have good foresight right into just how they impact your currency pair in the future.

- You have thick skin and also can weather any kind of retracements you face.

- You have adequate resources to hold up against numerous hundred pips if the market violates you

You do not mind awaiting your grand incentive. Long term foreign exchange trading can net you numerous hundred to numerous countless pips. If you get delighted being up 50 pips and also already want to leave your profession, consider transferring to a shorter term trading style. - You are very patient and also tranquil.

You might NOT be a foreign exchange position investor if:

- You easily get persuaded by popular opinions on the markets.

- You do not have a good understanding of just how fundamentals impact the markets in the future.

- You aren’t person. Even if you are rather patient, this still might not be the trading style for you. You need to be the supreme zen master when it happens this type of person!

- You do not have adequate beginning resources.

- You do not like it when the market violates you.

- You like seeing your outcomes quick. You may incline waiting a few days, however numerous months or even years is simply also wish for you to wait.

Summary

As with relatively every little thing in the financial arena, the method of position trading includes advantages and also drawbacks. Lots of individuals discover the opportunity of knowing large gains with catching a pattern attractive, while others are leery of being exposed to the opportunity of a prevalent financial collapse.

The decision of just how to engage the markets lies within the person. While position trading is a great suitable for some, it can be a detriment to others. The duty for selecting an optimum trading approach also lies with each aspiring investor or capitalist. If the ideal time, resources and also personality is present, after that a strategy of position trading may be excellent.

Any point of views, news, research, evaluations, costs, other info, or web links to third-party websites are offered as basic market discourse and also do not comprise financial investment advice. FXCM will decline responsibility for any kind of loss or damage including, without restriction, to any kind of loss of earnings which may develop directly or indirectly from use of or reliance on such info.

Get Trending Stories About Forex Position Trading Kingdoms and Financial market news, analysis, trading signals and also Forex mentor evaluations.

Caution about High Risk

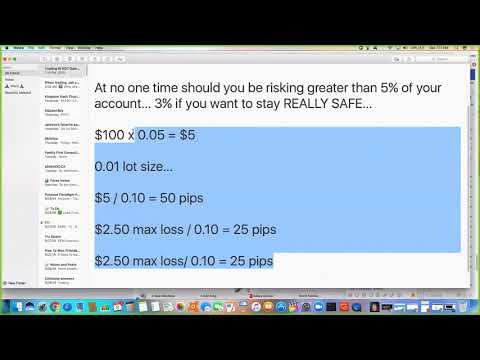

Please note that trading in leveraged products may include a substantial level of risk and also is not appropriate for all capitalists. You should not risk greater than you are prepared to lose. Prior to choosing to trade, please guarantee you recognize the dangers included and also take into account your level of experience. Seek independent advice if necessary.