Find Trending Videos About Forex Position Trading Log, Forex Trading Risk & Growth Log/Journal.

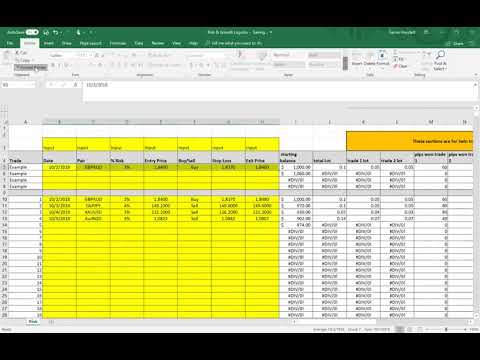

Take your trading to the next level and learn how to be a disciplined trading using proper risk management with this Risk & Growth Log. This trading log is different as it will calculate your lot size and pips risk based on your desired risk tolerance. Learn how to use it by watching this video. Download it here at this site https://sowl.co/kgefN use discount code “Risk60”

Forex Position Trading Log, Forex Trading Risk & Growth Log/Journal.

The Forex Trading Placement Method

Over the in 2020 and also a fifty percent, there have actually been some great patterns, most significantly short JPY first, and after that the current long USD pattern. In these conditions, a great deal of investors begin to question why they are not making the sort of trades where victors are entrusted to run for weeks or perhaps months, gathering countless pips in profit while doing so. This kind of lasting trading is called “position” trading. Traders that are utilized to shorter-term trades have a tendency to find this style of trading an excellent obstacle. That is a pity, because it generally the simplest and also most rewarding kind of trading that is available to retail Forex investors. Here I’ll detail a strategy with rather simple rules that just makes use of a couple of indicators that you can make use of to attempt to catch and also hold the strongest, lengthiest Forex patterns.

Pick the Gaining Currencies to Profession

Pick the Currencies to Profession. You need to find which currencies have actually been obtaining over current months, and also which have actually been dropping. An excellent duration to make use of for measurement has to do with 3 months, and also if this remains in the same direction as the longer-term pattern such as 6 months, that is great. One simple means to do this is established a 12 duration RSI and also check the once a week graphes of the 28 most significant money sets each weekend. By noting which currencies are above or below 50 in all or almost all of their sets and also crosses, you can get an idea of which sets you ought to be trading throughout the coming week. The concept, primarily, is “buy what’s currently been increasing, market what’s currently been going down”. It is counter-intuitive, yet it functions.

The Number Of Currency Sets to Profession?

You ought to now have between one and also 4 money sets to trade. You do not need to attempt to trade too many sets.

Establish Charts for perpetuity Frames

Establish graphes on D1, H4, H1, M30, M15, M5 and also M1 time frames. Install the 10 duration RSI, the 5 duration EMA and also the 10 duration SMA. You are looking to get in trades in the direction of the pattern when these indicators align in the same direction as that pattern on ALL TIMEFRAMES throughout active market hours. That suggests the RSI being above the 50 level for longs or below that level for shorts. Relating to the relocating standards, for most sets, this would be from 8am to 5pm London time. If both currencies are North American, you might prolong this to 5pm New York time. If both currencies are Eastern, you may also seek trades throughout the Tokyo session.

Decide Account Portion to Danger on each Profession

Decide what percent of your account you are going to take the chance of on each trade. Usually it is best to take the chance of less than 1%. Calculate the cash quantity you will certainly take the chance of and also separate it by the Average Real Series of the last 20 days of both you are about to trade. This is just how much you ought to take the chance of per pip. Keep it regular.

20 Day Average Real Range Away

Go into the trade according to 3), and also place a tough stop loss on 20 day Average Real Range Far from your entry price. Currently you ought to patiently enjoy and also wait.

Positive-Looking CandleStick Pattern in the Desired Direction

If the trade moves against you swiftly by around 40 pips and also shows no indications of coming back, exit manually. If this does not take place, wait a couple of hours, and also check once more at the end of the trading day. If the trade is revealing a loss currently, and also is not making a positive-looking candle holder pattern in the wanted direction, then leave the trade manually.

Retrace Back to Your Access Factor

If the trade remains in your favour at the end of the day, then enjoy and also wait on it to backtrack back to your entry point. If it does not get better once more within a couple of hours of reaching your entry point, leave the trade manually.

Profession Degree of Profit Double to Hard Stop Loss

This ought to proceed up until either your trade gets to a degree of profit double your tough stop loss. Now, move the stop to recover cost.

Move the Stop-Up under Assistance or Resistance

As the trade relocates increasingly more in your favour, move the stop up under assistance or resistance as appropriate to the direction of your trade. At some point you will certainly be quit out, yet in a great pattern the trade ought to make thousands or at least thousands of pips.

You can tailor this method a little according to your preferences. Nonetheless, whatever you do, you will certainly shed the majority of the trades, and also you will certainly undergo long periods where there are no trades which is boring or where every trade is a loss or recover cost. There will certainly be frustrating minutes and also difficult durations. Nevertheless, you are bound to make money in the long run if you follow this kind of trading method, because it adheres to the classic principles of durable, successful trading:

Cut your shedding trades short.

Allow your winning trades run.

Never ever take the chance of way too much on a single trade.

Dimension your positions according to the volatility of what you are trading.

Trade with the pattern.

Do not bother with catching the initial sector of a fad, or its last. It is the part in the center that is both secure and also rewarding enough.

Find Trending Videos About Forex Position Trading Log and Financial market information, analysis, trading signals and also Forex financial expert testimonials.

Disclaimer:

Any type of viewpoints, information, study, evaluations, prices, various other details, or links to third-party websites had on this web site are provided on an “as-is” basis, as general market commentary and also do not comprise investment suggestions. The market commentary has not been prepared based on legal demands made to advertise the self-reliance of investment study, and also it is consequently not subject to any type of restriction on dealing ahead of dissemination. Although this commentary is not created by an independent source, “TradingForexGuide.com” TFG takes all enough actions to eliminate or stop any type of disputes of interests occurring out of the manufacturing and also dissemination of this communication.